After the U.S. Department of Labor set its sights on environmental, social, and governance, or ESG, investments in America’s private sector retirement plans, financial industry experts have tried to highlight the importance of ESG factors as a source of value for investors first and foremost.

“The choice to either deliberately ignore the materiality of ESG factors and disregard them as a source of performance, or to expect to have the ability to prove their financial efficacy beyond any doubt, is inconsistent with the natural pursuit of excellence in investing. Asset managers, as fiduciaries, must continue to have a broad lens when making investment decisions. Judgments on ESG factors are rooted in the hunt for value, not values, with the best interest of the investor paramount,” Rick Lacaille, Global Chief Investment Officer, State Street Global Advisors, London, said in a Wall Street Journal article.

“Let the marketplace determine the value of research and results arising in asset management. The degree of scrutiny from investors and their agents and the high level of transparency afforded to investors will continue to drive a healthy and competitive market,” he added.

Lacaille pointed out that there is sufficient evidence from numerous and varied studies linking ESG factors like supply chain resilience or protection of company data with longer term corporate and investment performance to conclude that these are worthy of consideration.

As a way to help investors tap into these opportunities, State Street Global Advisors offers a suite of socially responsible and ESG-related ETFs. For example, the recently launched SPDR S&P 500 ESG ETF (EFIV) enhances both SPDR’s ESG and S&P 500 ETF offerings, helping investors incorporate ESG while achieving a risk and return profile comparable to the S&P 500. The ETF tracks the S&P 500 ESG Index, which is designed to measure the performance of securities meeting certain sustainability criteria (i.e. criteria related to environmental, social, and governance factors) while maintaining a similar overall industry group weight as the S&P 500 Index.

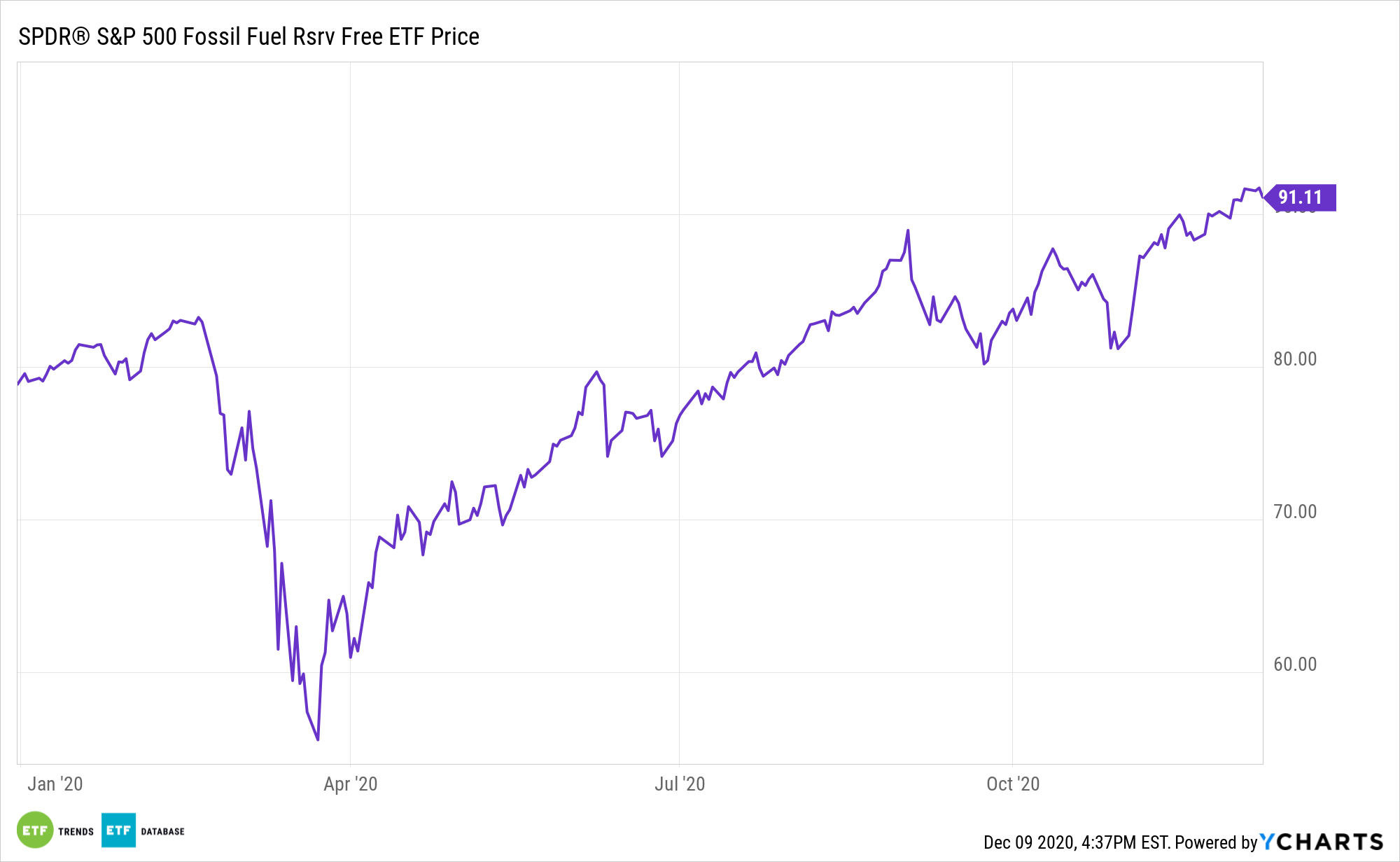

State Street Global Advisors’ SPDR S&P 500 Fossil Fuel Free ETF (SPYX) tries to allow climate change-conscious investors to align the core of their investment strategy with their values by eliminating companies that own fossil fuel reserves from the S&P 500.

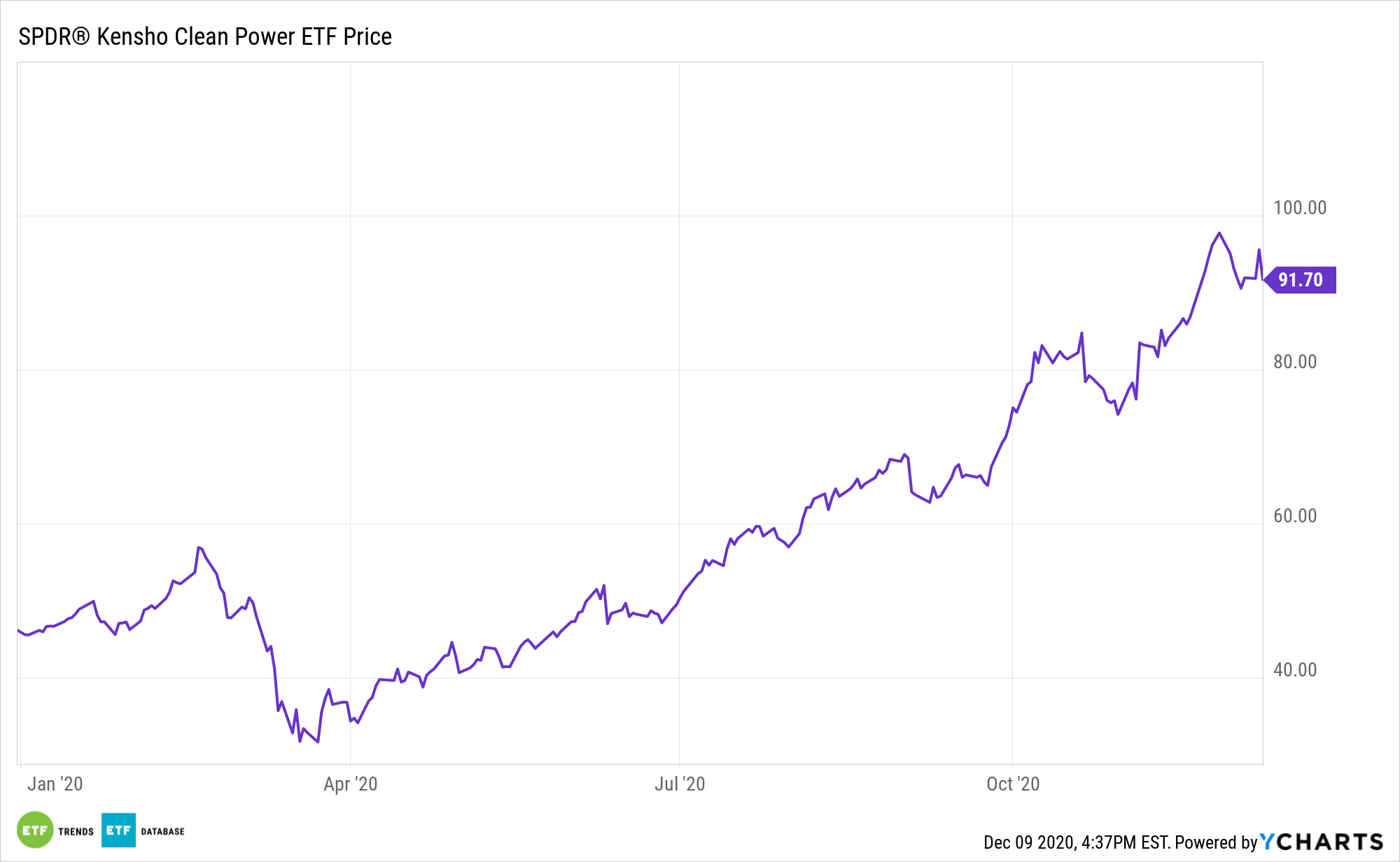

The SPDR Kensho Clean Power ETF (CNRG) seeks to provide exposure to the clean power industry in terms of both generation and underlying technology. Alternative energy sources are an increasingly important part of the power generation conversation.

Finally, the SPDR MSCI ACWI Low Carbon Target ETF (NYSEArca: LOWC) targets the MSCI ACWI Low Carbon Target Index, which tries to address carbon exposure by overweighting companies with low carbon emissions relative to sales and per dollar of market capitalization, as compared to the broader market. LOWC was created for the U.N. Joint Staff Pension Fund.

For more news, information, and strategy, visit the ESG Channel.