By Bob Smith, President & CIO

Earlier this week, I spoke at the Barron’s Institutional Summit about how the ESG investing landscape is changing and what’s driving momentum for ESG adoption among our institutional clients, which includes public retirement plans, defined contribution plans, non-profit organizations, and insurance companies. As I see it, the three key drivers right now are alignment, sentiment, and regulation.

Alignment

One of the reasons people invest in good ESG companies is to align their investments with their values. This is becoming increasingly important in the non-profit world, where every organization has a mission with both idealistic and tangible goals that it aspires to achieve for the community it serves.

Mission Driven Investing seeks the active alignment between the investment activities of the organization and its specific mission and operating objectives. This is typically accomplished through both exclusionary SRI and inclusionary ESG factor screening.

The way values alignment is increasingly expressed by investment managers is by reporting an investment or portfolio alongside the corresponding United Nations-supported Sustainable Development Goal (SDG). The SDGs were launched in 2015 and are a set of 17 goals with 169 underlying targets that both companies and societies worldwide are striving to achieve by 2030. These goals are intended to solve pervasive real-world problems, such as eliminating hunger and poverty, ensuring access to quality education, and building sustainable cities and communities.

Investment managers can help organizations map and identify how and where their respective missions and values align with the greater global community and how their individual efforts are creating positive impact. We believe that this form of reporting and analysis will be increasingly employed by organizations to help improve the effectiveness of the impact created by their respective missions and help to drive the investment process.

Sentiment

Sentiment is indeed an important consideration for why things happen, particularly in the public fund arena. Public policy positions across a variety of ESG topics have not only been directly reflected in governmental actions but also in a growing number of public retirement systems across the U.S.

Today, there are approximately 22 public retirement systems that are official signatories of the Principles for Responsible Investment (PRI), and five systems that state they integrate ESG risk considerations throughout their investment activities. Combined, these plans now represent 35% of all public U.S. retirement plan assets for a total of $1.3 trillion and 33% of all plan participants, which is 8.3 million people. We believe that as public sentiment favoring responsible investment continues to grow, so too will the adoption by many more public retirement systems.

There is evidence to suggest that the favorable alignment between public retirement plan goals and responsible investing is also supplemented by their strong desire to fulfill a fiduciary duty. In a 2019 Cerulli Survey, it was found that 87% of institutional asset owners (e.g., public plans) integrated ESG criteria into their investment analysis because it was a significant or somewhat important factor in helping to meet their respective fiduciary duty.

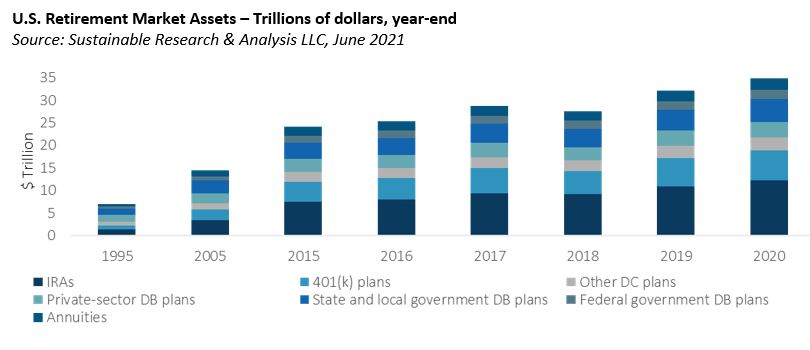

We’re also seeing ESG increasing in favor among defined contribution, or 401(k) plans, and this is being driven by a significant shift in workplace demographics, regulatory policy, and federal legislation that will likely offer advisors – those who are prepared – a substantial business development opportunity.

Let’s consider a few facts.

- There are 56 million Millennials in the U.S., which is one-third of the workforce and growing.

- There are over 600,000 401(k) plans with 60 million active participants and roughly $7 trillion to $8 trillion in market assets, with an increasing share from Millennial investors over the next 20 to 30 years.

- Research shows that Millennial investors are twice as likely to prefer responsible investing over conventional alternatives and desire more options in their 401(k) plans.

- The past regulatory barriers that prevented greater plan adoption of ESG-integrated investment vehicles have been removed by the Biden Administration. Congress has introduced legislation that seeks to amend ERISA by making it clear that plans may prudently consider ESG factors in their investment decisions, the passage of which looks very promising.

We believe that for these and other reasons, the future is bright for greater ESG adoption across the 401(k) marketplace and that this will continue to drive the growth of sustainably focused mutual funds and ETFs, as well as UMA and SMA strategies across the asset allocation spectrum.

Regulation

Other influences that will contribute to this trend of greater adoption of ESG integration will come from the regulatory world. This was confirmed with the EU’s introduction in March of the long-awaited Sustainable Finance Disclosure Requirements (SFDR).

The SFDR aims to ensure that investors have the disclosures they need to make investment choices in line with their sustainability goals, and it seeks to aggressively combat greenwashing within the investment services industry.

Here in the U.S., we have already seen the SEC act with its issuance of an Investment Alert in April. The SEC informed investors and investment management firms that it seeks greater disclosure from companies about their climate-related risks.

Like EU regulators, the SEC also issued warnings about potential greenwashing by investment management service providers. The alert clearly signaled that Chairman Gensler will be making climate risk disclosure and ESG integration claims by investment firms’ the top priorities for the SEC’s investigative efforts in 2021 and beyond.

Ahead of new regulation, we are seeing national ratings agencies exert greater influence over the credit and insurance markets, as they ramp up their requirements of corporations and governments for greater climate risk disclosures.

We also expect that they will increasingly apply greater scrutiny of a wide range of ESG factors that they deem financially material to the credit and operating standing of the organizations under their review. Their opinions on these issues will increasingly matter to the markets and serve to foster discipline and structure in the application of ESG risk analysis across the financial markets.

We believe the insurance industry is a pivotal component because of the important services it provides, and it can have tremendous influence over human behavior in countless ways, including commercial and personal sustainability practices.

In recent years, the industry has withstood some significant climate-related catastrophes that have caused sizable financial challenges. In recognition of these trends, and the likelihood that they will continue, the industry has become increasingly ESG risk aware in both its underwriting and investment activities.

We believe this is encouraging, given the industry’s inherent influence over all types of consumers seeking to utilize their risk-bearing capabilities. In this capacity they are, and will increasingly become, agents for change in the drive for greater adoption of ESG risk management practices.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.