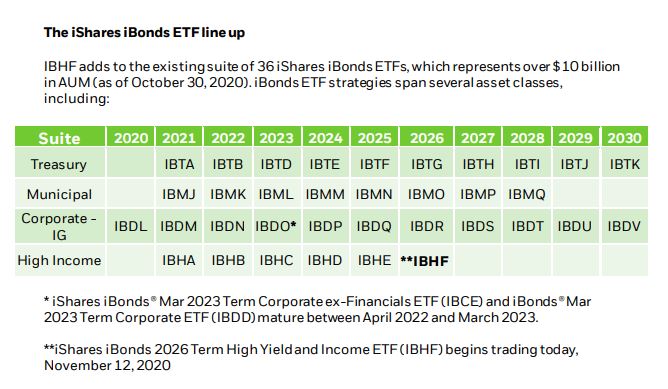

Looking at the current trajectory for iShares, the iShares iBonds suite has now crossed $10 billion in AUM and is projected to grow to $20 billion in the next five years. On Thursday, BlackRock announced the launch of the iShares iBonds 2026 Term High Yield and Income ETF (IBHF).

The fund, available on NYSE Arca, seeks to track the investment results of an index composed of U.S. dollar-denominated, high yield, and other income-generating corporate bonds maturing between January 1, 2026 and December 15, 2026.

Karen Schenone, Head of iShares Fixed Income Strategy for USWA within BlackRock’s Global Fixed Income Group, says, “Having now served investors for over a decade, iBonds ETFs have advanced the modernization of bond portfolios.”

Schenone continues, “Like all innovations, iBonds ETFs streamlined what was previously a cumbersome process by making it convenient to build scalable bond ladders, pick precise points on the yield curve, and match expected cash flows to target time-specific goals. As investor demand for iBondsETFs continues, we expect the AUM of the suite to double, reaching $20 billion over the next five years.”

iBonds ETFs are designed to mature, like a bond. The funds have a specified maturity date, and similar to individual bonds, investors are exposed to less interest rate risk over time, as iBonds ETFs approach maturity.

They are also traded like stock. Investors can trade these ETFs throughout the day on the exchange instead of the over the counter (OTC) bond market. This helps, as the ETFs can be diversified like a fund as well. iBonds provide exposures to multiple bonds in a single fund.

iBonds ETFs by the numbers

- 10 years of iBonds: iShares launched the first iBonds ETFs – the first term maturity ETFs to market – in January 2010, offering investors a new take on bond laddering – ETFs designed to mature at a specific date like a bond, trade like a stock, and offer the diversification of a fund.

- Over $10 billion in AUM: iBonds ETF AUM has seen steady growth since the suite’s inception in 2010, crossing $10 billion across all asset classes in October of this year. In the last three years, the AUM has more than doubled in size from $4.5 billion at the end of 2017 to $10.08billion at the end of October 2020, an increase of over 124%.

- 56 iBonds ETFs launched since the suite’s inception: The launch of IBHF expands the iShares iBonds suite to 37 live products across four asset classes-U.S. treasury, municipal, investment grade, and high-income corporate sectors. 19 iBonds ETFs (10 investment grade and 9 municipal funds) have, by design, matured, providing investors a total return experience close to holding a portfolio of individual bonds.

- An average of 293 individual bonds: Across the four asset classes, on average, each iBonds ETF is composed of293 individual bonds.3Bond ETFs hold hundreds of individual bonds and help investors increase diversification across bond issuers while potentially reducing concentration risk.

For more market trends, visit ETF Trends.