Summary

- One of the primary attractions of MLP investments is the potential for tax-deferred income. Whether you invest in an MLP directly or invest in an ETF that predominately owns MLPs, a good portion of the distribution you receive is likely to be a tax-deferred return of capital.

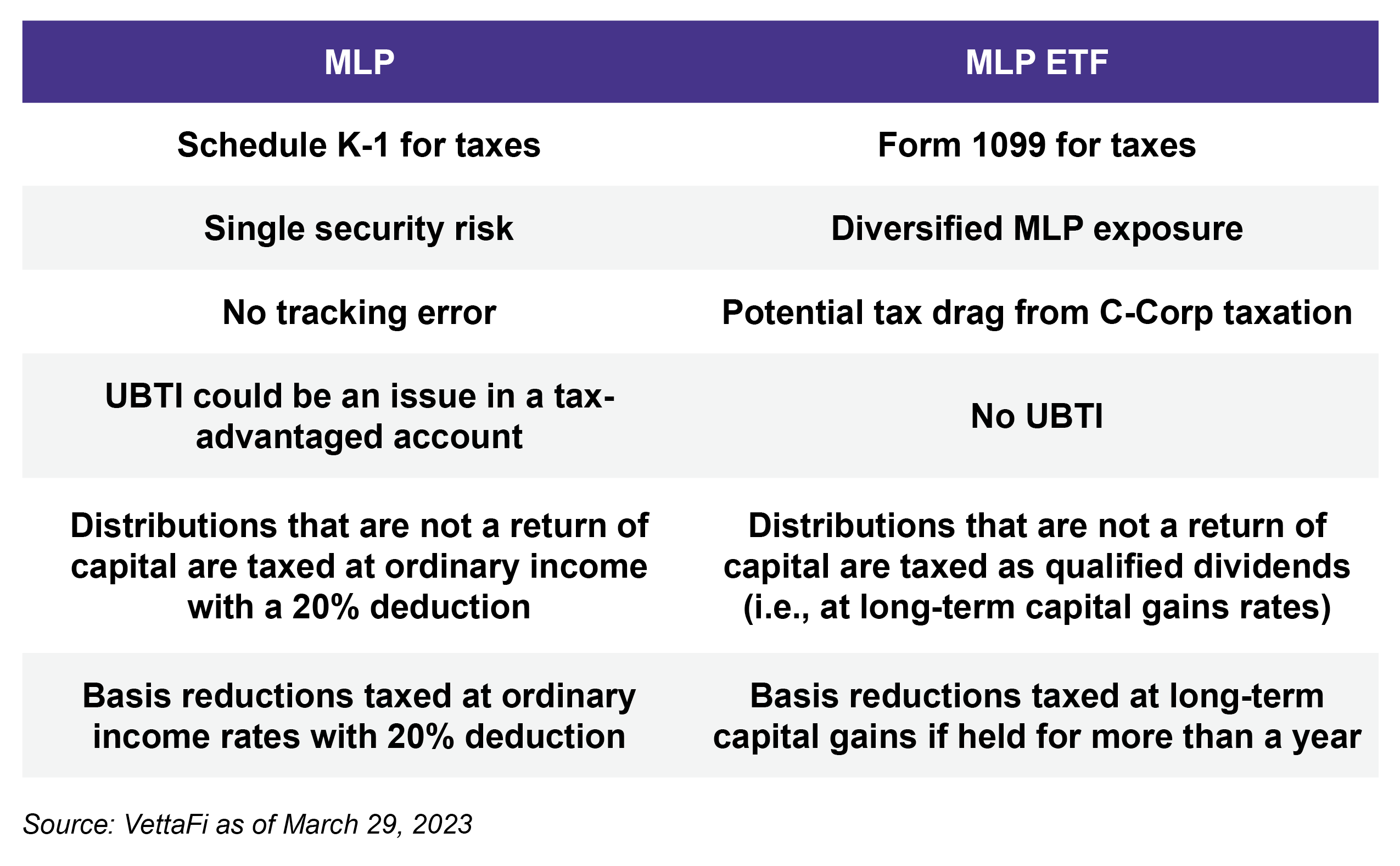

- An individual MLP will issue a Schedule K-1, and an MLP ETF provides a Form 1099. However, there are other important differences in tax treatment to keep in mind.

- MLPs are pass-through entities, and MLP unitholders (investors) are treated as if they directly earned their portion of the MLP’s income.

With April 15 right around the corner, it is timely to revisit the tax advantages of MLPs and MLP ETFs. MLPs tend to be known for their generous yields, which are currently around 8.0%, but fewer investors understand the tax benefits associated with distributions from MLPs or MLP ETFs. (MLP dividends are called distributions.) MLP income is often tax-deferred, which means you receive a distribution but don’t pay taxes on it until you sell the position. Today’s note explains the tax advantages of MLPs in a simplified manner, but there are links throughout to more in-depth pieces. For more on the topic of MLP tax advantages, please join our upcoming 30-minute LiveCast on April 11 at 12:30 PM ET: “MLPs 101: Dividends, Tax Efficiency, and More” (register here).

As a reminder, VettaFi is not an accounting firm or tax consultant, and this piece does not constitute tax advice. For details specific to your situation and investment, please consult your tax advisor.

MLPs and MLP ETFs: The Benefits of Tax-Deferred Income

One of the primary attractions of MLP investments is the potential for tax-deferred income. Whether you invest in an MLP directly or invest in an ETF that predominately owns MLPs, a good portion of the distribution you receive is likely to be a tax-deferred return of capital. Though it can vary, typically 70%–100% of an MLP’s distribution is considered a return of capital. That means taxes on the return of capital portion of the distribution are not paid until the investor sells their position. In short, an investor gets cash but pays taxes later, which is desirable. Because a significant portion of income is typically tax-deferred until sale, a longer holding period takes greater advantage of the special tax treatment.

Importantly, return of capital distributions lower an investor’s basis in an MLP or MLP ETF. When the investor sells their position, they will pay taxes on the reduced basis. From an estate planning perspective, if someone passes away while owning an MLP or MLP ETF, the basis for heirs is stepped up to fair market value on the date of death. In this scenario, neither the investor nor their estate would have to pay taxes on the return of capital distributions received. Accordingly, MLPs can be an interesting estate planning tool, while also providing income for retirees.

MLPs vs. MLP ETFs: Tax Nuances to Consider

While directly owning individual MLPs or owning an MLP-focused ETF can provide tax-deferred income, there are other key differences to note. For example, if you own an individual MLP, you will receive a Schedule K-1 for completing your taxes, whereas an investor in an MLP ETF will receive a more user-friendly Form 1099 while also getting diversified MLP exposure. Investors should also be conscious of the type of account used to invest in MLPs. Owning an individual MLP in a tax-exempt account could result in Unrelated Business Taxable Income (UBTI), but an MLP ETF will not generate UBTI (read more). An ETF that mainly owns MLPs will be taxed as a corporation, which can result in the ETF lagging its underlying index or holdings (read more) (1).

For an MLP or MLP ETF, there can be times when part of the distribution is not a return of capital. That portion of the distribution would be a qualified dividend for an MLP ETF and taxed at long-term capital gains rates. If you directly own an MLP, the portion of the distribution that is not considered a return of capital is taxed at ordinary income rates with a 20% qualified business income (QBI) deduction.

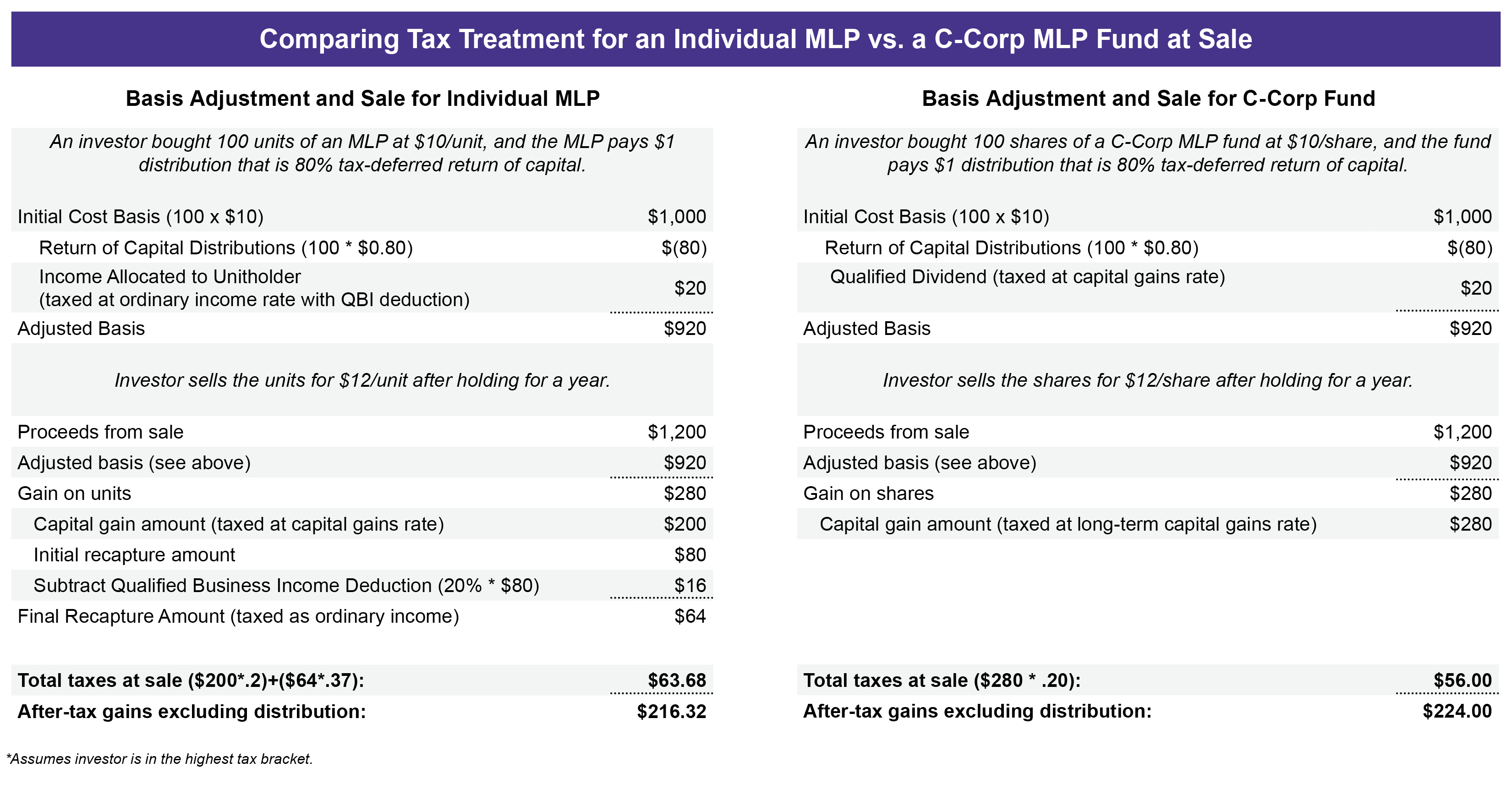

There are also important differences in tax treatment for basis reductions. Recall, return of capital distributions lower an investor’s basis, and basis reductions are taxed when the position is sold. For an individual MLP, basis reductions are taxed at ordinary income rates with the 20% QBI deduction at sale. Basis reductions for an MLP ETF are taxed at sale at long-term capital gains rates if held for more than a year. The table below highlights some of the key differences between owning an individual MLP and owning an MLP-focused ETF. For more detail, please see this note and see the example included in the Appendix of this piece.

MLP Taxation 101: Why Do MLPs Enjoy Special Tax Advantages?

How are MLPs able to provide tax-deferred income? MLPs are pass-through entities that are afforded special tax treatment due to their business activities, which involve minerals and natural resources. MLP unitholders (investors) are treated as if they directly earned their portion of the MLP’s income, which is why they receive a Schedule K-1 each year for filing their taxes. The K-1 details their share of an MLP’s income, deductions, credits, and other items. The difference between the distributions received and the net income allocated to the unitholder is treated as a tax-deferred return of capital. Distributions typically exceed the net income allocated to the investor.

The pass-through nature of MLPs allows investors to avoid double taxation (i.e., the corporation and the investor pay taxes on dividends and capital gains). However, it also applies to state-level taxes, which means the investor could theoretically have to pay state income taxes in states where the MLP operates (2). For more on MLP taxation, please see this note.

Bottom Line

Investors have been attracted to MLPs and MLP ETFs by generous, tax-advantaged yields, even as MLPs’ tax-deferred income carries some additional complexity. Investors should be aware of the tax nuances for MLPs and MLP ETFs to ensure they are maximizing the utility of these investments and their special tax treatment.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

Related Research:

Understanding the Tax Benefits of MLPs

Beyond the K-1: Tax Treatment for an MLP Fund

MLPs, UBTI, ETFs, and IRAs: What You Need to Know

Income Opportunities: MLPs, CEFs, and Return of Capital

Appendix:

For more detail, please see this note, where this table originally appeared.

On the surface, the MLP ETF (labeled here as a C-Corp fund) appears advantaged based on the bottom-line number, but keep in mind that C-Corp funds accrue a deferred tax liability for the portion of distributions considered to be a tax-deferred return of capital and for gains in underlying holdings. When a fund is in a net deferred tax liability status, a 10% increase in the underlying holdings may only result in a 7.7% increase in the fund given a 21% corporate tax rate and approximately 2% for state income taxes. If a C-Corp fund is in a net deferred tax liability status with 23% tax drag, the 20% gain in the fund corresponds to a 26% gain in the underlying holdings. In other words, without the tax drag, the sales price could be $12.60 instead of $12 assuming the fund was in a net deferred tax liability status for the entire period owned.