By Nick Erickson & John Sama, Sage Advisory

Most ESG investors would agree that climate change risk is at or near the top of their list of sustainability issues. According to the US SIF Foundation’s biennial ESG “Trends Report” released Monday, climate change remains the top ESG issue for money managers, who incorporate climate change risk factors to $4.2 trillion in assets.

The long-term economic consequences of climate change span the financial, housing and infrastructure, agriculture, and geopolitical security sectors, to name a few. A 2018 report from the Intergovernmental Panel on Climate Change (IPCC) estimated that with just a 1.5°C warming of the planet, by the year 2100 economic losses globally would total $54 trillion – the combined total annual GDP of the U.S., European Union, and China.

As with most forms of extreme event risk, it is impossible to predict the exact timing, magnitude, and cost of the next catastrophe. Unlike black swan events, however, which are completely unexpected, climate risk is more of a “known unknown.” While no individual natural catastrophe can be directly attributed to climate change, increasing temperatures globally create conditions that are more conducive to a higher frequency or severity (or both) of a multitude of perils, including hurricanes, severe storms, floods, wildfires, and droughts.

Credit Ratings Begin to Reflect Climate Risks

To recognize the impact climate change can have on municipalities, credit rating agencies have recently begun to factor such risks into their evaluations. “We look not just at the vulnerability of state and local governments, but their ability to manage the impact,” said Emily Raimes, Vice President with Moody’s Public Finance Group. “While we’ll be looking at the data on rising sea levels and who may be more vulnerable, we’ll also be looking at what these governments are doing to mitigate the impact.”[1]

Earlier this year, Sage’s report Climate Risk and Municipal Credit Ratings looked at the relationship between cities’ credit ratings and their level of preparedness for climate-related events.[2] Utilizing the climate data set from the Notre Dame Global Adaptation Initiative (ND GAIN), Sage determined that municipalities with higher credit ratings, on average, reflected lower levels of overall climate risk and were generally better prepared to deal with their expected level of climate-related risk.

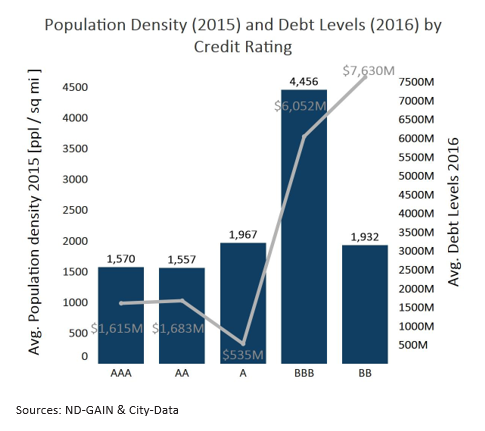

When it came to evaluating climate risk exposure, Sage’s study also found that population metrics mattered. Whether it was related to population density for heat, cold, and drought risk, or the percent of the population living within a flood plain area or high sea level risk region, the underlying factor that had the largest impact on a municipality’s perceived climate risk was its population size and geographic placement. This relationship between population metrics, credit quality, and climate risk is illustrated in the chart below.

When it comes to climate risk preparation, Sage found that a municipality’s overall economic health had the largest influence over its respective climate risk readiness score. A municipality whose economic health was good, as reflected in its credit worthiness, seemingly had sufficient financial flexibility to support its community during adverse climate-related events and was adequately prepared for future re-occurrences. On the other hand, municipalities that had weaker fundamental economic conditions were less likely to be able to do either.

Municipalities Offset Risks Through Investment

Governments large and small rely on the $4.1 trillion municipal bond market for much of their infrastructure work. Indeed, about two-thirds of infrastructure projects in the United States are paid for by municipal bonds, and more than 50,000 states, local governments, and other authorities have issued bonds to finance their work. This is important because when climate preparedness and the probability of adverse event risk are unbalanced, it creates a domino effect. A municipality that is unable to support its community when a significant adverse climate event happens is likely to see its citizens relocate, and as a result, tax revenue declines. These conditions often lead to further erosion of a municipality’s already weak financial condition. To fund the resulting revenue gap, municipalities often increase their debt leverage through the sale of debt securities; and with a smaller and weaker tax base, they generally find their credit ratings start to weaken.

“Where climate risk is most relevant to municipalities is where it can create an ‘acute revenue pressure,’” said Michael Rinaldi, senior director in Fitch Ratings’ public finance group. “This is especially the case for bonds backed by sales tax income where a specific event can upend the economy even for a short period of time.”[3]

To mitigate these concerns, some of the largest cities in the U.S. are starting to combat the physical risks of climate change by making investments. For example, Kansas City, Missouri, signed a consent decree with the Environmental Protection Agency (EPA) pledging $2.5 billion to upgrade its stormwater infrastructure, which handles both stormwater and wastewater and was built in the 19th century. Climate change is causing Kansas City to experience longer and larger rainfall events, causing the stormwater infrastructure to overflow and spill pollution into local lakes, streams, and rivers.[4] Another city, Aurora, Colorado, developed and invested in the Prairie Waters project, which is designed to provide its growing population with a sustainable long-term water supply under drought conditions.[5] These are just two examples of many. As of early 2019, cities were collectively working on about 240 climate-related projects totaling $47 billion, according to Moody’s Investors Services, which expects cities to issue a growing number of bonds to help finance these projects.

Measuring & Pricing Climate Risk is a Challenge

Over the past few years, the realities of climate change have moved to the forefront of investors’ minds, and a crucial factor in understanding and managing climate risk is ensuring that it is properly evaluated and quantified. This can be a difficult proposition since past climate change data may be associated with significantly different climate conditions that no longer reflect current risk. Additionally, the challenge in this task is determining how to convert climate data into a quantitative metric that can be included in credit analysis and, ultimately, security pricing. We believe that it is important for ESG investors to recognize that using credit ratings in conjunction with a full climate risk analysis can help to incorporate and quantify the relevant risks associated with climate change in a securities valuation more completely.

After recognizing the need to address climate change risks within our ESG Municipal Bond Framework and leveraging the climate insights provided by the ND GAIN data set, we were able to create a climate resiliency framework. This framework was constructed to function as a separate component of our overall ESG risk assessment methodology and to provide a climate resiliency factor that could be applied to the municipal projects that are approved within our overall ESG framework.

Sage’s Assessment of ESG Impact + Climate Resiliency + SDGs Alignment

ESG Impact Methodology

The municipality projects that we analyze through our ESG framework are designed to mitigate a perceived environmental risk (i.e., clean energy, clean water) or address a social issue in a community in need (i.e., accessible schools, affordable housing). These projects are evaluated and scored on both the project’s expected impact and the intensity of the impact on the community.[5] Project impact evaluates the scope of the project and how well it fits within our ESG framework. Intensity of impact looks at how much perceived impact the project will have on the underlying community being served by that project. A score is derived for both the project impact and impact intensity, and the average of these two scores yields our overall ESG score. Each security is assigned a Sage ESG Leaf Score based upon its overall score (see below). Securities that are three leaves and above are considered eligible for inclusion within our ESG investable universe.

Climate Resiliency Methodology

To analyze climate resiliency, we began by utilizing the data provided by the ND GAIN climate study. ND GAIN categorizes climate risk into five groups: sea level rise, drought, cold, heat, and flood. Each city can be exposed to multiple risks, so we grouped the cities based on the climate event that posed the most risk. Each city also has a climate readiness score assigned to it. By evaluating each city’s respective climate risk in relation to its readiness, we can assign a climate resiliency factor to that city on a scale of 1-5, with one being the lowest climate resiliency and five the highest.

The addition of climate-related analysis provides an extra layer of risk management and ensures that we are being adequately compensated for the climate risk a city may face. This evaluation process allows us to produce a ranked universe of climate valuation-adjusted ESG municipal projects from which our portfolio managers can evaluate and select. Having an awareness of climate risk in the municipal market is one thing, but understanding the impact that climate-related events can have on the underlying fundamental characteristics of a municipal bond in the form of credit rating and valuation can help our portfolio managers construct a portfolio that is better aligned with clients’ risk tolerance and values.

Alignment with the Sustainable Development Goals

Lastly, we evaluate each bond’s alignment with the United Nations-supported Sustainable Development Goals (SDGs). The SDGs are a set of 17 goals, listed below, and each goal has underlying targets, for a total of 169 targets. In 2015 the United Nations General Assembly set the 2030 goals, which are designed to be a “blueprint to achieve a better and more sustainable future for all.”

At Sage, we believe it is important to not only report on a bond’s ESG characteristics, but to also recognize how they are aligned with a global set of sustainability goals.

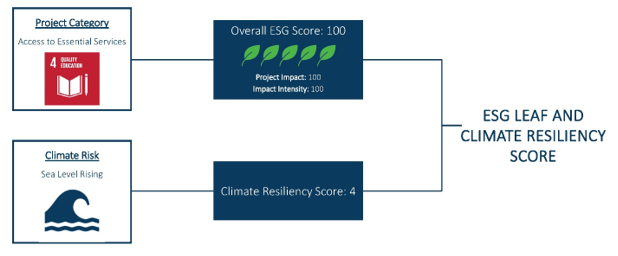

The following bond issue is for a school district in South Carolina. Horry County School District issued $72 million in municipal bonds to upgrade and modernize their facilities. Because the proceeds are directed toward free public education, the bonds align with SDG goal 4, Quality Education, and Target 4.1, which by 2030 works to ensure that all girls and boys complete free, equitable, and quality primary and secondary school.

Since the bond issuance was for construction of public education facilities and modernization, it would have a project impact score of 100. And because the percent of school-age children living in poverty in the district is greater than the national average, the intensity of impact score would also be 100, giving the county an overall ESG score of 100, which equates to a Sage ESG Leaf Score of 5 leaves. When it comes to climate risk, Horry County’s biggest risk is rising sea levels, but the county is generally very well prepared to handle this climate risk and therefore it carries a climate resiliency score of 4 (out of 5).

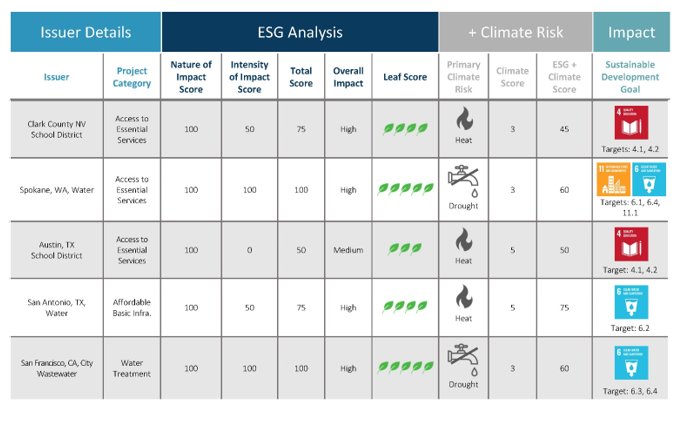

The following Impact Scorecard illustrates how Sage records our Sage ESG Leaf Score, Climate Resiliency Score, and SDGs alignment for each issuer in a portfolio.

Sage’s ESG analysis combined with our climate resiliency framework enables investors to have an apples-to-apples comparison of various climate risks and their impact on credit ratings and valuations. Ideally, this analysis helps to determine if a municipal issue is appropriately priced within its peer group of similar credits. A credit that has identical fixed income characteristics but has a different climate resiliency score should reflect that difference in its valuation. In our next climate perspective, we will examine a case study of two municipal credits, how they differ in their climate resiliency and how those differences are reflected in their current and anticipated valuations.

Originally published by Sage Advisory

Sources:

1. Brown, Amanda. “Climate Change Could Make Borrowing Costlier for States and Cities.” PEW. October 1, 2019.

2. “ESG Perspectives: Climate Risk & Municipal Credit Ratings.” Sage Advisory. May 2020.

3. Nauman, Billy. “Municipal Bond Issuers Face Steeper Borrowing Costs from Climate Change.” Financial Times. January 7, 2020.

4. Preville, Phillip. “The Future of Stormwater Management Runs Through Kansas City.” Medium. July 13, 2020.

5. “Guidance and Case Studies for ESG Integration: Equities and Fixed Income.” CFA Institute. September 12, 2018.

Disclosures

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. The information included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. This report is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results. Sustainable investing limits the types and number of investment opportunities available, this may result in the Fund investing in securities or industry sectors that underperform the market as a whole or underperform other strategies screened for sustainable investing standards. No part of this Material may be produced in any form, or referred to in any other publication, without our express written permission. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory. com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.