The shipping industry experienced record profits in 2021 driven by high freight rates as supply chain issues persisted. Air freight and cargo shipping companies have proven that they have great pricing power and would benefit in an environment of increasing consumption and recovering global trade. U.S. Global Investors gave a recent webcast with Tom Lydon, CEO of ETF Trends, discussing supply chain dynamics, why freight rates could remain high in 2022, and an ETF strategy that focuses on the air freight and shipping industry.

Frank Holmes, CEO of U.S. Global Investors and executive chairman of HIVE Blockchain Technologies, discusses the disruption that is happening within the shipping industry in a global economy that has suffered a COVID-19 recession, as well as the impacts of the UN inclusion of shipping emissions within their climate policies.

“We believe that we are in a big secular move and that shipping… is in a secular run, that the wind is hitting their sail. It’s not a headwind, it’s a tailwind for this business in both cargo airlines in addition to cargo shipping,” Holmes says.

Paul Raman, portfolio analyst at U.S. Global Investors, discusses that even with commodity prices and supply/shipping issues, the shipping market is continuing to grow at roughly 6% overall and 18% on Trans-Pacific routes in particular. Raman discusses the differences in ship sizes and how some ships are built to specs specifically for the Panama Canal (Pamamax) while newer, more energy-efficient ships tend to be the largest dry bulk carrier ships that fall into the Capesize category that don’t need to go through canals.

“These ships have tremendous pricing power, and all this crisis out of Russia and Ukraine is only going to give them more pricing power,” explains Holmes. “So I think you’re going to continue to see revenue growth, which is going to be substantial, because the rest of the world, we’ve seen from G20 countries, will print the money.”

Companies such as Maersk, a Danish company, posted record profits in 2021 due to increasing freight rates. Maersk has been one of the largest spenders in the industry on technology, explains Holmes, which has helped provide the company with advanced analytics over many of its competitors.

Performance Looking Forward for Shipping

Freight rates have begun to edge upwards again as ports are moving more units than they were at the height of supply chain disruptions. Technological upgrades in China with ports going fully robotic means that ships are loaded more quickly and efficiently, increasing productivity to help meet surging demand.

Air freight had a strong year in 2021 as well, with demand increasing 18.7% compared to 2020. Rates are currently trending 220% above 2019 rates.

“Cargo space is definitely limited on the aircraft, and airlines still have 30% of their fleets parked. They haven’t really ramped up some of the production; that’s also tending to help the rates go up as well, particularly between U.S. and Asia which has been a very, very strong market,” says Raman.

The shipping industry is resilient, Holmes explains, and current geopolitical tensions are only going to hand over more pricing power to the industry. As of March 1, Britain and Canada closed ports to Russian ships, and three of the largest container shipping companies have cut off nonessential deliveries to Russia; these companies are Maersk, MSC, and CMA CGM.

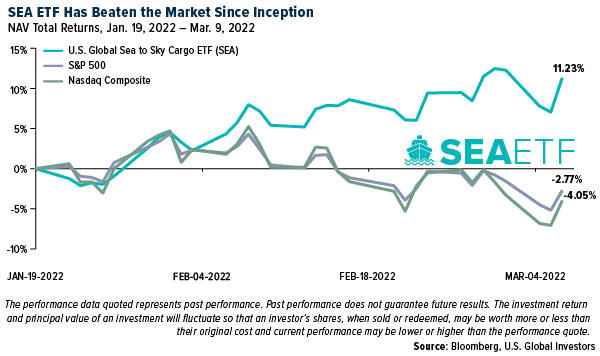

Of the advisors on the call, 94.3% reported that they believe geopolitical tensions and supply chain disruptions will continue to keep cargo shipping rates higher in 2022. For advisors seeking exposure, the U.S. Global Sea to Sky Cargo ETF (SEA) provides an excellent opportunity that focuses on shipping at 70% and air freight at 30% of the fund.

SEA seeks to track the SEA Index, a smart beta 2.0, as Holmes describes it, that focuses on 29 companies in shipping and air freight. The index is weighted heaviest to the top six shipping companies by market cap, cash flow return on invested capital, cash-flow-to-price, and earnings-to-price at 5% weight each, followed by the next seven shipping companies at 4% weighting each, then the top 10 air freight companies at 3% weight each, followed by the next six shipping companies at 2% weight.

Financial advisors who are interested in learning more about investing in the outperformance of the shipping industry can watch the webcast here on demand.