As ETFs around the world garnered a record high $7.6 trillion in 2020, environmental, social, and governance (ESG) investing was one of the bright spots in the industry. With the ESG space reaching a tipping point in challenging 2020, look for more strength in 2021 with ETFs like the SPDR S&P 500 ESG ETF (EFIV).

The fund seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of an index that provides exposure to securities that meet certain sustainability criteria (criteria related to environmental, social, and governance (“ESG”) factors) while maintaining similar overall industry group weights as the S&P 500 Index.

In seeking to track the performance of the S&P 500 ESG Index (the “index”), the fund employs a sampling strategy, which means that it is not required to purchase all of the securities represented in the index. Overall, EFIV gives investors:

- Investment results that, before fees and expenses, correspond generally to the S&P 500 ESG Index.

- Exposure to an index that is designed to select S&P 500 firms meeting certain sustainability criteria (related to environmental, social, and governance factors) while maintaining similar overall industry group weights as the S&P 500 Index.

- Potential ESG core exposure, based on its focus on sustainability criteria and comprehensive market coverage of the flagship core S&P 500 Index.

ESG Reaching a Tipping Point in 2020

The ESG space was already gaining momentum before the pandemic hit the capital markets in early 2020. Even the pandemic itself was a temporary roadblock, as many ESG ETFs outperformed.

Within the past year, EFIV is up 19%. The fund has been on a steady upward trajectory since November and gained a healthy 3% thus far in the new year.

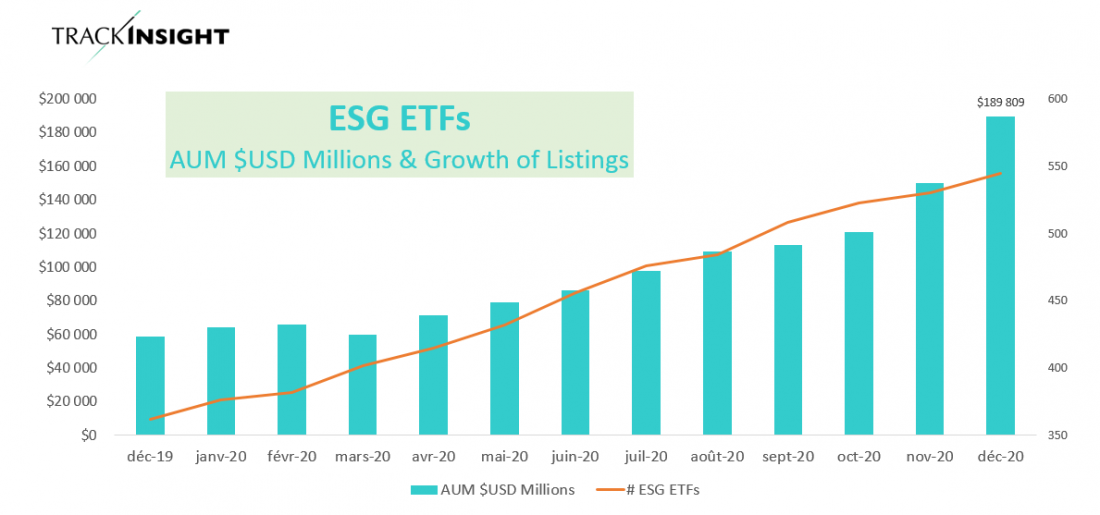

As a Nasdaq article noted, “Environmental, Social, Corporate Governance (ESG) ETFs reached a tipping point in 2020, witnessing an incredible 223% growth over the year, achieving a new record of $189 Billion in AUM. ESG ETFs captured $97 Billion of flows over the course of 2020. Nearly 200 ESG ETFs were brought to market during the same period as ESG is set to become a key battleground for issuers over 2021.”

“It’s also clear that 2020 was a long-awaited turning point for ESG ETFs with huge growth in this sector,” the article continued. “With competition for potentially Trillions of dollars of new ESG assets heating up, we expect to see more issuers enter the ESG ETF market over 2021.”

For more news and information, visit the ESG Channel.