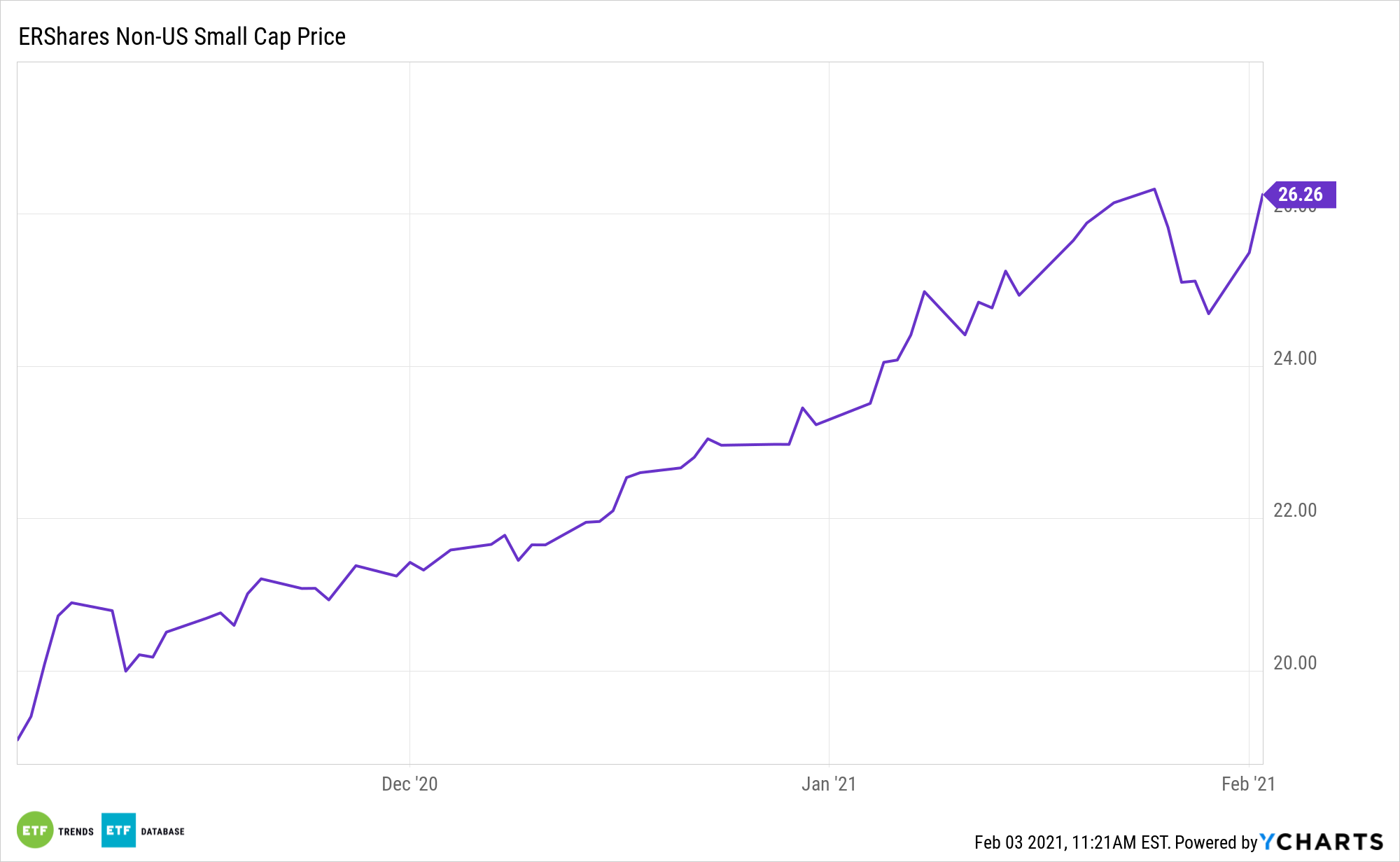

If there’s an asset class that combines hidden gem status with significant potential, it’s international small caps. Good news: the ERShares International Equity ETF (NYSEARCA: ERSX) simplifies access to ex-US smaller stocks.

ERSX selects the most entrepreneurial, primarily Non-US Small Cap companies, that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers strong performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

The fund is a relevant choice for investors seeking international small cap exposure because many actively managed small cap funds can’t hold ex-US equities.

“Institutional investors typically overlook or underweight small cap equities in global mandates for a number of reasons, including a higher risk level(relative to large caps), a lack of operational history, liquidity, and information/data gaps which make it challenging to make informed investment decisions. However, investors who are willing to embrace the risk in small cap investing also stand to reap the benefits of allocating to this asset class–potentially earning higher risk-adjusted performance and portfolio diversification,” according to S&P Dow Jones Indices.

ERSX: A World of Opportunity

A strong point in favor of ERSX is that the fund offers similar growth profiles to dedicated domestic small cap funds.

“While risk-adjusted performance over longer term for international small cap are comparable to that of U.S. small caps, quality metrics are actually better,” notes S&P. “International small caps, on average, have higher returns on capital, higher long-term growth, lower debt, and cheaper valuations than U.S. small caps.”

As noted above, international small caps are often overlooked by analysts and professional investors, making stock picking in the arena difficult for retail investors. That’s a problem solved by ERSX.

International small caps represent 20% of global equity market value, but just 6% of institutional investors’ portfolios, according to S&P.

For more on entrepreneurial strategies, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.