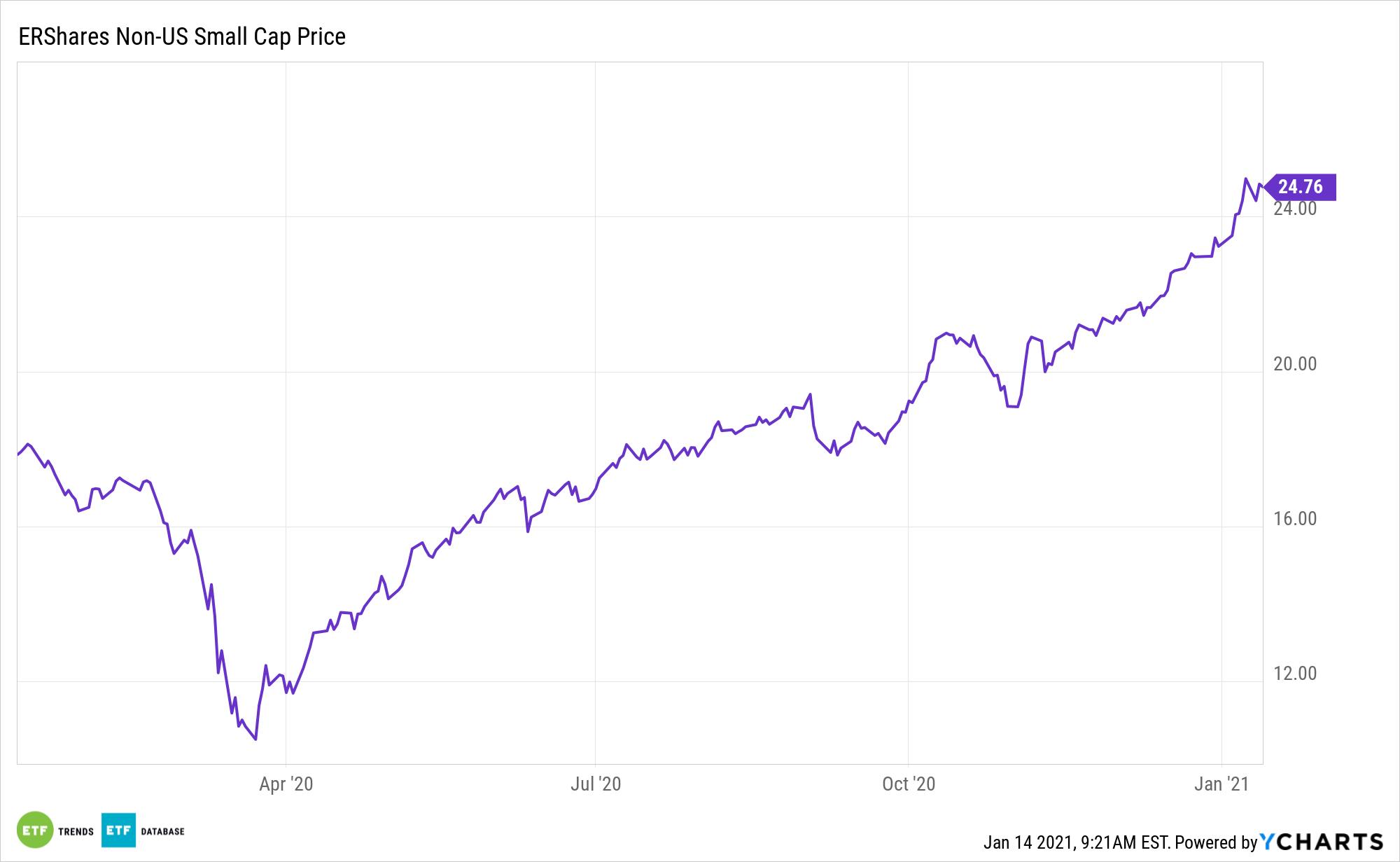

Small cap equity ebullience that started last year is carrying over into 2021, lifting exchange traded funds such as the ERShares International Equity ETF (NYSEARCA: ERSX) in the process.

ERSX selects the most entrepreneurial, primarily Non-US Small Cap companies, that meet the thresholds embedded in their proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers strong performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

It’s clear that small caps still have plenty of momentum across all sectors moving into 2021.

“After a Q4 sprint that puts US small-cap stocks virtually even with US large-cap stocks for 2020 in terms of full-year performance (a 21% rise for the US large-cap Russell 1000® Index relative to a 20% rise for the US small-cap Russell 2000® Index), this asset class continues to rise in the early days of 2021,” according to FTSE Russell research. “The Russell 2000 was up nearly 6% year-to-date as of Friday, January 8, relative to a 2.1% rise for the Russell 1000. Top sector drivers for the Index thus far in 2021 include Energy (+23.7%), Basic Materials (+8.2%), Utilities and Industrials (+6.4% each).”

ERSX Proving Persistent for Investors

The Entrepreneur Non-US Small Cap Index is comprised of 50 Non-US companies form around the world with market capitalization based between $300 million and $5 billion USD.

ERShares selects companies from all over the globe and across capitalization levels to create an eclectic and well-balanced mix in its funds.

While small cap value appears to be solidifying, small cap growth won’t necessarily lag. Fortunately ERSX addresses both factors.

“Optimistic US equity investors appear to be looking past the current bleak winter to a more rosy future, with encouraging factors like a supportive monetary and fiscal policy, accelerating COVID-19 vaccine rollout and an economic recovery driven by new stimulus all boding well for US small-cap stocks,” said Mark Barnes, head of Americas investment research, in FTSE Russell.

For more on entrepreneurial strategies, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.