When the momentum factor gets going, it’s tough to stop. Even with a major crisis like the COVID-19 pandemic. The iShares Edge MSCI USA Momentum Factor ETF (BATS: MTUM) has been yielding gains of over 21% YTD according to Morningstar performance numbers.

The fund seeks to track the investment results of the MSCI USA Momentum Index. MTUM generally will invest at least 90% of its assets in the component securities of the underlying index and may invest up to 10% of its assets in certain futures, options and swap contracts, cash and cash equivalents.

As far as the index goes, it consists of stocks exhibiting relatively higher momentum characteristics than the traditional market capitalization-weighted parent index, the MSCI USA Index, which includes U.S. large- and mid-capitalization stocks.

Momentum Myths

Andrew Ang, Head of Factor Investing Strategies at BlackRock, recently debunked a few myths regarding the momentum factor.

“Critics of momentum strategies typically point out that momentum is a high turnover strategy, and due to its higher turnover, transaction costs eat away any potential premium,” Ang wrote. “True, if you don’t implement it well. For example, The iShares MSCI USA Momentum Factor ETF (MTUM) typically has annual turnover between 100% to 150%. Yet, the factor’s higher relative turnover has not affected the fund’s ability to capture momentum.”

Another myth involves maintaining exposure to momentum over time.

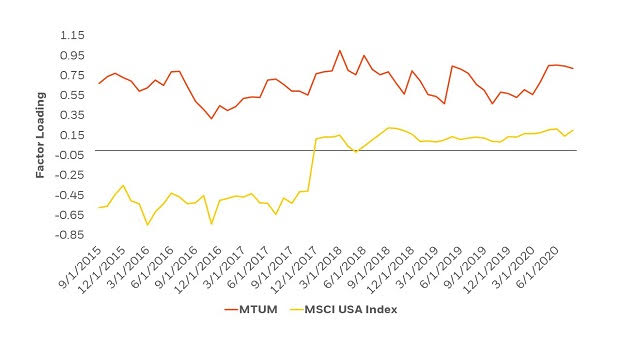

“Momentum naysayers have argued that investors are unable to have consistent exposure to the momentum factor in a passive index fund,” said Ang. “They contend that market sentiment can change rapidly, and an index-based ETF with a pre-defined rebalance schedule cannot capture these swift changes in trends. To test this theory we analyzed the factor loadings of MTUM relative to the MSCI USA Index over the past five years, shown below. Factor loading scores combine several different measurements of momentum to determine if a portfolio owns positively-trending stocks. If the score is above 0, the portfolio has deeper momentum characteristics than the global average. If the score is below 0, the portfolio has below average exposure to trending stocks.”

“The ETF has consistently shown positive momentum exposure, as well as higher exposure than the broad market. Even when markets sharply dropped in Q1 2020, and subsequently rebounded in the second quarter, MTUM was able to maintain positive momentum exposure throughout the change in market sentiment,” Ang added.

Ang’s last myth deals with the relative tax efficiency of momentum.

“Given its relatively high turnover, some skeptics argue that momentum strategies are tax inefficient,” Ang noted. “And while it is true that higher turnover strategies can lead to higher realized taxable gains, MTUM has never paid out a capital gain since inception.”

“The ETF wrapper allows a higher turnover strategy, like momentum, to deliver its targeted exposure while protecting the fund from tax decay,” Ang noted further. “Most trading of ETFs occurs on the secondary market – meaning when an investor sells their shares of an ETF, there is an investor on the opposite side who is buying those shares. In comparison, if an investor liquidates their shares of a mutual fund, the Portfolio Manager managing the mutual fund may need to sell underlying positions in the fund to raise cash. When the Portfolio Manager is forced to sell positions, the PM may realize taxable capital gains.”

With a 0.15% expense ratio, MTUM offers ETF investors momentum exposure at a low cost.

“As momentum has gained broader acceptance among academics as a factor, the narrative has shifted among practitioners as to whether momentum can effectively be captured. As MTUM has demonstrated, we believe that the answer is a resounding YES,” concluded Ang.

For more news and information, visit the Equity ETF Channel.