For investors wary of the bond markets with yields starting to show signs of life with recent upticks, it might best serve to get short-term exposure. That can be achieved via an ETF wrapper using the iShares 1-3 Year Treasury Bond ETF (SHY).

SHY seeks to track the investment results of the ICE U.S. Treasury 1-3 Year Bond Index (the “underlying index”). The fund generally invests at least 90% of its assets in the bonds of the underlying index and at least 95% of its assets in U.S. government bonds.

The underlying index measures the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than or equal to one year and less than three years. Keeping duration relegated to the short end of the yield curve means ETF investors get less exposure to volatility over an extended term.

SHY gives investors:

- Exposure to short-term U.S. Treasury bonds

- Targeted access to a specific segment of the U.S. Treasury market

- Use to customize exposure to Treasuries

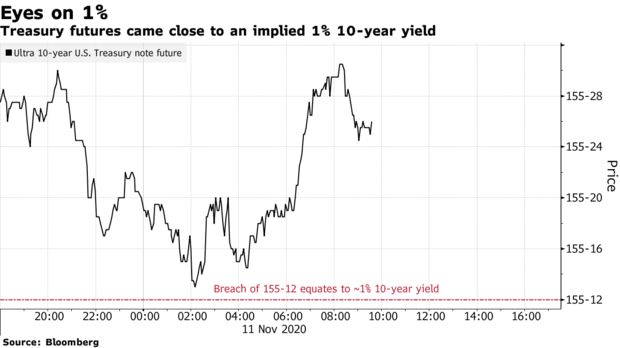

As far as what’s happening now in the bond markets, traders are keeping an eye on that benchmark 10-year yield. The 1% ceiling is one to watch, which could signal a sign of higher yields to come.

It’s certainly a welcome sign for fixed income investors hunting for yield since the pandemic sell-offs hit back in March. With a renewed risk-off sentiment, yields could be pushing higher despite the market uncertainty that still exists with the COVID-19 pandemic and now the U.S. presidential election lurking in the backdrop.

“Now investors are monitoring a possible break of that level as an event that could bring in more selling and potentially drive yields even higher,” a Bloomberg article noted. “An unruly selloff could even get the attention of the Federal Reserve, which has been buying about $80 billion of Treasuries a month to ensure smooth market function and keep financial conditions easy.”

“There will be added focus on the indirect bids at the sale as a measure of international participation, after dealers were left with big chunks of this week’s historically large 3- and 10-year auctions,” the article added.

With the dynamism of an ETF wrapper, SHY could also be used as a non-leveraged play for short-term traders who don’t want the exposure to leveraged funds. SHY’s expense ratio comes in at 0.15%.

For more news and information, visit the Equity ETF Channel.