According to the latest Morningstar report for U.S. mutual fund and exchange-traded fund (ETF) fund flows, passive funds notched their best month year-to-date during the month of June with inflows of $69 billion across all category groups. The market share for passive funds now accounts for 40 percent compared to a year ago when it was 37.4 percent.

It’s an uptrend that’s recently hit its stride in just the past five years, according to the report. In the meantime, June wasn’t kind to active funds, which lost $22.5 billion after a volatility-laden May that, in turn, saw a number outflows in passive and active equity funds.

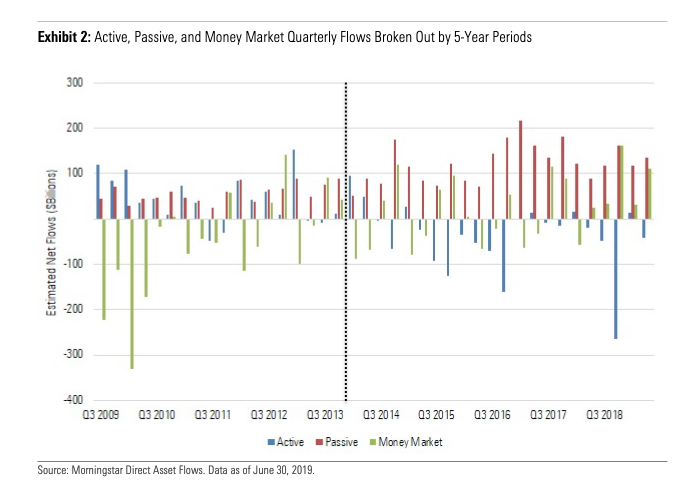

“Passive demand has been growing for years, but as we have noted before, passive flows accelerated significantly five years ago, a that trend has continued,” the report noted. “To a large degree, the past 10 years were a tale of two decades. In the five years following the 2007–09 crisis, passive funds collected an impressive $1.16 trillion”

“Passive flows more than doubled to $2.56 trillion during the past five year,” the report added further. “Yes, they likely benefitted from $956 billion in active-fund outflows. But, even if all those active outflows went to passive vehicles, that still left $1.6 trillion of additional inflows. Neither did that demand come from cash leaving money-market funds, as those vehicles had inflows of nearly $590 billion during the decade’s second half.”

Morningstar’s report about U.S. fund flows for June is available here. Highlights from the report include:

- In June, long-term open-end mutual funds and ETFs rebounded with $46.0 billion in inflows after nearly $2.0 billion in outflows in May. Despite last month’s dip, long-term flows were strong during 2019’s first half, totaling $224.0 billion, slightly ahead of 2018’s $219.0 billion.

- Passive funds had their best month year-to-date, collecting $68.6 billion in June while active funds lost approximately $22.5 billion to outflows.

- Taxable-bond funds recovered from May’s weak demand with $37.4 billion in inflows. Among active taxable-bond funds, multisector-bond fund Pimco Income, which holds a Morningstar Analyst Rating™ of Silver, dominated with $1.9 billion in June inflows. It finished the first half of 2019 with $13.7 billion in inflows, more than twice that of runner-up Lord Abbett Short Duration Income.

- Among all U.S. fund families, iShares led in June with $34.6 billion in inflows, which benefitted from strong demand for its equity factor ETFs. Bronze-rated iShares Russell 1000 Value had the largest inflows of $5.0 billion, while iShares Russell 1000 Growth wasn’t far behind with inflows of $4.0 billion in June. For both funds, those figures were their best monthly inflows ever.

For more trends in ETFs, visit our Equity ETF Channel.