The debt market is a vast sea that investors often can’t simply navigate on their own. Novice bond investors can get complete exposure via ETFs like the iShares Core Total US Bond Market ETF (IUSB).

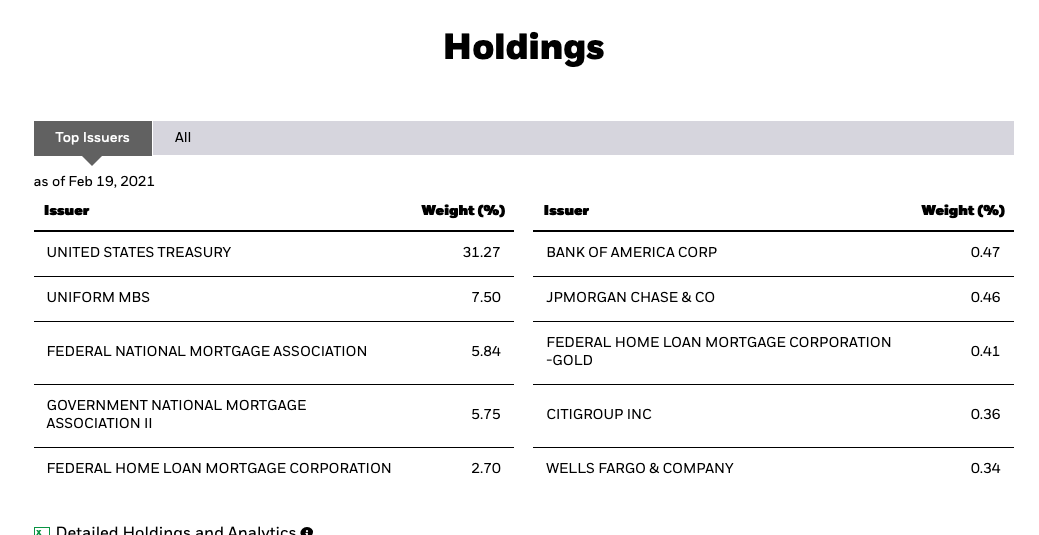

IUSB seeks to track the investment results of the Bloomberg Barclays U.S. Universal Index. The fund generally will invest most of its assets in the component securities of the index and may also invest in certain futures, options and swap contracts, cash and cash equivalents, including shares of money market funds advised by BFA or its affiliates, as well as in securities not included in the underlying index, but which BFA believes will help the fund track the underlying index.

Overall, IUSB gives investors:

- Low cost comprehensive exposure to the broad bond market

- Exposure to potentially higher yielding bonds not included in the Bloomberg Barclays U.S. Aggregate Bond Index

- A low expense ratio of 0.06%, 35 basis points lower than its category average

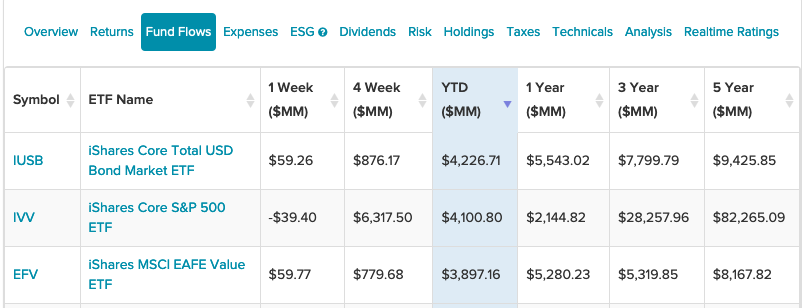

Strong YTD Inflows Despite the Threat of Inflation

With the capital markets digesting the potential threat of inflation, fund managers are adjusting their debt portfolios accordingly. IUSB is nevertheless seeing strong year-to-date inflows.

“The big risk in the market really is inflation, whether it is transitory or whether it is something more deep rooted,” said Arvind Narayanan, head of investment-grade credit at Vanguard. “There’s just a tremendous amount of stimulus in the marketplace, both monetary and fiscal, that favor economic growth.”

A Bloomberg article also noted that bullish bond investors “argue that the chances of price pressures that weren’t present prior to the pandemic suddenly emerging in its aftermath are slim, at best, given the continuing structural shifts in the economy.”

“Inflation will be more transitory than sustained,” said Dominic Nolan, a senior managing director at Pacific Asset Management. “We have to see how steep the curve gets and if the perceived inflationary pressures actually materialize into inflation.”

Of course, it’s up to the Federal Reserve to decide what the fate of interest rates will be.

“Rising rates could very well be a prelude to inflation as we take into account the current macroeconomic environment,” John Reed, head of global trading at KKR, which manages about $79 billion of credit assets, said via email. “A modest rise in rates off current levels seems likely for the remainder of 2021, but the Fed has been transparent in willing the market to invest behind yield, growth and recovery.”

For more news and information, visit the Equity ETF Channel.