Summary:

- The Gulf of Mexico is the second-largest oil-producing area in the United States behind Texas and is expected to see record output this year.

- Midstream companies with offshore operations in the Gulf of Mexico are investing in building additional capacity to prepare for production growth.

- The Bureau of Ocean Energy Management (BOEM) recently held a sale of new leases that could help contribute to future production years from now.

Discussions around U.S. energy production tend to be dominated by onshore activity, and offshore production tends to be more of an afterthought. However, the long-term outlook for offshore is compelling. Offshore production in the Gulf of Mexico (GOM) is poised for growth as new projects have come into service, and new leases have been acquired. Today’s note looks at oil production in the GOM and how midstream companies are preparing for the growth opportunity.

Offshore oil production moves the needle.

While oil production in Texas and the larger Permian basin are closely followed as a primary growth driver for total U.S. production (read more), there are other areas — albeit smaller — that are expected to meaningfully contribute to growing oil volumes from the U.S. Oil production offshore in the GOM, the second-largest producing area in the U.S. behind Texas, has risen by 39% since 2013 to over 1.7 million barrels per day (MMBpd), or about 15% of U.S. production in 2022.

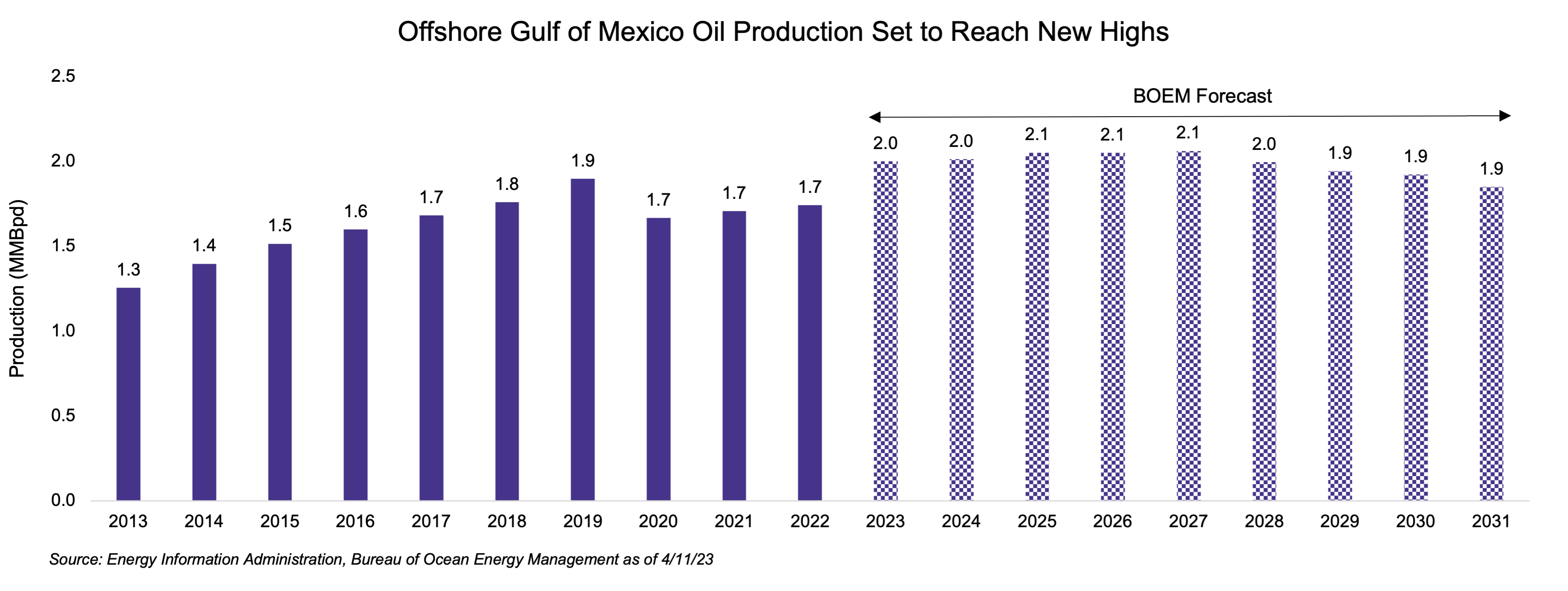

Annual GOM production fell from an all-time high of 1.9 MMBpd in 2019 due to the pandemic and hurricane-related interruptions, but production should be setting new records soon. For 2023, the Bureau of Ocean Energy Management (BOEM) expects a 14.7% increase in oil production from 2022 levels to 2.0 MMBpd. As shown in the chart below, production is forecasted to increase to 2.1 MMBpd in the middle of this decade and then level off at 1.9 MMBpd in 2030.

Higher volumes in 2023 reflect full-year contributions from projects that came online in 2022 and new additions in 2023. Multiple projects started production in 2022, including the King’s Quay FPS operated by Murphy Oil (MUR), which will eventually connect seven wells and is designed to produce up to 85 thousand barrels per day (MBpd). A few major projects that have come online this year were initially targeting 2022 in-service dates. For example, bp’s (BP) Argos platform, and Shell’s (SHEL) Vito Floating Production System (FPS), which combined add up to 200 Mbpd in production capacity in the GOM, were initially earmarked to come online in 2022.

Asia and Europe import crude from the U.S. amid a shortage of Middle Eastern and Russian supply.

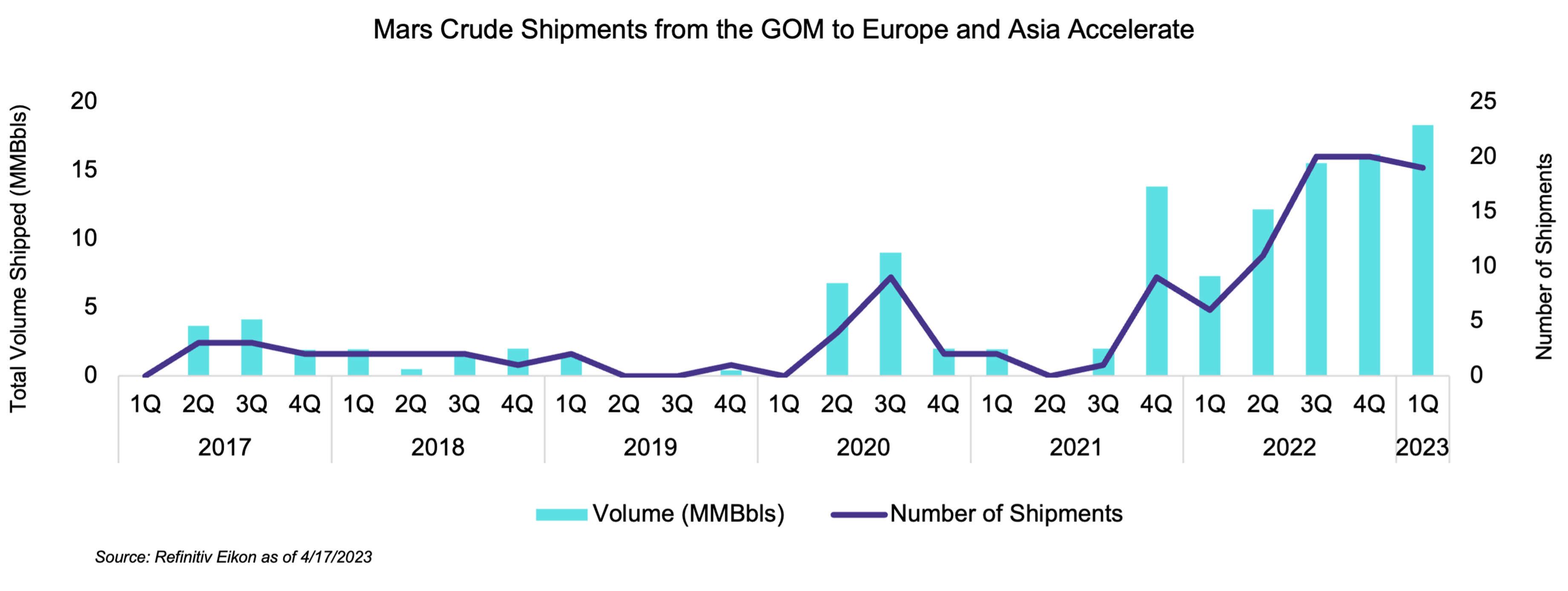

While most Lower 48 onshore oil production tends to be sweet, oil produced from the GOM tends to be sour (i.e., contains more sulfur), including the common Mars grade. Sour crude is the preferred feedstock for more complex refineries in Europe and Asia – some of which have sought out new supplies as they replace Russian barrels or supplement volumes from the Middle East given OPEC+ production cuts. Waterborne shipments of Mars crude from U.S. ports to Europe and Asia spiked in 2022, according to Refinitiv Eikon ship tracking data (see chart below). The trend has continued so far in 2023. Waterborne exports to Europe and Asia reached a quarterly record by volume shipped in 1Q23 and are on pace to surpass 2022 levels.

Midstream players are building offshore infrastructure.

Just like with onshore production, midstream companies also help facilitate offshore production by operating pipeline systems servicing production platforms. Midstream players with operations in the GOM are investing to grow capacity to transport crude oil produced offshore. For example, Enbridge (ENB CN) owns several oil pipeline networks that have a combined capacity of over 0.4 MMBpd. In 2022, ENB completed the Vito Oil Pipeline Project, a 120-MBpd pipeline connecting Shell’s Vito FPS to the Shell Mars System platform.

Williams Companies (WMB) currently has five expansion projects underway in the GOM that are slated to come online in 2024 and 2025, in addition to an expansion completed in 1Q23. WMB expects its annual adjusted EBITDA from the GOM to double from 2021 levels by 2025 and highlighted the capital-efficient nature of its deepwater GOM expansions, which drive attractive returns.

Genesis Energy (GEL) also owns interests in offshore pipelines as well as several platforms in the GOM and is investing in expansion projects. In 2022, GEL announced it would spend approximately $500 million to expand its Cameron Highway Oil Pipeline System (CHOPS), as well as build a new 105-mile pipeline, called SYNC, to connect new developments to its existing network. Both are expected to be complete in 2H24. In 4Q21 GEL sold a 36% stake in CHOPS, which transports all the production from bp’s Argos platform, for $418 million, which pre-funded much of the capital required for the expansion and new development. GEL also sold the idled Independence Hub platform to LLOG in 2022, which will serve as the floating production system for the Salamanca development. Production is expected to begin by 2025 and will connect with the 100% Genesis-owned SEKCO pipeline network already in place.

Additional leases sold by the U.S. government could extend GOM growth in the future.

Production in the GOM is from federal leases managed by the BOEM, which estimates the undiscovered technically recoverable oil at over 29 billion barrels. It is worth noting that the BOEM production forecasts do not include recent and upcoming lease sales. Admittedly, the timeline from a lease sale to actual production spans many years, but today’s lease sales could add to production growth years from now. The BOEM held a lease sale in March and will hold another one in September as was required by the Inflation Reduction Act.

Bottom Line:

As new capacity comes online in the Gulf of Mexico, the region is positioned to be a growth driver for U.S. oil production. Midstream players with offshore operations in the area are investing in growing transportation capacity to facilitate the forecasted production growth.

Related Research:

Bigger in Texas: Energy Reserves, Production & Exports

For more news, information, and analysis, visit the Energy Infrastructure Channel.