Key Takeaways

While pending increases to the capital gains tax rate are likely to only impact a subset of investors, we expect the tailwind for ETF demand to persist.

While pending increases to the capital gains tax rate are likely to only impact a subset of investors, we expect the tailwind for ETF demand to persist. - Just three of the 585 Equity ETFs offered by iShares, Invesco, Schwab State Street Global Advisors, and Vanguard and star rated by CFRA passed along any capital gains to shareholders in 2020 that maintained positions throughout the year.

- In contrast, many mutual funds passed along some tax burden to shareholders, even those that stayed loyal throughout the year.

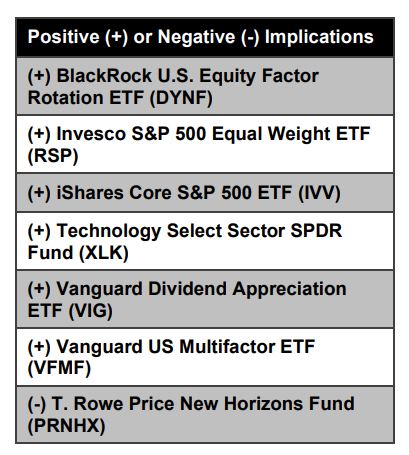

- Market-cap weighted ETFs such as iShares Core S&P 500 ETF (IVV 418 ***) and Technology Select Sector SPDR (XLK 143 *****), smart-beta ETFs such as Invesco S&P 500 Equal Weight ETF (RSP 148 ***) and Vanguard Dividend Appreciation ETF (VIG 153 ***), and actively managed BlackRock U.S. Equity Factor Rotation ETF (DYNF 35 ****) and Vanguard US Multifactor ETF (VFMF 100 ****) all incurred zero capital gains in 2020.

Fundamental Context

Equity mutual funds continue to bleed assets in 2021. According to Investment Company Institute (ICI) data, equity mutual funds incurred $117 billion of net outflows year-to-date through April 14, while equity ETF new share issuance was $229 billion. This continues a multi-year trend of equity ETF market share gains. However, if President Biden and the Democrats successfully raise the capital gains tax rate in 2021, to pay for pending fiscal spending, even more investors may prefer to control their tax-paying destiny and sell some existing mutual fund positions in exchange for ETFs.

The five largest ETF providers manage 88% of U.S.-listed ETF assets. Equity ETFs provided by these firms — BlackRock, Vanguard, State Street Global Advisors, Invesco, and Schwab – rarely passed along a capital gain to their shareholders in 2020. Indeed, the three “sinners” represent just 0.5% of the equity ETFs rated by CFRA and all are offered by BlackRock.

The largest capital gain as a percentage of its net asset value (NAV) was incurred by the $37 million iShares Evolved U.S. Innovative Healthcare ETF (IEIH 33 ****). This actively managed sector fund paid out capital gain of $0.57 a share, equal to 1.7% of its NAV. For the firm’s two other funds, the capital gain represented less than 0.08% of their NAVs. More importantly, popular market-cap weighted IVV, smart-beta iShares Edge MSCI Momentum Factor ETF (MTUM 174 ****), and actively managed DYNF were not included on this list of capital gain payers.

Meanwhile, Invesco, Schwab, State Street Global Advisors, and Vanguard had zero equity ETFs that passed along any capital gains to shareholders. The firms’ lineup includes market-cap weighted XLK, and smart-beta RSP, and VIG. Investors in these and other equity ETFs do face tax consequences when they sell their shares. But unlike with a mutual fund, redemptions by other shareholders do not typically create a taxable event for long-term holders of the ETF.

ETFs are generally more tax-efficient than mutual funds. Unlike mutual funds, ETFs generally do not sell securities when investors redeem their shares. Most trading takes place in the secondary market, with sell orders being crossed with buy orders through the exchange as they are with stocks.

When the selling pressure exceeds the demand, ETF shares are redeemed through an authorized participant using an in-kind mechanism that allows the fund to reduce the likelihood of capital gains. In addition, index-based equity ETFs typically have lower turnover rates — IVV and XLK have an annual turnover rate of just 4% — than active mutual funds where the management team has the discretion to take profits throughout the year. With less trading at the fund level, fewer capital gains are incurred with equity ETFs.

In 2020, 37 of 39 of T. Rowe Price’s domestic equity mutual funds incurred a capital gain including the T. Rowe Price New Horizons Fund (PRNHX 83 ***), which paid out 9.2% of its NAV. T. Rowe Price launched actively managed equity ETFs in 2020.

Meanwhile, Dimensional Fund Advisors announced in November 2020 plans to soon convert a suite of tax-managed mutual funds into ETFs. According to the company, while the six mutual funds have delivered tax efficiency like what is available in the existing ETF market, their conversion will provide an additional tool to manage capital gains, supporting the funds’ goal to deliver higher after-tax returns by minimizing the tax impact.

Conclusion

One of the benefits investors in ETFs have historically enjoyed is strong tax efficiency. ETF-focused advisors and investors in 2020 received fewer surprises at year-end and we expect more people that mix ETFs and mutual funds together will be more inclined to shift toward strategies to avoid paying higher capital gains taxes in the future. There is a range of strong tax-efficient actively managed and index-based ETFs to consider.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.