Getting quality and value in bond exposure is an added plus when it comes to high yield debt investing. Thankfully ETF investors can get both with the iShares Edge High Yield Defensive Bond ETF (HYDB).

HYDB seeks to track the investment results of the BlackRock High Yield Defensive Bond Index. The fund will invest at least 80% of its assets in the component securities of the underlying index and may invest up to 20% of its assets in certain index futures, options, options on index futures, swap contracts, or other derivatives.

The index consists of U.S. dollar-denominated, high yield corporate bonds. Component securities include publicly-issued debt of U.S. corporations and U.S. dollar-denominated, publicly issued debt of non-U.S. corporations or similar entities.

HYDB:

- Aims to track an index that looks to deliver superior risk adjusted and total returns relative to the broader high yield corporate bond market

- Seeks to mitigate risk while providing enhanced returns by blending two diversifying factors – quality and value

- Pursues income with less risk than the broad high yield bond market

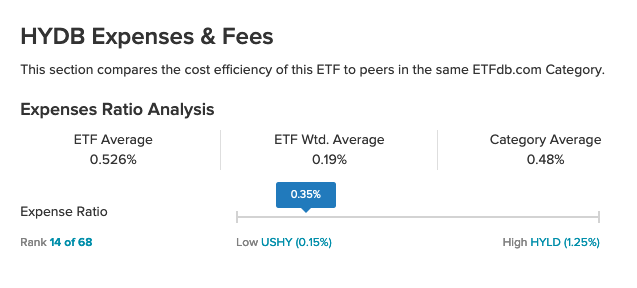

At a 0.35% expense ratio, HYDB is 13 basis points less than its category average.

Fed Stays Put on Rates

The interest in high yield could spike higher after the Federal Reserve recently decided to stay put on interest rates. Yields have already been low to begin with and could stick around for some time as the economy continues to cope with Covid.

“The Federal Reserve pledged on Wednesday to keep its low interest rate policies in place even well after the economy has sustained a recovery from the viral pandemic,” a USA Today article said. “The Fed said in a statement after its latest policy meeting that the improvement in the economy and job market has slowed in recent months, particularly in industries affected by the raging pandemic. The officials kept their benchmark short-term rate pegged near zero and said they would keep buying Treasury and mortgage bonds to restrain longer-term borrowing rates and support the economy.”

Furthermore, “the Fed has signaled that it expects to keep its key short-term rate at a record low between zero and 0.25% through at least 2023. Earlier this month, Vice Chair Richard Clarida said he expects the Fed’s bond purchases to extend through the end of this year, which would mean continued downward pressure on long-term loan rates.”

For more news and information, visit the Equity ETF Channel.