Key Takeaways

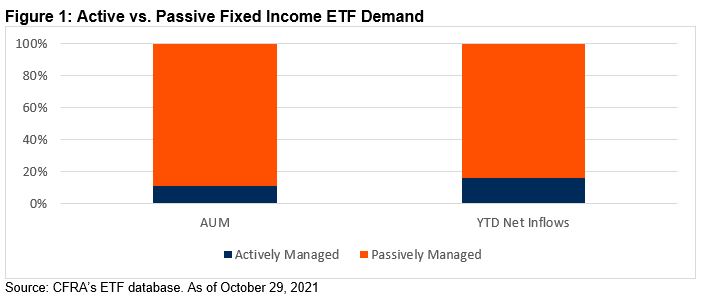

Actively managed fixed income ETFs pulled in 16% of the category’s net inflows year-to-date through October, more than the 11% share of the asset base. CFRA sees room for further growth as asset managers launch products targeted to key bond sectors.

Actively managed fixed income ETFs pulled in 16% of the category’s net inflows year-to-date through October, more than the 11% share of the asset base. CFRA sees room for further growth as asset managers launch products targeted to key bond sectors.- John Hancock rolled out two active fixed income ETFs so far in 2021, expanding a lineup previously focused on smart-beta index-based equity ETFs.

- John Hancock Corporate Bond ETF (JHCB) and John Hancock Mortgage-Backed Securities ETF (JHMB) provide a different risk-reward profile than index-based fixed income products. JHCB seeks out undervalued BBB-rated bonds, while JHMB owns floating rate bonds that mitigate against rising interest rates

Fundamental Context

John Hancock launched its first fixed income ETFs in 2021, nearly six years after offering a suite of equity products. The long-time provider of active mutual funds rolled out six smart-beta equity ETFs in September 2015, with John Hancock Multifactor Mid Cap ETF (JHMM) currently the largest at $2.6 billion in assets. In addition to other broad market-cap oriented ETFs, the firm’s equity lineup includes sector-targeted products, such as five-star rated John Hancock Multifactor Health Care ETF (JHMH) and John Hancock Multifactor Industrials ETF (JHMI).

The firm’s 15 equity ETFs are passively managed in partnership with Dimensional Funds, focusing on smaller-cap companies that have relatively strong profitability and attractive valuations. However, John Hancock’s two most recent ETF launches were actively managed fixed income products run by an experienced team within its parent company, Manulife Investment Management.

Actively managed fixed income funds gathered 16% of the category’s net ETF inflows in the first ten months of 2022, more than their 11% share of the market. Most of the active assets are in ultra-short-fixed-income products and broad market core bond ETFs, like JPMorgan Ultra-Short Income ETF (JPST) and PIMCO Active Bond ETF (BOND). Yet, CFRA expects demand for corporate and mortgage-backed funds will expand further as more asset managers expand their lineups to other investment styles and leverage their experienced teams.

JHCB seeks to opportunistically find attractively valued securities within the corporate bond market. The fund launched in March 2021 and is run by Jeff Given, Howard Greene, and Pranay Sonalkar. Working with a team of credit analysts, JHCB seeks out issuers that could experience a credit upgrade or that are trading at an unwarranted discount to peers. In a recent recorded interview with CFRA, Given explained that many companies previously on the edge of investment grade were downgraded to junk status in 2020 during the heart of the pandemic, but he’s starting to see the trend shift in the other direction. We think this is positive for the investment style going forward.

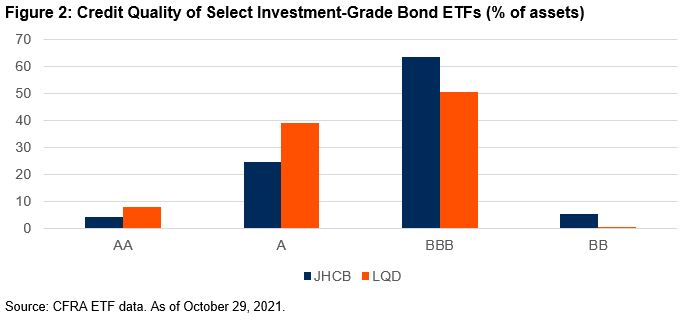

Given added that AA- and A-rated bonds do not have a lot of excess return potential, so he and the management team seek out “diamonds in the rough” within the BBB ratings category. Indeed, relative to index-based iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), JHCB recently had more exposure to BBB bonds (63% of assets vs. 51%) and less in A-rated securities (24% vs. 39%) upon CFRA’s review of the ETF holdings.

JHMB provides exposure to U.S. government agency bonds, collateralized mortgage obligations, and asset-backed securities. Managers Given and Green also work with Manulife colleagues David Bees and Peter Farley to actively run this ETF, which launched in August 2021. Bees, who also spoke to CFRA, explained the fund’s combination of agency bonds and securitized credit provides the flexibility to navigate different economic environments. The team was attempting to mitigate the tapering of the Federal Reserve’s asset purchases and protect against rising interest rates by favoring shorter-duration asset-backed securities and invest in floating-rate securities (15% of assets at the end of September 2021). JHMB’s average duration was recently 4.0 years, 10% less than the 4.4 years for index-based iShares MBS ETF (MBB), while offering a higher 1.73% 30-day SEC yield (1.22% for MBB). JHMB also takes on additional credit risk versus its peer. Bees explained that passively managed mortgage bond ETFs invest almost exclusively in fixed-rate mortgage-backed securities.

JHMB’s management team expects spreads for mortgage-backed securities to widen heading into 2022 and it sees more interesting investment opportunities in asset-backed securities. Examples the team identified using bottom-up research include franchise restaurants and shipping container related bonds.

Conclusion

Actively managed fixed income ETFs have the flexibility to take on credit risk or reduce interest rate sensitivity. These ETFs can also accomplish the inverse in response to a shifting macroeconomic environment. To hear from the managers behind John Hancock’s relatively new ETFs, watch this CFRA video with Bees and Given recorded in November: https://youtu.be/a7wlcbO5TR0

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.