Thanks to rising oil prices and a focus on renewable sources, the energy sector has been on an uptrend after a pandemic-ridden year. ETF investors looking beyond broad-based commodity plays can give the iShares MSCI Global Energy Producers ETF (FILL) a look.

FILL seeks to track the investment results of the MSCI ACWI Select Energy Producers Investable Market Index (IMI). The fund generally will invest at least 90% of its assets in the component securities of the underlying index and in investments that have economic characteristics that are substantially identical to the component securities of the underlying index.

The index measures the combined performance of equity securities of companies in both developed and emerging markets that are primarily engaged in the business of energy exploration and production. At a 0.39% expense ratio, FILL is below its category average.

Overall, FILL gives investors exposure to:

- Exposure to companies that engage in the exploration and production of oil and gas, or in the production and mining of coal and other fuels.

- Targeted access to global energy producer stocks.

- Use to diversify your portfolio and to express a global sector view.

- Strong performance, with the fund up about 61% over the last 12 months.

A Diversified Sector Play

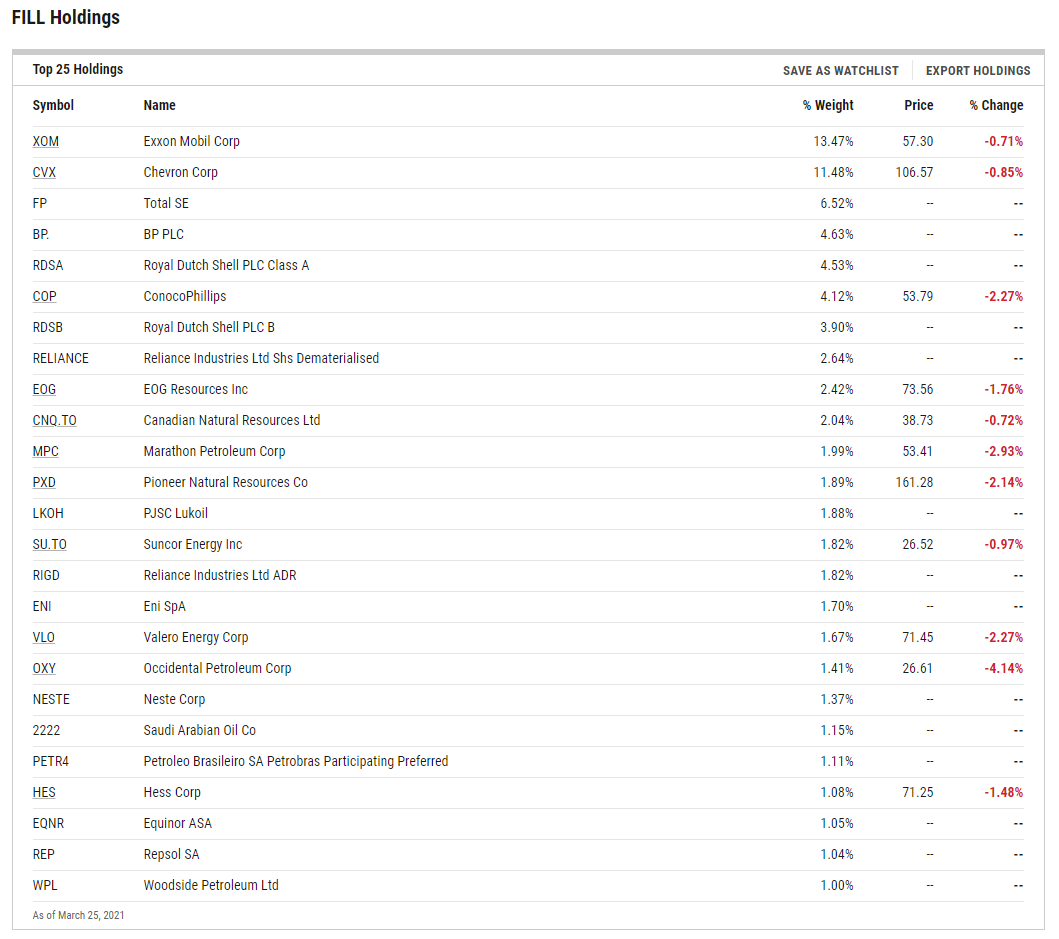

Looking under the hood of FILL, familiar names include Exxon Mobil Corp and Chevron. These two make up the majority of the fund’s asset allocation at about 25%, while the rest comprise equities from other countries.

ETF investors get a diversified play in both other countries and the energy sector itself.

“This ETF offers exposure to the global energy sector through a diverse portfolio of domestic and international equities, with exposure spreading across both developed and emerging markets,” an ETF Database analysis said. “Not surprisingly, FILL has a heavy tilt towards mega cap stocks, as this ETF includes a number of the world’s biggest oil companies.”

“Furthermore, the global label on this ETF may be a bit misleading seeing as how emerging market companies account for only a minimal fraction of total assets,” the analysis said further. “Roughly half of the underlying portfolio is invested in U.S. energy stocks, which makes this fund less of a true broad-based play on the global energy sector than some might expect. On the other hand, FILL features by far the most diverse portfolio of holdings among broad energy ETFs.”

For more news and information, visit the Equity ETF Channel.