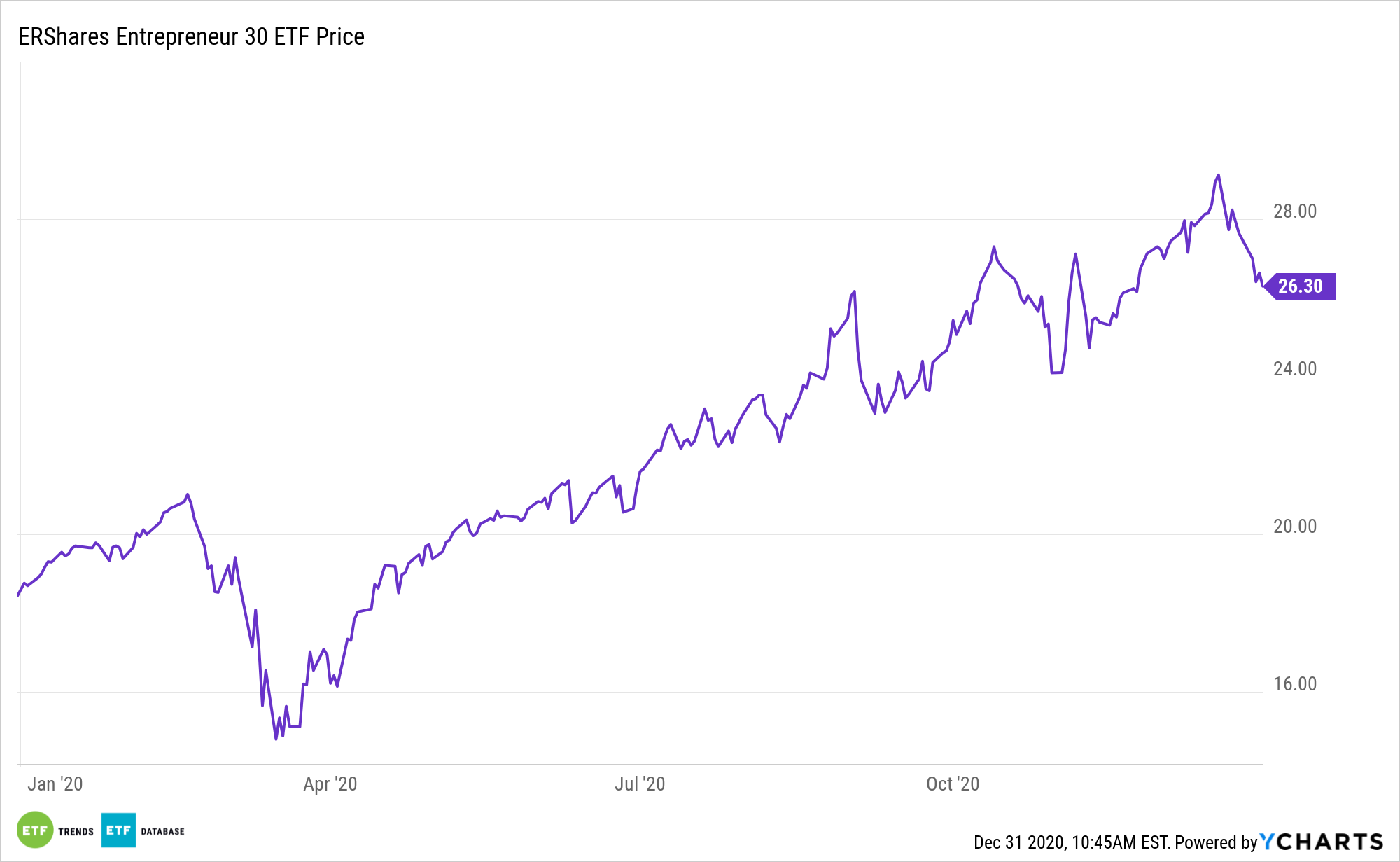

The Entrepreneur 30 Fund (ENTR) offers investors a way to straddle the line between the growth and value factors in a unique fashion.

The Entrepreneur 30 Fund tries to reflect the performance of the Entrepreneur 30 Index, which is comprised of 30 U.S. companies with the highest market capitalizations and composite scores based on six criteria referred to as entrepreneurial standards. ENTR primarily invests in US Large Cap companies that meet the thresholds embedded in their proprietary Entrepreneur Factor (EF).

ENTR’s methodology is particularly relevant at a time when many market observers are wagering on a value rebound, and at a time when it’s clear disruptive growth investing is here to stay.

ENTR isn’t a traditional large-cap blend fund, nor is it a prosaic factor strategy. The ERShares ETF goes deeper than typical stock or ETF offerings.

Entrepreneurial Innovation for 2021

Be it e-commerce, fintech, healthcare innovation, streaming entertainment, or many other concepts, one of the reasons this fund is relevant for 2021 is because it provides exposure to an array of seismic shifts taking place in the investing landscape, a trend thematic ETFs leverage better than their old guard counterparts.

Disruptive technologies are changing the way new products and services are being brought to market, already seen in the development of artificial intelligence and robotics. As the number of companies that focus on highly advanced computer integration grows, so does the number of targeted ETF strategies that have been designed to capture the best growth opportunities.

ENTR’s indexing methodology incorporates the ERShares Entrepreneur Factor, which delivers strong performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics.

ERShares incorporates a bottom-up investment orientation, powered by artificial intelligence, that stands above other investment factors such as momentum, sector, growth, value, leverage, market cap (size), and geographic orientation. With the aid of AI and Thematic Research, ERShares incorporates a macro-economic, top-down approach that integrates changing investment flows, innovation entry points, sector growth, and other characteristics into a dynamic, global perspective model.

For more on entrepreneurial strategies, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.