Up 70% within the past year, the iShares Self-Driving EV and Tech ETF (IDRV) can drive any portfolio to more gains in 2021.

“If the future of cars is to be electric, the 2020s will be the decade that turns the tide,” a Forbes article said. “Last year, demand for electric vehicles (EVs) led to a meteoric rise in Tesla’s stock price, turning the electric vehicle pioneer from a bankruptcy candidate into the most valuable car manufacturer in the world. Domestically, over 18 million electric vehicles are expected to hit the road over the next 10 years, boosted by a notably pro-electric Biden administration.”

Per the iShares website, the fund will provide prospective investors with:

- Access to companies at the forefront of self-driving and electric vehicle (EV) innovation

- Exposure to global stocks along the full value chain of self-driving and EV industries, across sectors and geographies

- Long-term growth with access to companies that can shape the global economic future

IDRV will invest in domestic and international markets per its prospectus, which states that “the Underlying Index is composed of equity securities of companies listed in one of 43 developed or emerging market countries that derive a certain specified percentage of their revenue from selected autonomous or electric vehicle-related industries, as defined by IDI.”

IDRV’s Diverse Holdings

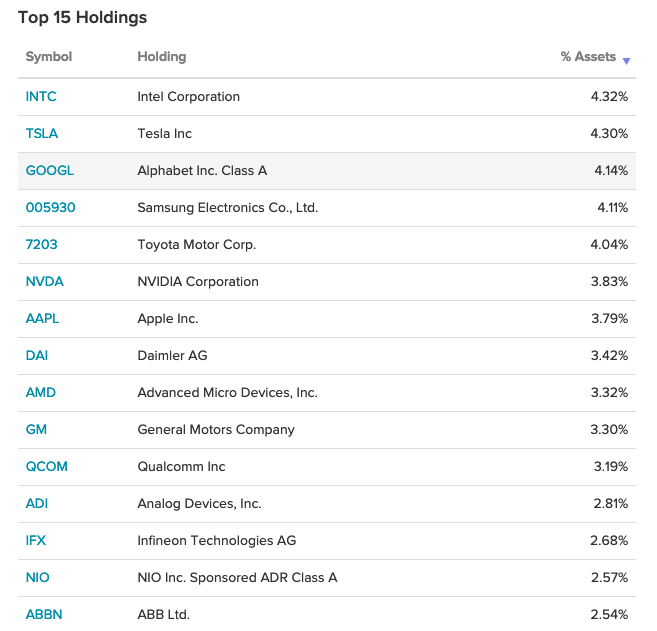

IDRV holdings include familiar names like Tesla, but also big tech names like Intel Corporation and Google. And then there are small cap growth names, giving the fund varied exposure with relatively deep holdings.

“Another modest fund with about $300 million in assets, this iShares fund may have the longest list of total components with about 100 holdings at present,” a U.S. News report said. “At the top of the list are favorites like Tesla, but you’ll also find traditional automakers such as General Motors (GM) and Toyota Motor Corp. (TM) that continue to invest heavily in EVs.”

“There are also software and hardware firms helping to support this transition from the old automotive industry to the new,” the article added. “The number of legacy players may turn off investors who just want to play tomorrow’s electric vehicle leaders, but all in all, this is a great one-stop fund to play the broad trend of EVs in all forms. The expense ratio is 0.47%.”

For more news and information, visit the Equity ETF Channel.