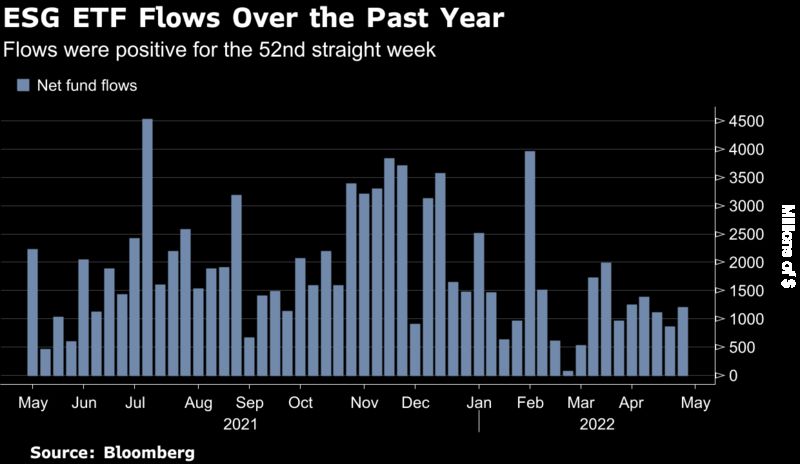

Investors continue to pump money into ESG-themed funds even after the market faced its worst slump since 1970. Bloomberg is reporting that investors last week put more than $1.2 billion into ESG-focused ETFs. So far this year, ESG funds have drawn in more than $22 billion of investor capital. Meanwhile, the S&P 500 dropped 3.8% last week. The index dropped 8.8% for the month.

But while flows into ESG ETFs have been positive over the past year, the U.S. funds that follow environmental, social, and governance investment principles are down 13% year-to-date as of April 29, down as much as the S&P 500 this year.

While ESG funds keep posting inflows, data compiled by EPFR Global show that equity funds suffered three consecutive weeks of net redemptions through April 27, the longest streak of withdrawals since August 2020. Over those three weeks, $32 billion was pulled out. In the first three months of 2022, stock funds took in almost $200 billion.

Why the dissonance? According to a report issued by Bloomberg Intelligence analysts Shaheen Contractor and Athanasios Psarofagis, the assets of ESG ETFs posted “a rare decline” in the first quarter, and “a slowdown after record growth could be prolonged, at least in the U.S., as ESG returns continue to face challenges.”

While inflows are for now likely to continue, the report states that asset gains are “being driven by large one-off allocations by institutional investors rather than organic growth,” before adding, “a wider investor base will be needed to sustain growth.”

State Street Global Advisors offers a suite of ESG-themed ETFs, including the SPDR MSCI ACWI Climate Paris Aligned ETF (NZAC) (formerly known as the SPDR MSCI ACWI Low Carbon Target ETF (LOWC)), the SPDR S&P ESG ETF (EFIV), the SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX), and the SPDR MSCI Emerging Markets Fossil Fuel Reserves Free ETF (EEMX).

NZAC, which tracks the MSCI ACWI Climate Paris Aligned Index, is designed to support investors who seek to reduce their exposure to transition and physical climate-related risks and who wish to pursue opportunities arising from the transition to a lower-carbon economy in alignment with the Paris Agreement requirements.

EFIV follows the S&P 500 ESG Index, which is the ESG offshoot of the S&P 500. The fund is designed to deliver comparable industry exposures to the S&P 500, though the ESG fund holds 308 stocks and the parent index holds over 500.

SPYX tracks the S&P 500 Fossil Fuel Free Index, a benchmark of companies within the S&P 500 that are “fossil fuel-free,” defined as companies that don’t own fossil fuel reserves (thermal coal reserves, coal reserve byproducts, or oil or gas reserves).

EEMX, which tracks the MSCI Emerging Markets ex Fossil Fuels Index, credibly excludes fossil fuel stocks, as the energy sector represents only 0.41% of the ETF’s portfolio.

For more news, information, and strategy, visit the ESG Channel.