Many investors think their portfolios are diverse, but what’s the point of diversifying investments that are highly correlated to each other? International small caps are a prime mechanism for investors looking to trim intra-portfolio correlations.

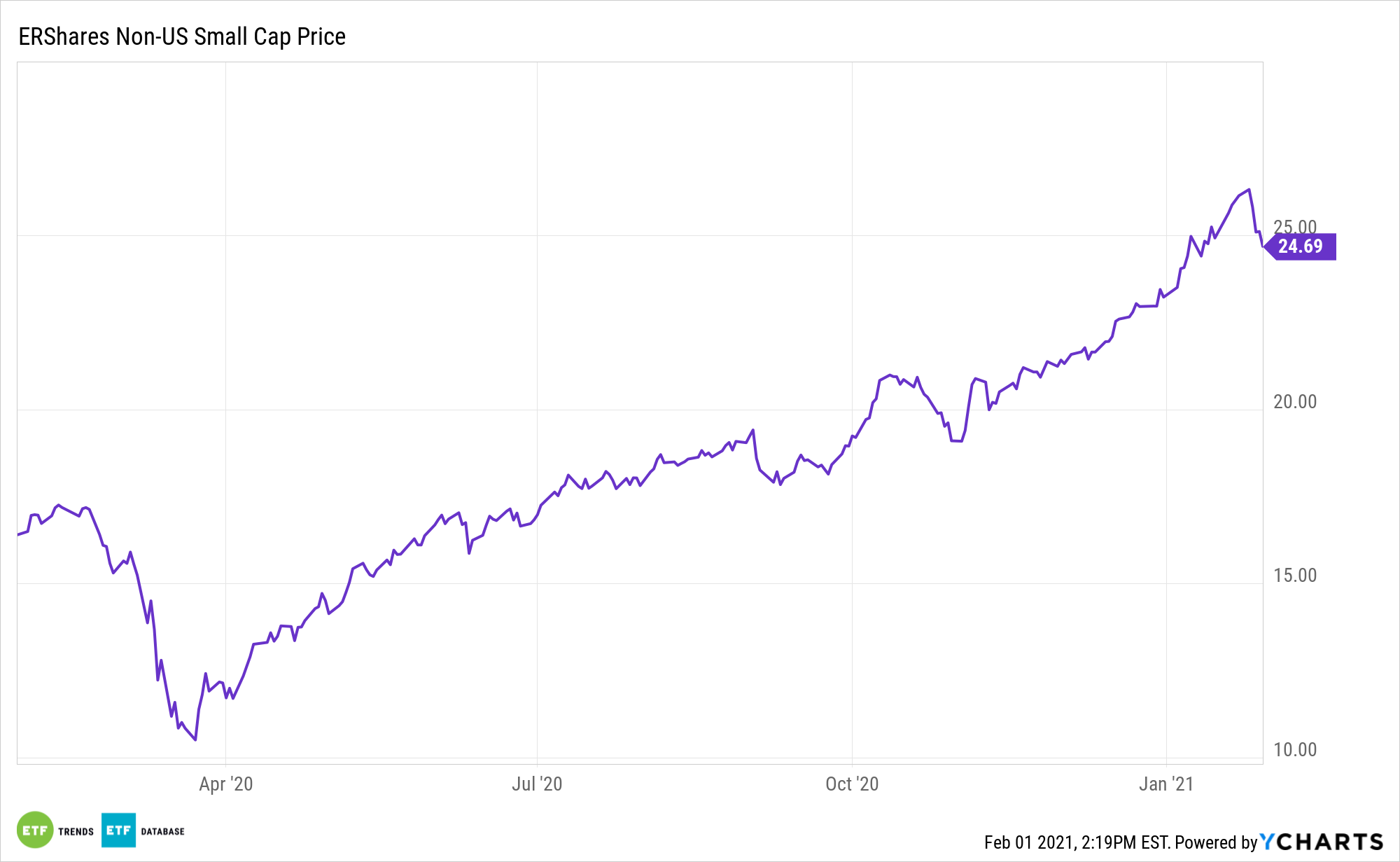

Enter the ERShares International Equity ETF (NYSEARCA: ERSX).

ERSX selects the most entrepreneurial, primarily Non-US Small Cap companies, that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers strong performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

“International small cap stocks have had a consistently lower correlation with U.S. stocks than have large cap international stocks. This makes sense in that smaller companies are typically more focused on their local economies and less influenced by global factors,” according to Sapient Investments.

Lower Correlations with ERSX

There are an array of benefits attributable to ex-US small caps.

“Small cap stocks typically do not have as large a percentage in global sales as large cap stocks. Most of their business is in their local economies. In an era of rising trade tensions, this may be a significant plus,” notes Sapient.

Small cap investors already know that looking at equities outside the large cap universe can yield substantial gains, but one area they may not have considered is looking abroad.

International small caps are generally export-oriented, globally structured, innovative, and have a high to dominant share of a niche market, often one in which the U.S. counterparts don’t compete effectively.

“Although small cap stocks have had a higher level of volatility, their higher returns have more than compensated for that. The same is even more true of international small cap stocks—note in the graph below that the return/risk tradeoff between small cap and large cap is much steeper for international than for U.S. stocks,” concludes Sapient.

For more on entrepreneurial strategies, visit our Entrepreneur ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.