Key Takeaways

Capital Group, one of the largest managers of active mutual funds in the U.S., has filed paperwork to launch its first ETFs, with plans to launch six products in the first quarter of 2022.

Capital Group, one of the largest managers of active mutual funds in the U.S., has filed paperwork to launch its first ETFs, with plans to launch six products in the first quarter of 2022.- The pending ETFs will be fully transparent each day, unlike some recently launched products from Capital Group’s peers that reveal holdings on a monthly or quarterly basis.

- Capital Group’s ETFs will leverage existing teams behind widely held mutual funds, such as American Funds Growth Fund of America (AGTHX), but the ETFs will be complementary products rather than clones.

Fundamental Context

Capital Group’s entry into the ETF market, albeit late, will be a key milestone for active ETFs. The asset manager behind the popular suite of American Funds mutual funds today filed initial paperwork to launch five equity ETFs and one fixed income product, with an expected launch late in the first quarter of 2022. The firm’s equity ETFs, which will be listed under the name Capital Group rather than American Funds to avoid likely confusion, will join actively managed ETFs from well-known providers, including American Century, Fidelity, Invesco, JPMorgan, and T. Rowe Price. Actively managed ETFs represent just 2% of equity ETF assets and 4% of overall assets, according to CFRA data, but these equity ETFs gathered 9% of the flows year to date as of mid-August. Capital Group is currently one of few top-tier active managers to not offer an index-based or active ETF alternative as investors have increasingly shifted away from just owning active mutual funds. We think Capital Group’s efforts could help validate all actively managed ETFs in an industry where many people think of them as just passively replicating the S&P 500 Index.

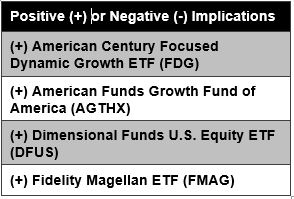

The pending ETFs will surprisingly be fully transparent. Some of the established firms that launched active equity ETFs in the past 18 months did so using a structure that delayed the disclosure of fund management’s investment decisions through a semi-transparent structure. American Century Focused Dynamic Growth ETF (FDG 84) and Fidelity Magellan ETF (FMAG) are some examples.

Capital Group previously licensed the use of a semi-transparent structure, but the firm’s pending ETFs will reveal the full portfolio and weights daily. We do not foresee the daily disclosure to be a major challenge, as managers of Capital Group’s mutual funds have historically taken a long-term approach using moderate turnover, according to CFRA Research, but mutual fund investors might wonder why they know so much less about what they own. Going fully transparent will also enable the firm to offer two ETFs – Capital Group Global Growth Equity (CGGO) and Capital Group International Focus Equity ETF (CGXU) – that invest primarily in non-U.S. stocks as well as give its U.S. offerings such flexibility. Asset managers can only invest in U.S. stocks with the approved semi-transparent ETF structures.

In the past, we keenly focused our attention on the firm’s 13F filings to understand what stocks were collectively bought and sold each quarter. For example, Capital Group reduced its stake in Tesla (TSLA 706) and JPMorgan (JPM) by 8.9% and 6.0%, respectively, in the second quarter while boosting its share count in CVS Health Corp (CVS ) and Applied Materials (AMAT) 34% and 15%, respectively, according to data on Capital IQ’s platform.

The new ETFs are intended to complement rather than clone existing American Funds. For example, the pending Capital Group Growth ETF (CCGR) sounds like American Funds Growth Fund of America, which launched nearly 50 years ago and manages approximately $280 billion in assets across various share classes. CFRA believes the four-star rated AGTHX, which is a retail class of the mutual fund, has strong reward potential and incurs modest costs relative to the broader U.S. equity mutual fund category. While three of the portfolio managers of CCGR are also on the team that runs AGTHX, Capital Group stressed to CFRA that the ETFs would be run separately to give clients a choice to have the more tax-efficient structure in a taxable account or the mutual fund in a retirement account.

Though the firm plans to initially offer one fixed income ETF, we expect more to come. Capital Group Core Plus Income (CGCP) is slated to launch by the end of first quarter 2022 and will be run by the same three portfolio managers as American Funds Strategic Bond Fund (ANBAX 11 **). We expect the pending ETF to invest primarily in investment grade bonds but have some high yield exposure given its focus on current income.

Holly Framsted, Head of ETFs at Capital Group, told CFRA that the first six products will be the beginning of the company’s ETF franchise of products. We expect Capital Group will expand its lineup over the next few years to provide an ETF alternative for clients across dozens of strategies. There is currently a wide range of actively managed taxable and tax-exempt mutual funds offered by American Fund across various investment styles, such as short-term, high yield, and emerging markets.

A key unknown is how Capital Group prices the products. While AGTHX and ABNDX respectively charge 0.61% and 0.57% expense ratios, which are below each of their CFRA mutual fund peer averages, they are less attractive compared to some of the newly launched active ETFs due to the mutual funds’ inclusion of distribution and other administration costs. For example, this summer Dimensional U.S. Equity ETF (DFUS) and JPMorgan ActiveBuilders U.S. Large Cap Equity ETF (JUSA) began trading with expense ratios of 0.11% and 0.17%, respectively. Given Capital Group’s scale, we would expect CCGR, CGCP, and their future ETF siblings to charge much lower fees than the retail versions of similar-sounding mutual funds to appeal to a more cost-conscious ETF investor base.

Conclusion

While the ETF industry is 28 years old, we think there remains lots of room for growth, particularly in the still-burgeoning actively managed space. Capital Group has the relationships within the wealth management market, the deep pockets to competitively price the products, and the ability to generate alpha through security selection to garner investor interest. However, in 2022 they will need to educate investors about what makes their products stand out in an ever-crowded yet concentrated ETF market.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.