Fixed income investors know by now that getting yield in the current market environment requires a well-thought-out strategy. One way to get quality exposure to high yield in this challenging fixed income environment is the iShares iBoxx $ High Yield Corporate Bond ETF (HYG).

HYG seeks to track the investment results of the Markit iBoxx® USD Liquid High Yield Index, which is a rules-based index consisting of U.S. dollar-denominated, high yield corporate bonds for sale in the U.S. The fund generally will invest at least 90% of its assets in the component securities of the underlying index and may invest up to 10% of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index.

HYG offers investors:

- One of the most widely used high yield bond ETFs

- Exposure to a broad range of U.S. high yield corporate bonds

- Use to seek higher income

“With average yields close to 6%, high-yield bonds can offer investors an opportunity to earn more income in a very low-interest-rate world,” an Advisor Perspectives article cautioned. “That’s a benefit not many fixed income investments can provide. Those higher yields come with greater risks, however, and despite the strong performance recently, we believe investors should approach the market carefully because risks remain elevated.”

HYG holds debt in sectors that are less likely to default, such as healthcare. As of October 30, HYG has debt holdings in Tenet Healthcare Corporation and Bausch Health Companies Inc.

An Active, Investment-Grade ETF Option

Additionally, for peace of mind, fixed income investors can also opt to go for active funds. By putting high yield investment options in the hands of professionals, and with the ability to adjust on the fly, active funds are an excellent option.

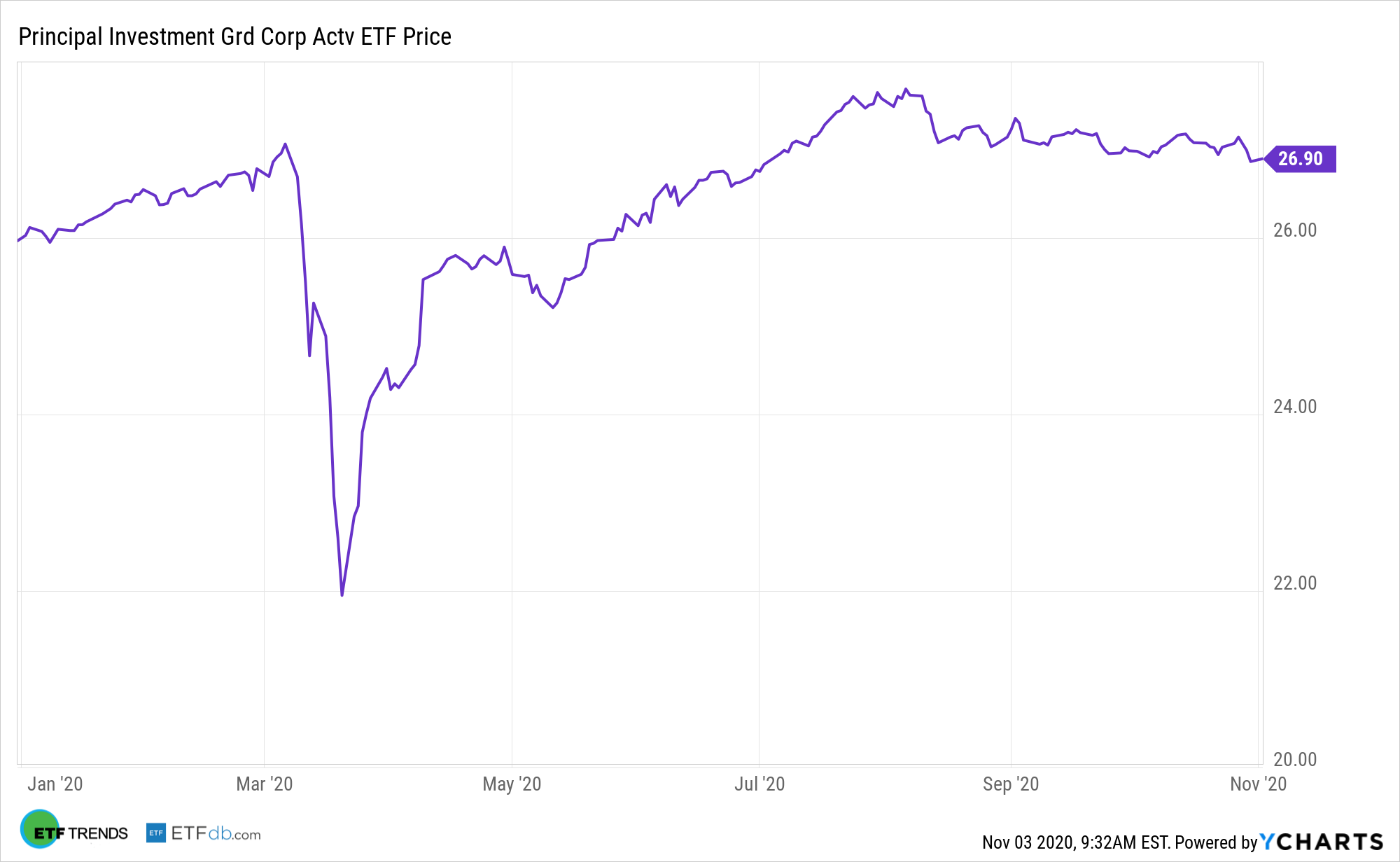

One fund to look at is the Principal Investment Grade Corporate Active ETF (IG). IG seeks to provide current income and, as a secondary objective, capital appreciation.

IG seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its net assets, plus any borrowings for investment purposes, in investment grade corporate bonds and other fixed income securities at the time of purchase. “Investment grade” securities are rated BBB- or higher by S&P Global Ratings (“S&P Global”) or Baa3 or higher by Moody’s Investors Service, Inc. (“Moody’s”) or, if unrated, of comparable quality in the opinion of those selecting such investments.

For more news and information, visit the Equity ETF Channel.