By Michael Lane, Head of iShares US Wealth Advisory for BlackRock

The debate about international investing has raged for decades, on a range of topics including diversification benefits, how riskier companies in less developed countries can provide opportunities for greater returns, and how investors in countries around the world may make the mistake of assuming too much of a “home bias” when investing. Well, as we review portfolios from U.S. financial advisors, it seems the U.S. home bias has been growing. But is now the right time to turn away from the potential benefits of both developed and undeveloped international investing? After thirty-two years in the business, I’ve seen this play out many times where investors chase what has been hot and run from logical and reasonable investments.

Many financial advisors have long had a love-hate relationship with international investing. They recognize that it is important to have diversified portfolios, which including non-U.S. stocks helps accomplish, and that there are many world class non-U.S. companies that offer potential returns. But as the world became more globalized, many of these theoretical diversification benefits were expected to wane. The thought was that markets around the world should begin moving more in sync as companies expanded their global footprint.

This has led to many advisors that I’ve spoken to over the years expressing a certain amount of skepticism about stocks outside the U.S. They argue that the political and currency risks are not worth taking, especially given how the world had become so interconnected. I’ve often heard some advisors say investing in large, U.S. companies dependent on exporting for much of their revenue means you are already exposed to the global economy, just without added risks.

All of this has resulted in the average advisor portfolio in the U.S. being significantly underweight non-U.S. developed and emerging market stocks, according to my colleagues Brett Mossman and Patrick Nolan who analyze advisor model portfolios. The average international equity allocation for U.S. financial advisors’ equity sleeve is only 25.3%, well below the weight of international markets in the MSCI ACWI Index (Source: BlackRock’s advisor portfolio analysis, as of Dec 2019). That means an investor could be missing out on potential diversification benefits and growth prospects.

To be fair, sticking to the U.S. has worked well in recent years. The annual return of the MSCI ACWI ex-USA Index over the last 10 years is 4.97% (Source: Thomson Reuters, as of June 30, 2020). Over the same period, the S&P 500 annual return was 13.99%. It thus comes as little surprise that many feel no pressing need to embrace international investing.

However, there are several important shifts in both the markets and the global economy that are leading many advisors that I’m speaking to begin to change their minds. It is time to reconsider international investing and potentially increasing exposure to non-U.S. There are two main themes driving this shift:

Diversification and deglobalization

An effective measure of diversification benefits is correlation: how much different assets move in synch with each other. A correlation of one means they move up or down at the same rate, while a negative correlation means they move in opposite directions. Interestingly, the correlation of international and U.S. equities has declined since the early 2000s, belying the widespread belief that there are limited diversification benefits of international investing.

And more importantly than the more recent time period, I believe that correlations will continue to decline in coming years, given the trend towards deglobalization. For a range of reasons, from COVID disruptions to trade tensions, there can be little doubt that the world is becoming more fragmented, and few signs that will change any time soon. More companies dependent on international supply chains may bring those dependencies back into one’s home country. One consequence of that could be the increased diversification benefits of international investing.

This is especially true in the current environment where countries are recovering from the coronavirus at different rates. My colleagues at the BlackRock Investment Institute recently moved to an overweight of European stocks, seeing them as critical beneficiaries of a global economic restart, while moving to a neutral position on the U.S. The key point is that we are seeing a divergence in policy responses to the virus, recovery rates and economic rebounds, all of which underscores the importance of being more broadly diversified.

A changing global economy

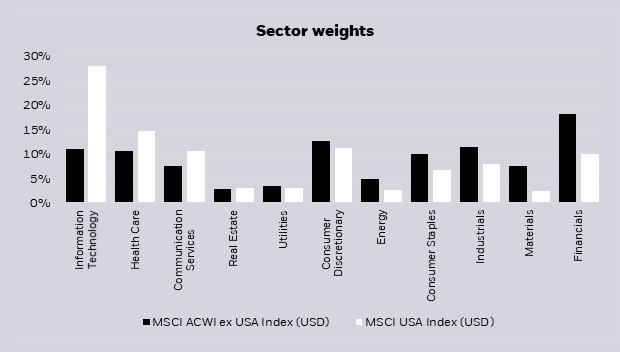

International investing has become increasingly diverse and diversified. Sector weights are very different outside the U.S. for example. The U.S. has higher exposure to technology and health care, but less to financials, industrials and consumer staples and consumer discretionary.

MSCI US sector weights v MSCI ACWI ex US sector weights

Source: MSCI, as of June 2020. Subject to change.

Moreover, international investing offers the potential exposure to both innovation that is occurring outside the U.S. in everything from electric vehicles to automation, as well as accelerating trends in less mature markets. Investors could benefit from both – and miss out if they continue to steer clear of non-U.S. investors.

Obviously, the world has changed immensely in the last few months. We all hope the world will return to some semblance of pre-COVID normalcy soon, but many changes are undoubtedly here to stay. I believe it is important that investors prepare for and adapt to this changing world. Increasing exposure to international investing is one way to do exactly that.

For more insights from iShares, visit iShares.com.

Related Funds:

iShares MSCI ACWI ex U.S. ETF – ACWX

iShares Core MSCI Europe ETF – IEUR

iShares Core MSCI Total International Stock ETF – IXUS

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/developing markets and in concentrations of single countries. Diversification and asset allocation may not protect against market risk or loss of principal.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective. The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by MSCI Inc., nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with MSCI Inc.

©2020 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.