On the surface, it might be difficult to comprehend how Bitcoin and environmental, social, and governance (ESG) investing might affect each other. However, the two are more closely linked than one might imagine.

“Bitcoin is nursing losses after its worst weekly plunge in almost a year and on one view its longer term outlook could be even worse because of environmental concerns and tightening regulations,” a Bloomberg article explained. “The sheer amount of energy needed to mine Bitcoin and the prospect that governments will create more obstacles for the largest cryptocurrency point to the token losing ‘most of its value over time,’ BCA Research Inc. said.”

Nonetheless, that hasn’t stopped Bitcoin bulls from piling into the cryptocurrency, which has drawn interest from institutional investors as well as electric automaker giant Tesla.

Still, BCA Research contends that the sheer energy necessary to mine the cryptocurrency outweighs its benefits related to ease of payments via a digital medium. Additionally, BCA Research sees governmental regulations as an additional roadblock that Bitcoin must deal with over the long-term.

“Many companies have cozied up to Bitcoin in order to associate themselves with the digital currency’s technological mystique,” BCA Research Chief Global Strategist Peter Berezin added. “As ESG funds start to flee Bitcoin, its price will begin a downward spiral. Stay away.”

An ESG ETF to Consider if Bitcoin Isn’t an Option

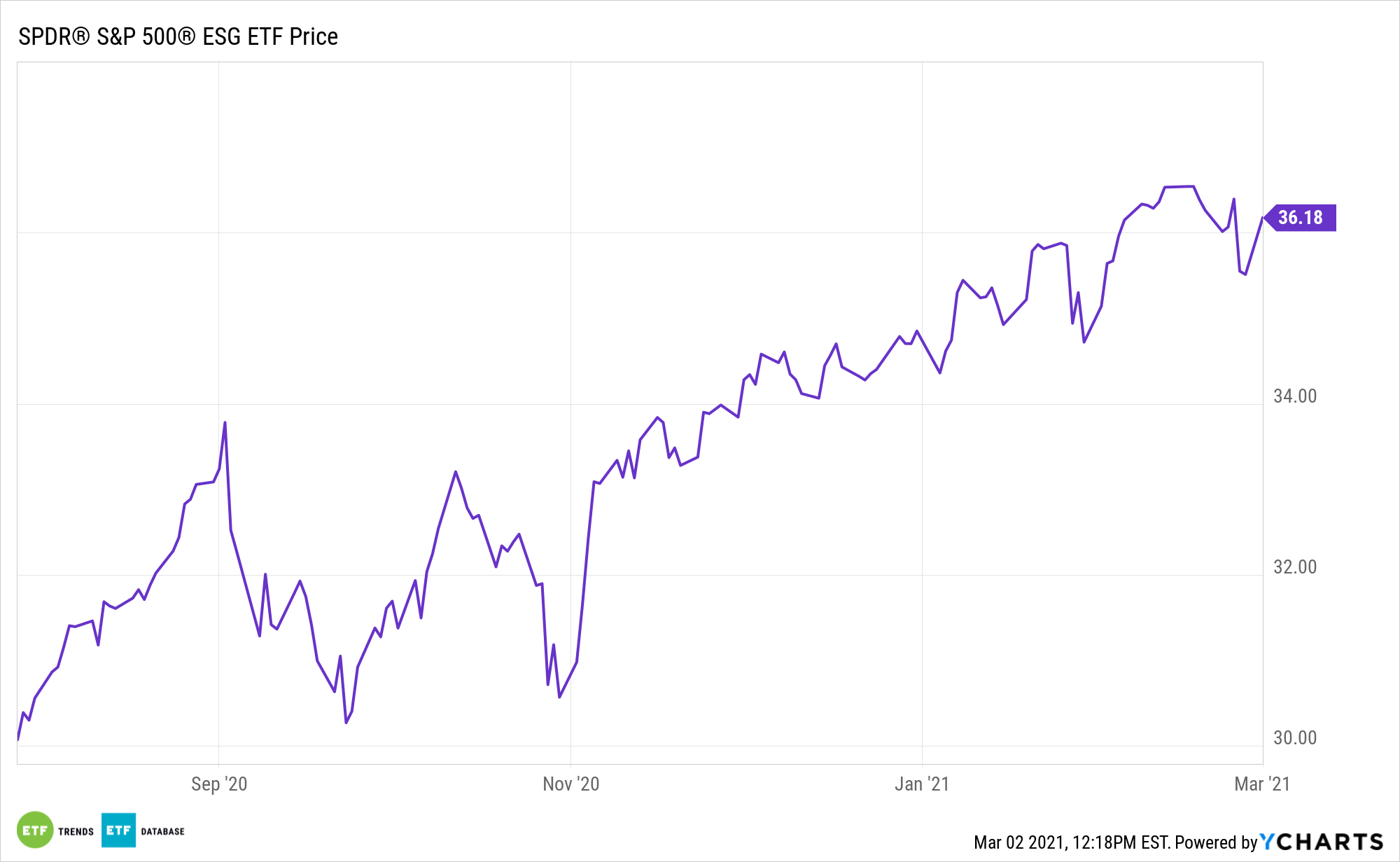

For investors who aren’t ready to hop on the cryptocurrency bandwagon just yet, there are ESG ETF options to consider. One of them is the the SPDR S&P 500 ESG ETF (EFIV).

The fund seeks to provide investment results that correspond generally to the total return performance of an index that provides exposure to securities that meet certain sustainability criteria (criteria related to ESG factors) while maintaining similar overall industry group weights as the S&P 500 Index.

In seeking to track the performance of the S&P 500 ESG Index, the fund employs a sampling strategy, which means that it is not required to purchase all of the securities represented in the index. Overall, EFIV gives investors:

- Investment results that, before fees and expenses, correspond generally to the S&P 500 ESG Index.

- Potential ESG core exposure, based on its focus on sustainability criteria and comprehensive market coverage of the flagship core S&P 500 Index.

- A low expense ratio of 0.10%, 27 basis points below the category average.

For more news and information, visit the ESG Channel.