A Q&A with Jennifer Delaney, CFA, a product strategist representing the BlackRock Emerging Markets Fund and the BlackRock International Fund, and Jasmine Fan, CFA, a product strategist representing iShares international equity products.

Jasmine Fan: U.S. stocks have been the best performers for the better part of a decade, why should investors think international now?

Jenny Delaney: International exposures are likely to play an increasingly important role both in the global economy and in U.S. investor portfolios for three reasons.

First, the potential diversification benefits of international investing have been brought into sharp relief by deglobalization trends. Declines in economic trade and investment between countries have been accelerated by the COVID<-19 outbreak. The pandemic is having a profound impact on global business and that means investors need to look internationally for global exposures that they could previously gain from investing in domestic multi-national companies.

Next, we believe that there are potential growth opportunities to be found in accelerating investment trends taking place in less mature markets and in innovation coming from outside the U.S.

Finally, international equity markets are more diverse compared with 20 years ago across sectors and styles, which makes is simpler today to incorporate international exposure into more portfolios.

Jasmine: BlackRock’s portfolio analytics can give a reading on the positioning of U.S. financial professionals — how are they positioned?

Jenny: The average international equity allocation for U.S. financial professionals’ equity sleeve is 25.3%, down from 30% in 2018, according to BlackRock’s advisor portfolio analysis.[1] We think that’s too low.

Jasmine: Why?

Jenny: International equity holdings of the average portfolio do not match the economic impact of those international economies. They are, for example, much lower than the weight of international markets in the MSCI ACWI index (Figure 1).

Figure 1: World equity index composition vs. average financial professional’s portfolio

This isn’t a big surprise. Home-country bias is common in U.S. portfolios. And remember that we’re fresh off the longest U.S. bull market in history, so it follows that financial professionals in the U.S. were reluctant to favor international stocks for fear of missing out.

Jasmine: What’s unique about international investing vis-à-vis the U.S.?

Jenny: For one thing, international investing offers opportunity up and down the value chain across industries that can be overlooked in U.S.-centric portfolios. Supply chains have many layers, including manufacturing, services and technology. Often, companies best positioned to benefit from the various stages of the supply chain are located around the globe.

Take electric vehicles. Norway is the global leader in electric vehicles in terms of electric car market share, while China and continental Europe both have more electric vehicles on the road than the U.S.[2] Leading battery suppliers to the electric vehicle industry are typically found in Asia.

Jasmine: There are potentially significant growth opportunities outside of the U.S.?

Jenny: That’s right. In less developed markets, investment trends that might be mature in the U.S. still have opportunity to accelerate from a lower starting point, and local players can capture such growth. Take e-commerce: Growth in this industry has been significantly faster for leaders in Southeast Asia, where e-commerce penetration is still in the single digits versus teens in Europe, 27% in China and 18% in the U.S.[3] As a result, both user growth and e-commerce penetration are growing more rapidly in the region, accelerated further by the COVID-19-related behavioral changes.

In addition, there is world-leading innovation coming outside of the U.S., such as industrial automation, payments and renewable energy. For instance, the transaction value of payments in China is five times more than the combined total of Visa and Mastercard.[4]

Jasmine: What are some major changes you have observed in international investing?

Jenny: International investing no longer just means opportunities in Europe. Today, unlike two decades ago, the international equity universe is a diverse and diversified one, and truly global. The MSCI ACWI ex USA Index captures opportunities across 46 countries including 22 developed markets countries and 26 emerging markets countries, encompassing close to 2,500 stocks.[5] Asia represents 42% of the investment universe, Europe represents another 42%, and remainder comes from the Americas.

Jasmine: Are you saying the universe of international stock investing is becoming more diverse?

Jenny: Right. No single country dominates, and no country makes up over 20% of the universe. This is a broad, exciting universe of opportunities, from Austria to South Korea. In addition, the gradual opening of many foreign stock markets has provided investors more access to markets that were not previously available, such as Saudi Arabia and China.

The universe is also well diversified by sector compared with many investors’ existing domestic allocations. For example, the MSCI ex-USA Index has a higher weight to industrials and financials and lower weight to technology and health care compared to the MSCI USA Index. No one sector in the MSCI ex USA Index has over 20% weight.

Figure 2: MSCI US sector weights v MSCI ex US sector weights

Jasmine: How would adding international exposures shift a portfolio’s factor or style composition?

Jenny: Factors and styles are not the same across regions. For example, the MSCI EAFE Growth Index is made up of health care and consumer staples exposure while the MSCI US Growth Index is dominated by technology companies.

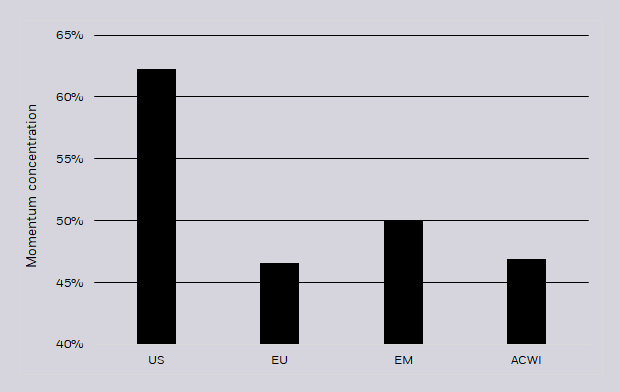

We can also look through the lens of factors, an investment approach that involves targeting specific drivers of return across asset classes. A recent analysis shows that the commonality driving the momentum factor, tendency of winning stocks to continue performing in the near term, is 62% in the MSCI USA Index, while the measurement is only 47% in the MSCI Europe Index (Figure 3). In other words, what’s considered “momentum” in the U.S. right now is more highly correlated to one another than momentum in Europe. As a result, increasing the weight of international allocation in a U.S. biased equity portfolio could serve as an efficient tool for investors to diversify their style and factor exposures, potentially reducing the risk of a strong momentum reversal that could adversely impact their portfolio returns.

Figure 3: U.S. stocks are more concentrated within the momentum factor

Jasmine: Last question. At BlackRock, we’re already seeing increased interest from clients in diversifying and expect this trend to persist through the remainder of 2020 and beyond. What else should investors know about diversification and international investing?

Jenny: Several forces could drive the correlation between U.S. equities and international equities lower in the next few years.

The renewed geopolitical tensions between the U.S. and China is exacerbating deglobalization trends and leading to more bifurcated supply chains. The increased weight of domestic sectors such as consumer, health care and technology versus the role of more globally correlated sectors such as energy and materials could also contribute to more divergent outcomes across countries.

Even without a drop in correlations, diversification benefits can come from other aspects such as foreign currency holdings and from the diverse sector, factor and style exposures which international investing offers.

Jasmine: Thanks so much for speaking with me, Jenny.

Related iShares Funds

- iShares Core MSCI EAFE ETF – IEFA

- iShares MSCI Intl Quality Factor ETF – IQLT

- iShares Core MSCI Emerging Markets ETF – IEMG

- iShares ESG Aware MSCI EAFE ETF – ESGD

Originally published by iShares

1. Source: BlackRock, Portfolio Solutions (as of June 2020.)

2. Source: iea.org (As of August 2020.)

3. Source: BlackRock, US Department of commerce, Euromonitor, OC&C Strategy Consultants (as of December 2019.)

4. Source: BlackRock, iResearch (as of December 2019.)

5. Source: MSCI (as of July 2020.)

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial advisors for more information regarding their specific tax situations.

The products referred to herein are not sponsored, endorsed or promoted by MSCI Inc. and MSCI Inc. bears no liability with respect to any such products or any index on which they are based. The prospectus contains a more detailed description of the limited relationship MSCI Inc. has with BlackRock and any related products.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Barclays, Bloomberg Finance L.P., BlackRock Index Services, LLC, Cohen & Steers Capital Management, Inc., European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Services, LLC, India Index Services & Products Limited, JPMorgan Chase & Co., Japan Exchange Group, MSCI Inc., Markit Indices Limited, Morningstar, Inc., The NASDAQ OMX Group, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), New York Stock Exchange, Inc., Russell or S&P Dow Jones Indices LLC. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE nor NAREIT makes any warranty regarding the FTSE NAREIT Equity REITS Index, FTSE NAREIT All Residential Capped Index or FTSE NAREIT All Mortgage Capped Index; all rights vest in NAREIT. Neither FTSE nor NAREIT makes any warranty regarding the FTSE EPRA/NAREIT Developed Real Estate ex-U.S. Index, FTSE EPRA/NAREIT Developed Europe Index or FTSE EPRA/NAREIT Global REIT Index; all rights vest in FTSE, NAREIT and EPRA.“FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2020 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are registered and unregistered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.