Key Takeaways

Tax-free municipal bond ETFs have gathered $16.4 billion of net inflows year-to-date through October 7, up from $14.6 billion for all of 2020.

Tax-free municipal bond ETFs have gathered $16.4 billion of net inflows year-to-date through October 7, up from $14.6 billion for all of 2020.- iShares National Muni Bond ETF (MUB) and Vanguard Tax-Exempt Bond ETF (VTEB) are the two largest municipal bond ETFs, but there are also some large index-based ETFs that focus on higher-yielding securities in the sub-category that can be used to boost income in an asset allocation strategy.

- PIMCO also recently launched a core-plus actively managed municipal bond ETF that invests in some speculative-grade bonds.

Fundamental Context

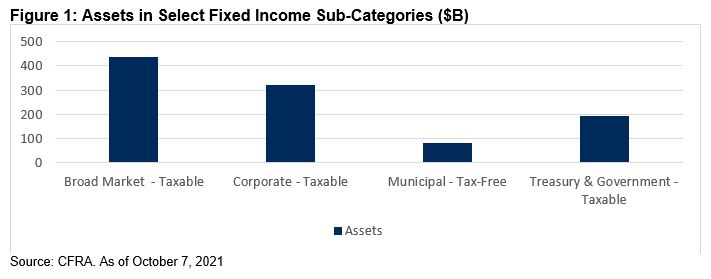

Demand for municipal bond ETFs continues to climb in 2021. Despite representing 6.8% of the fixed income ETF universe, municipal bond ETFs have gathered an 11% share of the $154 billion of net inflows for the asset category as of October 7. According to CFRA ETF data, the $16.4 billion of year-to-date net inflows for the municipal bond sub-category is higher than corporate bond ($16.2 billion) and Treasury and Government bond ($8.7 billion) ETF sub-categories, despite managing far less assets as shown in Figure 1. In addition, the net inflows for municipal bond ETFs in 2021 has already exceeded the $14.6 billion for all of 2020. We think investors growing comfort in the liquidity of fixed income ETFs has helped municipal bond products gain traction.

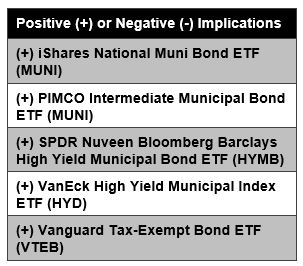

ETF investors typically need to choose between an investment-grade or high-yield muni bond approach. The $24 billion MUB and the $15 billion VTEB are the two largest municipal bond ETFs and while there are slight differences between them—VTEB charges an expense ratio that is one basis point less, and the funds track different benchmarks—both focus primarily on high-investment-grade-rated securities. Indeed, just 7.6% of VTEB’s recent holdings and 5.6% of MUB’s recent ETF holdings were rated BBB, the lowest investment-grade rating, while both funds had approximately 75% of assets in bonds that are rated AA or higher. Both funds sport 12-month yields of 1.8%.

Meanwhile, investors can take on additional credit risk in search of higher income with $3.7 billion VanEck High Yield Municipal Index ETF (HYD) or the $1.8 billion SPDR Nuveen Bloomberg Barclays High Yield Municipal Bond ETF (HYMB). Just 31% of HYMB’s assets and 25% of HYD’s assets were investment-graded rated debt with both funds holding a lot more speculative-grade-rated as well as non-rated bonds.

Investors might consider using these two types of index-based ETFs in tandem to build a portfolio, with a combination of MUB/VTEB with HYD/HYMB to generate additional income and manage their risk, based on their tolerance level. HYD and HYMB offer 3.3% and 3.0% yields, respectively.

PIMCO’s latest ETF takes an active approach to a core-plus municipal bond strategy. In September 2021, PIMCO Municipal Income Opportunities Active ETF (MINO) began trading, run by the same management team behind the $680 million PIMCO Intermediate Municipal Bond Strategy ETF (MUNI). But unlike MUNI, MINO has the flexibility to actively seek opportunities across the investment-grade and high-yield municipal market. Indeed, PIMCO believes that investment-grade municipals have recently been trading close to fair value when compared to after tax corporate spreads, while there continues to be pockets of opportunity in the high-yield segment. In addition, the asset manager noted that municipalities have relatively low default rates compared to corporate issuers. While MINO is still small, with just $42 million in assets, the fund recently held nearly 4% of assets in bonds rated BB or below and additional 26% stake in non-rated bonds.

CFRA will be hosting a webinar on October 13 with the portfolio manager of MUNI and MINO David Hammer to discuss opportunities in the municipal bond market. To register visit https://go.cfraresearch.com/MuniBonds

Conclusion

While municipal bond mutual funds remain popular, investors are increasingly looking to ETFs for tax-free income. We expect ETF demand to persist aided by strategies that take a flexible approach to credit quality either self-built or run by an active manager.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.