The Fed has announced the beginning of its tapering of bond purchases, 30-year record inflation was recorded for last month, and markets are beginning to build in at least two interest rate increases by the central bank next year to combat inflation. Markets are wobbling, and investors are seeking inflationary hedges as supply chain woes continue; Roxanna Islam, CFA for Alerian, makes the case that one place to look for income in the midst of historic inflation is the midstream market and MLP investment.

Costs of goods are rising in all sectors as a confluence of events have created a supply and demand imbalance that begin with the onset of the COVID-19 pandemic. The combination of supply chain stressors has caused input cost rises — think costs of materials and transportation — for companies, which in turn pass the buck on to consumers. That, along with rising wages as businesses desperately seek employees equating to the rising cost of services and goods, has created the perfect inflationary storm.

Despite increases in wages, wages compared to inflation were still at a deficit last month, meaning that more consumers are going to be spending less, particularly as prices keep climbing. This typically results in a decrease in the performance of equities, particularly if and when the Fed raises interest rates. Higher-rate environments mean that borrowing becomes costlier for companies and could cause them to decrease their capital spending, thereby reducing earnings growth, Islam explains.

Dividends are not an inflation-proof hedge by any means, but they do tend to be less volatile than earnings in high-inflation environments. Companies typically want to continue their dividend payments for a couple of reasons. Primarily, dividend payouts are seen as direct reflection of a company’s health, and cutting dividends can adversely affect the company’s financial position because of weakened investor faith. A second reason is that in higher price environments, since most companies pass the price raises on to consumers, they are often able to continue providing dividends, and in some cases even increase payouts.

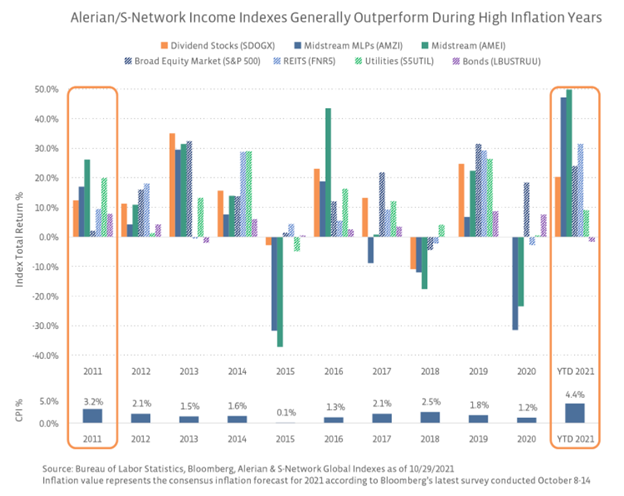

Image source: Alerian

Some types of equity investments, such as midstream companies, have provisions built into their contracts that protect them from inflation. These can and do include inflation adjustments with third parties, protection from regulations, and the ability to pass on higher costs to customers.

Alerian makes the argument that income-oriented indexes outperform their broader markets in high inflation years and that dividend-paying equities are positioned better than general equities. It’s not to say that these companies and the midstream industry can’t be adversely affected by inflationary pressures and see sinking stock prices, but the stability of dividends can yield higher returns for investors than they would capture otherwise.

As of October 29, the yield for AMZI was 7.40%; AMZI is the underlying index for the Alerian MLP ETF (AMLP) as well as the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). The Alerian Energy Infrastructure ETF (ENFR) has AMEI as its underlying index, and the yield at the same time was 5.87% for the index.

For more news, information, and strategy, visit the Energy Infrastructure Channel.