Fundamental Context

JPMorgan Asset Management plans to convert four mutual fund portfolios into ETFs in early 2022. The firm cited the continued convergence of mutual funds and ETFs as well as the benefits of intraday liquidity, transparency, and potential tax benefits of ETFs in explaining its plans to seek fund board approval for the change. The four funds, which collectively manage approximately $10 billion, are JPMorgan International Research Enhanced Equity Fund (OEIAX), JPMorgan Realty Income Fund (URTAX), JPMorgan Inflation Managed Bond Fund (JIMAX), and JPMorgan Market Expansion Enhanced Index Fund (OMEAX).

Actively managed ETFs pulled in 12% of ETF inflows thus far in 2021, despite representing 4% of assets. Investors continue to gain comfort in using ETFs to deliver better returns or incur less risk than using an index-based approach. Historically most active ETF assets were in fixed income products, offered by Fidelity, JPMorgan, PIMCO, and others, yet there has been a shift in 2021. Actively managed equity ETFs gathered $38 billion of new money year-to-date through August 10, nearly double the $21 billion for fixed income products. ARK Innovation ETF (ARKK 121 **) has led the charge among established products with $6.5 billion of new money followed by JPMorgan Equity Premium Income ETF (JEPI 62 NR) with $2.6 billion. There were 44 actively managed equity ETFs to gather more than $100 million.

Mutual fund-to-ETF conversion is a new industry development. Prior to 2021, there was never any such conversion, but Guinness Atkinson converted two small mutual funds in the first quarter of 2021. The largest was renamed SmartETFs Dividend Builder ETF (DIVS) and has approximately $30 million in assets. However, Dimensional Funds proved that a very large mutual fund could be converted to ETF when it formed Dimensional US Core Equity 2 ETF (DFAC), Dimensional US Core Equity Market ETF (DFAU), and two other ETFs that managed a combined $30 billion in assets. Such maneuvers allow asset managers to tap into demand for ETFs while keeping alive the fund’s track record for marketing purposes. But the big change for fund management is the need to provide full transparency.

JPMorgan chose a different route than many other large asset managers. In 2020 and thus far in 2021, American Century, Fidelity, Invesco, and T Rowe Price have launched ETFs with either the same name or a similar investment style as well-established mutual funds. Rather than converting to an ETF and needing to provide daily disclosure of their full portfolios, these firms have rolled out new products such as American Century Focused Dynamic Growth ETF (FDG) and Fidelity Blue Chip Growth ETF (FBCG) and were able to maintain the same level of semi-transparency they provide through mutual funds using unique ETF structures.

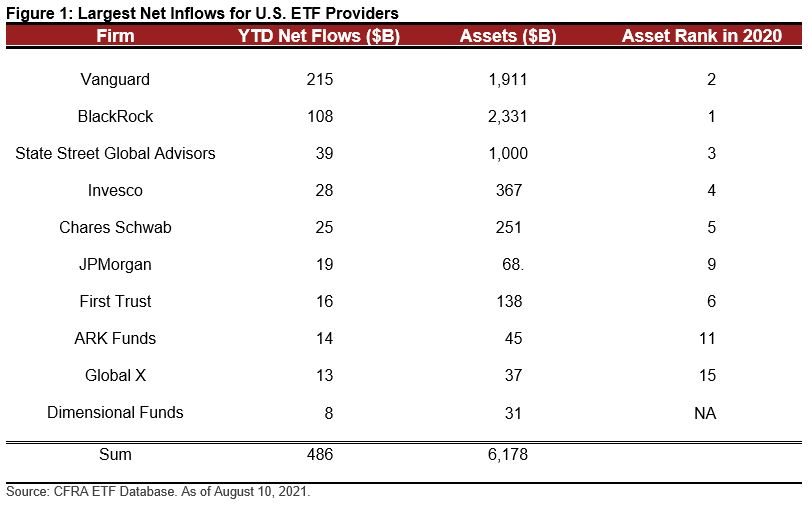

JPMorgan has already been modestly punching above its weight during a record year for net inflows. The firm has gathered $19 billion of new money into its U.S.-listed ETFs in 2021 according to CFRA’s ETF data, sixth-most in the industry ahead. JPMorgan is now the seventh-largest provider with $68 billion in assets after climbing two spots since the end of 2020. In addition to the demand for JEPI and active fixed income products like JPMorgan Ultra-Short Income ETF (JPST), JPMorgan has experienced growth with low-cost index-based international equity funds like JPMorgan BetaBuilders Europe ETF (BBEU). However, JPMorgan still recently had $900 billion in mutual fund assets spread across 129 portfolios. We expect in the next couple of years, more of these portfolios will exist as only ETFs.

Conclusion

Well-established active managers continue to shift their focus to the ETF industry inspired by record demand. While the mutual fund market remains much larger, we expect more firms to make their stock-picking skills available through an ETF. CFRA stands ready to begin coverage of JPMorgan’s future offerings soon after the conversion based on our forward-looking, holdings-based analysis.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.

All of the views expressed in this research report accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. For more information and disclosures, please refer to CFRA’s Legal Notice at https://www.cfraresearch.com/legal/.

Copyright © 2021 CFRA. All rights reserved. All trademarks mentioned herein belong to their respective owners.