While oil prices are surging and commodities are seeing gains, today, the companies that own the oil and gas have less than half of the value that they did seven years ago when oil prices were high, as current industries are increasingly more ESG investing-driven.

The traditional energy producers, U.S. gas and oil companies, currently trade for under half the value they had in 2014, which was the last time that West Texas Intermediate crude was over $80 a barrel, reports Bloomberg. This is a trend that is being seen globally too, with European markets reflecting the same pattern.

What’s so different this time around? Sustainability and environmental, social, and governance (ESG) awareness by investors is working to shift industries and sectors; trillions of dollars are being allocated into lower-emissions, sustainable investment options as ESG investing soars.

“Energy equities are nowhere close to where they were in 2014 when crude oil prices were at current levels,” said Michael Shaoul, chairman and CEO of Marketfield Asset Management, in an interview with Bloomberg TV on Tuesday. “There are a couple very good reasons for that. One is it’s been a terrible place to be for a decade. And the other reason is the ESG pressures that a lot of institutional managers are on lead them to want to underplay investment in a lot of these areas.”

This is a change that is leading to reduced gains in the exploration sector this year, and “is constraining investment in oil and gas,” according to analysts working for Morgan Stanley and led by Devin McDermott. About half of the global oil supply comes through public companies, and ESG investing is crimping allocations into the higher-emissions energy options.

Renewable and alternative energy stocks are on the rise currently, with global supply chain issues only growing worse, and with China’s commitment to lower emissions leading to an increase in renewable energy growth for the second-largest economy in the world.

SPDR Offers Emissions-Conscious Investing

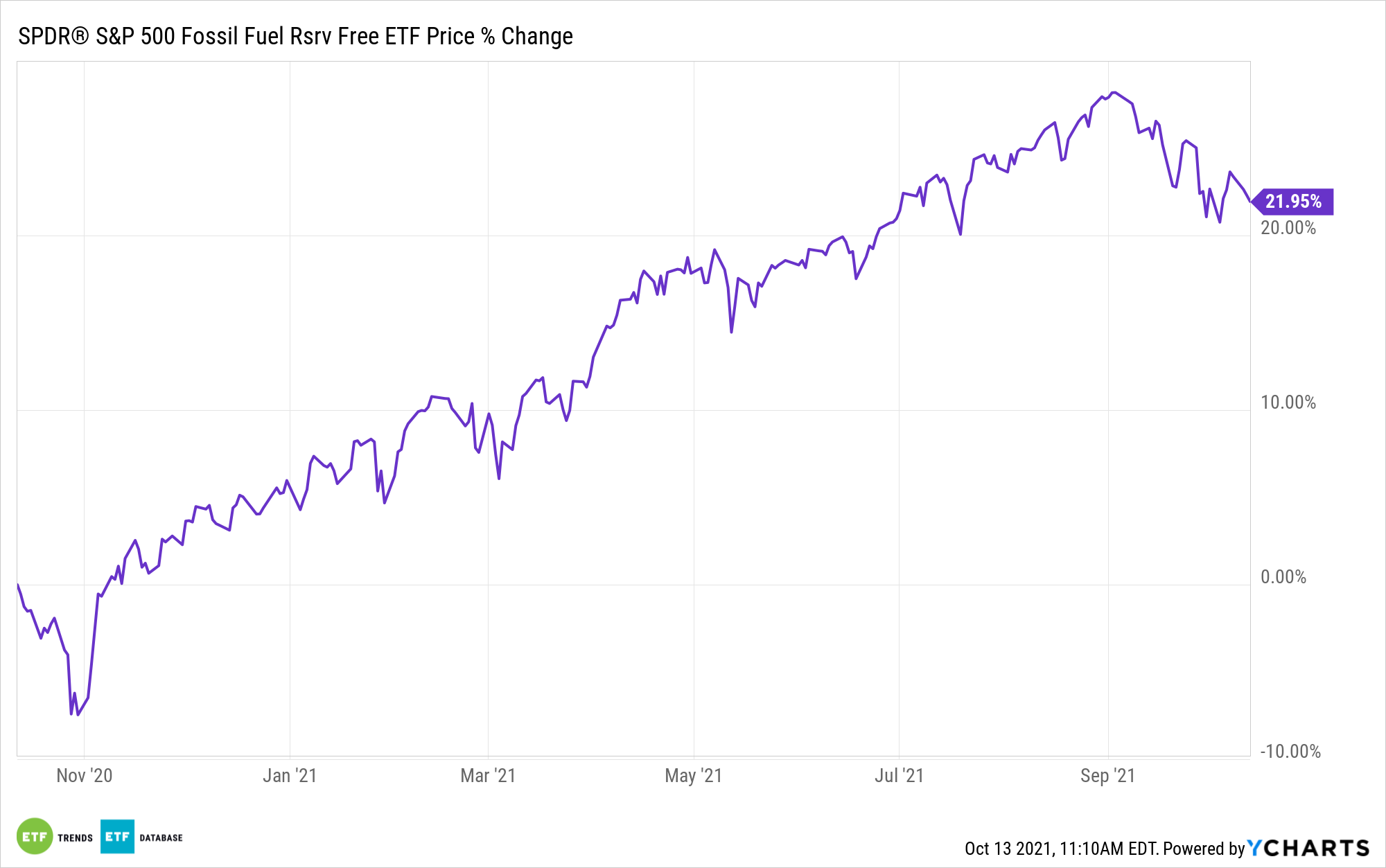

Investors looking to reduce exposure to fossil fuels in their investments need only turn to the SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX). The investment is a core allocation to the large-cap equities of the S&P 500, except with much-reduced carbon footprints.

The fund tracks the S&P 500 Fossil Fuel Free Index, a benchmark of companies within the S&P 500 that are “fossil fuel free,” defined as companies that don’t own fossil fuel reserves (thermal coal reserves and coal reserve byproducts, as well as oil or gas reserves).

That’s not the same as being devoid of all oil stocks. The fund still has minor allocations to fossil fuel companies, such as Valero (VLO) (0.09%) and Halliburton (HAL) (0.06%). But without exposure to companies actually holding the physical oil, coal, or gas reserves, the fund’s energy allocation is much reduced. Energy comprises just 0.83% of the ETF’s sector make-up, as compared to 2.97% of the SPDR S&P 500 ETF Trust (SPY).

Top sector allocations of SPYX include information technology at 28.17%, healthcare at 13.19%, and consumer discretionary at 12.75%.

SPYX has an expense ratio of 0.20%.

For more news, information, and strategy, visit the ESG Channel.