It seems clean energy investments can keep on riding the coattails of a Joe Biden presidency. The revelation of Biden’s clean energy plan gave ETFs like the iShares Global Clean Energy ETF (ICLN) even more tailwinds, and more importantly, more fund flows.

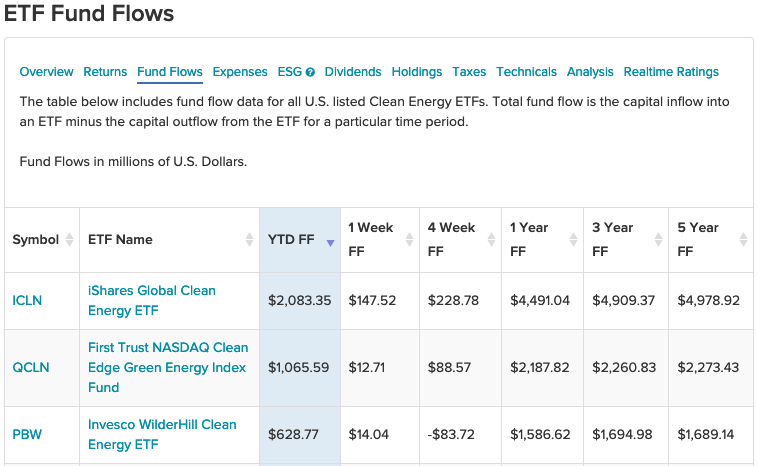

Looking at fund flow analytics from ETF Database, at the top of the heap is ICLN. It’s joined by two other clean energy funds, underscoring the popularity of the space since Biden’s presidential victory.

The fund seeks to track the S&P Global Clean Energy Index, which is designed to track the performance of approximately 30 clean energy-related companies. Overall, ICLN gives investors:

- Exposure to companies that produce energy from solar, wind, and other renewable sources.

- Targeted access to clean energy stocks from around the world.

- Use to express a global sector view.

- Strong performance, with a fund up over 160% within the past year and 7% in just the last 5 days.

Biden’s Big Energy Bet

Biden’s infrastructure plan would rank as one of the largest in terms of reducing emissions.

“If signed into law, the $2 trillion infrastructure proposal would rank as one of the largest federal efforts ever to curb the country’s greenhouse gas emissions,” a CNBC article said. “Many of the clean-energy measures, such as funding for electric vehicles, millions of additional charging ports for them, and retrofitting buildings and residences, would help the president achieve a goal of net-zero emissions by 2050, according to the White House.”

Another byproduct of the infrastructure plan is its boost on overall environmental, social, and governance (ESG) investing. ESG was already a popular space to begin with, but the introduction of Biden’s plan was a bonus.

“Investing according to environmental, social and governance — or so-called ESG — factors had been gaining steam before Biden’s plan,” the article said. “ESG funds captured $51.1 billion of net new money from investors in 2020 — their fifth consecutive annual record, according to Morningstar data. Their returns have also been strong relative to traditional funds — 3 in 4 sustainable funds ranked in the top half of their investment category over the past three years, Morningstar data shows.”

Another fund to track is the iShares ESG Aware MSCI USA ETF (ESGU). ESGU seeks to track the investment results of the MSCI USA Extended ESG Focus Index, which is designed to reflect the equity performance of U.S. companies that have favorable environmental, social, and governance (“ESG”) characteristics, while exhibiting risk and return characteristics similar to those of the MSCI USA Index.

For more news and information, visit the Equity ETF Channel.