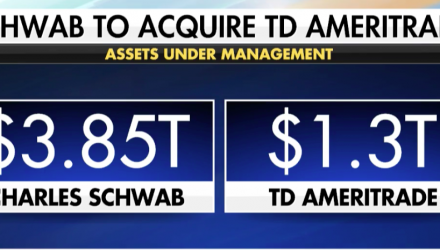

In a huge move that benefits investors, Charles Schwab is buying TD Ameritrade for $26 billion.

It keeps getting better for the investment community with more industry consolidation. It’s great news for investors and RIAs who do business and custody at both Charles Schwab and TD Ameritrade.

While most U.S. stocks were flat on Thursday, Charles Schwab (SCHW) closed up 7.33% for the day ($48.03 +$3.28) while TD Ameritrade (AMTD) closed up 16.92% ($48.38 +$7.00).

FOX Business’ Maria Bartiromo exclusively broke news of the merger this morning.

“Schwab is $3.85 trillion in client assets while TD Ameritrade has $1.3 trillion,” host Maria Bartiromo said while breaking the news. “This will allow the company to better compete with BlackRock’s iShares business. It comes after the race to zero commissions among asset managers, as Schwab was the first to make the move to make online commissions $0. Competitors have followed suit in quick fashion in the past several months.”

The Charles Schwab Corporation has more than 365 offices and 12.2 million active brokerage accounts, 1.7 million corporate retirement plan participants, 1.4 million banking accounts, and $3.85 trillion in client assets as of October 31, 2019.

Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, asset management, custody, and financial advisory services to individual investors and independent investment advisors.

Its broker-dealer subsidiary, Charles Schwab & Co., Inc. and affiliates offer a complete range of investment services and products including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; referrals to independent, fee-based investment advisors; and custodial, operational and trading support for independent, fee-based investment advisors through Schwab Advisor Services.

Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides banking and lending services and products.

Meanwhile, TD Ameritrade provides investing services and education to approximately 12 million client accounts totaling approximately $1.3 trillion in assets, and custodial services to more than 7,000 registered investment advisors.

TD Ameritrade is a leader in U.S. retail trading, executing an average of approximately 800,000 trades per day for our clients, more than a quarter of which come from mobile devices. They have a proud history of innovation, dating back to its start in 1975, and today its team is 10,000-strong.

For more trending ETF industry news, visit ETFtrends.com.