Getting single-country exposure to investment opportunities in Asia doesn’t have to be relegated to just China. Singapore’s better-than-expected export figures are showing improved strength in the country’s economy, which bodes well for ETFs like the iShares MSCI Singapore ETF (EWS).

“Singapore’s December non-oil domestic exports (NODX) increased 6.8% from a year earlier, official data showed on Monday, due to a rise in shipments of electronics as well as non-electronics such as specialized machinery and non-monetary gold,” a CNBC article noted. “The rise followed a 5.0% decrease in November.”

At a 0.51% expense ratio, EWS seeks to track the investment results of the MSCI Singapore 25/50 Index. The fund will at all times invest at least 80% of its assets in the securities of its underlying index and in depositary receipts representing securities in its underlying index.

The index is designed to measure the performance of the large- and mid-cap segments of the Singapore market. A capping methodology is applied that limits the weight of any single issuer to a maximum of 25% of the underlying index.

Overall, EWS gives investors:

- Exposure to large- and mid-sized companies in Singapore

- Targeted access to the Singapore stock market

- Use to express a single country view

EWS Looking to Financial Sector Strength

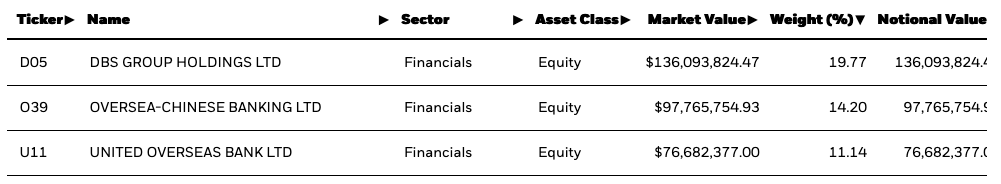

The EWS ETF’s top holdings lean toward finance. The biggest three are in the financial sector, which comprises 45% of the fund as of January 15.

The financial sector in Singapore is undergoing a revolution of sorts, with a tilt towards financial technology. As an Edge Markets article explained, Singapore’s “Monetary Authority of Singapore (MAS) called on financial organizations to ensure operational resilience during lockdown.”

“According to MAS managing director Ravi Menon, 85% of workers in the financial industry have been able to work from home,” the article added. “With the investments made to strengthen retail electronic payment systems in digital banking and online trading in the last few years, customers were able to access the majority of financial services online during the circuit breaker period. Without this infrastructure in place, it would have been more challenging for the financial sector to achieve operational resilience.”

For more news and information, visit the Equity ETF Channel.