Key Takeaways

AMC Entertainment (AMC) became the focus on U.S. equity markets in the last two weeks and helped drive the strong recent performance for Invesco Dynamic Leisure and Entertainment ETF (PEJ).

AMC Entertainment (AMC) became the focus on U.S. equity markets in the last two weeks and helped drive the strong recent performance for Invesco Dynamic Leisure and Entertainment ETF (PEJ).- However, index-based PEJ sold out of its 18% position in AMC before the end of last week as part of the quarterly rebalance when the stock no longer met the investment criteria.

- Instead, Expedia Group (EXPE) and Yum China Holdings (YUMC) were among the consumer-related stocks purchased.

Fundamental Context

AMC shares rose five-fold in value in less than two weeks. The movies & entertainment company opened trading on May 24 at $12.38 a share, before rising as high as $72.62 in the middle of trading on June 2 and ended last week at $47.91. Tuna Amobi, a CFRA Equity Analyst, noted that in recent months, AMC had rallied sharply on the gradual reopening of its domestic and international theater locations, with the latter picking up in recent weeks amid the vaccine rollout; AMC started 2021 at $2.20 a share. Amobi upgraded his recommendation on AMC to Hold from Sell on May 26 citing, among other factors, frenzied retail buying, which continued in subsequent days. On June 2, AMC traded approximately 766,000 shares, 20 times its volume a month earlier. Some of that elevated activity was the result of an already well-timed sale by an index-based ETF.

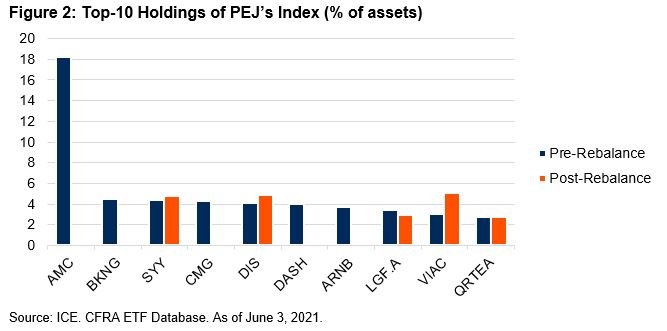

PEJ has outperformed the broader U.S. market and the consumer discretionary sector in 2021. PEJ invests in various leisure-related sub-industries, including hotels, resorts & cruise lines, movies & entertainment, and restaurants. The ETF was up 32% year-to-date through June 4, ahead of the 6.5% gain for the Consumer Discretionary Select Sector SPDR ETF (XLY) and the 13% return for the SPDR S&P 500 ETF (SPY). However, in the past three years, PEJ’s 4.7% return lagged the 18% gains for XLY and SPY. A recent, sizable position in AMC helped boost PEJ, but we have concerns about the ETF’s prospects going forward due to risk and reward concerns.

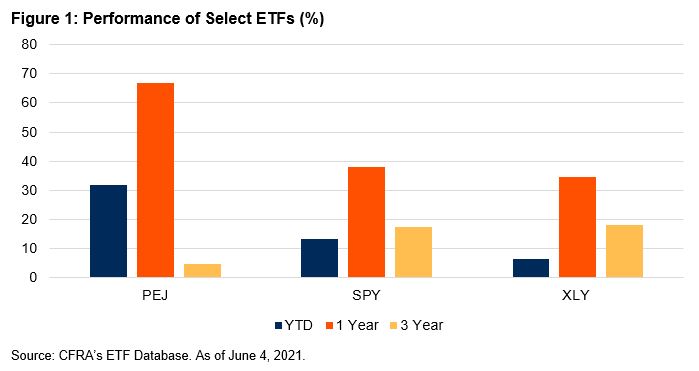

PEJ looks very different from a week ago. The approximately $2 billion industry focused smart-beta index ETF had been gaining investor interest in 2021 as a product to participate in the reopening of America with Covid-19 vaccine concerns fading. The ETF pulled in more than $940 million in assets in the first five months of 2021. While PEJ holds 30 stocks, the stake in AMC rose from an approximately 3% of assets position when it was added in February to an 18% stake at the beginning of trading on June 2. In what likely will prove to be prescient timing, PEJ sold its full AMC position along with some other top-10 positions. In Figure 2, we show the top-10 holdings of the ICE index tracked by PEJ on June 2, prior to the rebalance and June 3, following the rebalance.

By tracking a quasi-active benchmark, PEJ benefitted from impeccable timing. On a quarterly basis, the ICE Dynamic Leisure & Entertainment Intellidex Index, tracked by PEJ, scores companies within certain leisure and entertainment industries based on price momentum, earnings momentum, quality, management action, and value metrics. The index separates large-caps and smaller caps in the scoring process. Only eight stocks are chosen from the large-cap group, with the remainder in small caps. In response to an inquiry from CFRA, ICE explained that in February 2021, AMC made it into the index, ranking 20th based on the model score in the small sub-group. In May, the stock was ranked lower at 32, and therefore missed being kept in the index. Other recent top-10 positions to be removed were Airbnb (ABNB), Booking Holdings (BKNG) and DoorDash (DASH). Invesco replicates the ICE index rather than making its own discretionary decisions with PEJ.

EXPE and YUMC were among the stocks added to PEJ last week. These large-cap stocks joined existing positions such McDonalds (MC), ViacomCBS (VIAC) and Walt Disney (DIS) in PEJ’s current top-10 holdings. Meanwhile, Bloomin’ Brands (BLMN), Choice Hotels (CHH), and The Cheesecake Factory (CAKE) were some of the smaller caps added to the ETF.

Conclusion

We believe investors need to regularly look inside smart-beta ETFs, such as PEJ, as they are not static. PEJ’s prospects will be driven by its new portfolio, which no longer includes high-flyer AMC. CFRA’s rating of U.S. sector ETFs is not driven solely by its past performance record but by the holdings inside, its relevant costs, and relative ETF sentiment.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.