It all started with “green bonds” more than a decade ago and has now grown to include bonds that provide social benefits, such as job creation. Green bonds in particular are fixed income instruments for which the funds are contractually tied to environmental projects. The bonds are typically asset backed and/or backed by the issuing entity’s balance.

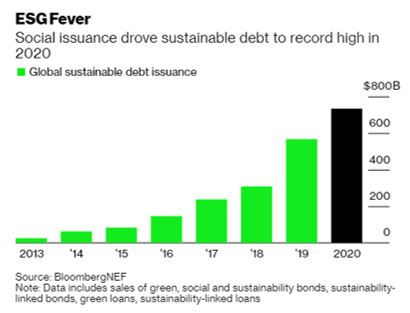

The World Bank issued the first green bond in 2009 and issuance has since grown to more than $300 billion in 2020. Up until recently green and social bonds were primarily only available via primary bond markets (i.e. purchased directly from the issuer). However, recently a small number of ETFs have launched that cater to this market. A key reason for ETFs entering the space is the development of a more robust secondary market that allows for better transparency and price discovery.

As with any nascent sub-asset class, there has been a lot of focus on developing the infrastructure to evaluate these bonds over the past decade. Almost all green and social bonds carry some requirement to update investors on project development and results, but the standardization of third party reviews has been slow to develop.

That is changing. For example, the Sustainability Accounting Standards Board and the International Integrated Reporting Council intend to merge later this year, which would simplify the evaluation of green bonds and other sustainable investing projects. Additionally, the European Union is evaluating reporting standards and plans to make changes that would further increase transparency and provide ways to quantify emissions reduction.

These actions will likely facilitate more capital flows into these bonds in the future – a near necessity if current 2050 emissions goals remain in place, which are estimated to require at least $1 trillion per year to reach. It is also clear that the Biden administration will remove any impediments that were put in place by the prior administration, driving additional issuance.

Originally published by Spinnaker Trust