Capital keeps on flowing into emerging markets as more investors embrace a growing risk-on sentiment. These flows are helping core EM funds like the iShares Core MSCI Emerging Markets ETF (IEMG).

IEMG seeks to track the investment results of the MSCI Emerging Markets Investable Market Index. The index is designed to measure large-, mid-, and small-cap equity market performance in the global emerging markets.

“The iShares Core MSCI Emerging Markets ETF (IEMG) is the younger, cheaper variation on BlackRock’s flagship iShares MSCI Emerging Markets ETF (EEM),” the fund’s ETF Database profile noted. “IEMG debuted in 2012 as part of the new ultra-low-cost iShares Core series, which was designed to attract buy-and-hold investors.”

“IEMG delivers broad exposure to emerging markets equities included the popular MSCI emerging market benchmarks, and does it for a fraction of the price charged by the legacy iShares fund,” the profile added. “IEMG also includes smaller-cap names ignored by its older sibling, making it a staple holding of long-term investors who want exposure to emerging markets.”

IEMG offers investors:

- Exposure to a broad range of emerging market companies

- Low cost, comprehensive access to stocks in emerging market countries

- Use at the core of a portfolio to diversify internationally and seek long-term growth

- A low 0.11% expense ratio

- A strong 12% YTD performance to start 2021

15 Weeks of Inflows

As investors turn up the risk dial, EM ETFs are happy to see the increased inflows. A Business Standard article broke down the numbers:

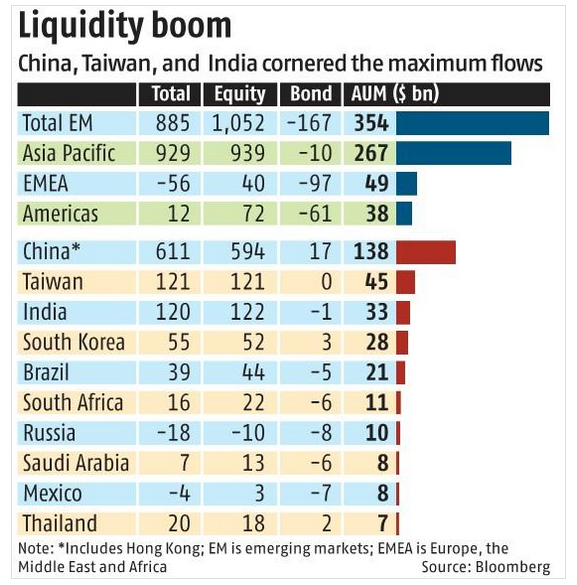

“Investors added money to exchange-traded funds (ETFs) that buy emerging market stocks and bonds last week. This was the 15th straight week of inflows,” the article said. “Total inflows during this period were $26.4 billion. Inflows to US-listed emerging market ETFs that invest across developing nations, as well as those that target specific countries totalled $885 million in the week ended February 12, compared with gains of $1.29 billion in the previous week, according to the data compiled by Bloomberg.”

Inflows have reached $9.44 billion thus far in 2021. India has been seeing the strongest inflows with $120 million, up 25% from the previous week.

For more news and information, visit the Equity ETF Channel.