In terms of how the energy sector impacts everyday life, many investors look through the lenses of exploration, production, and refiners.

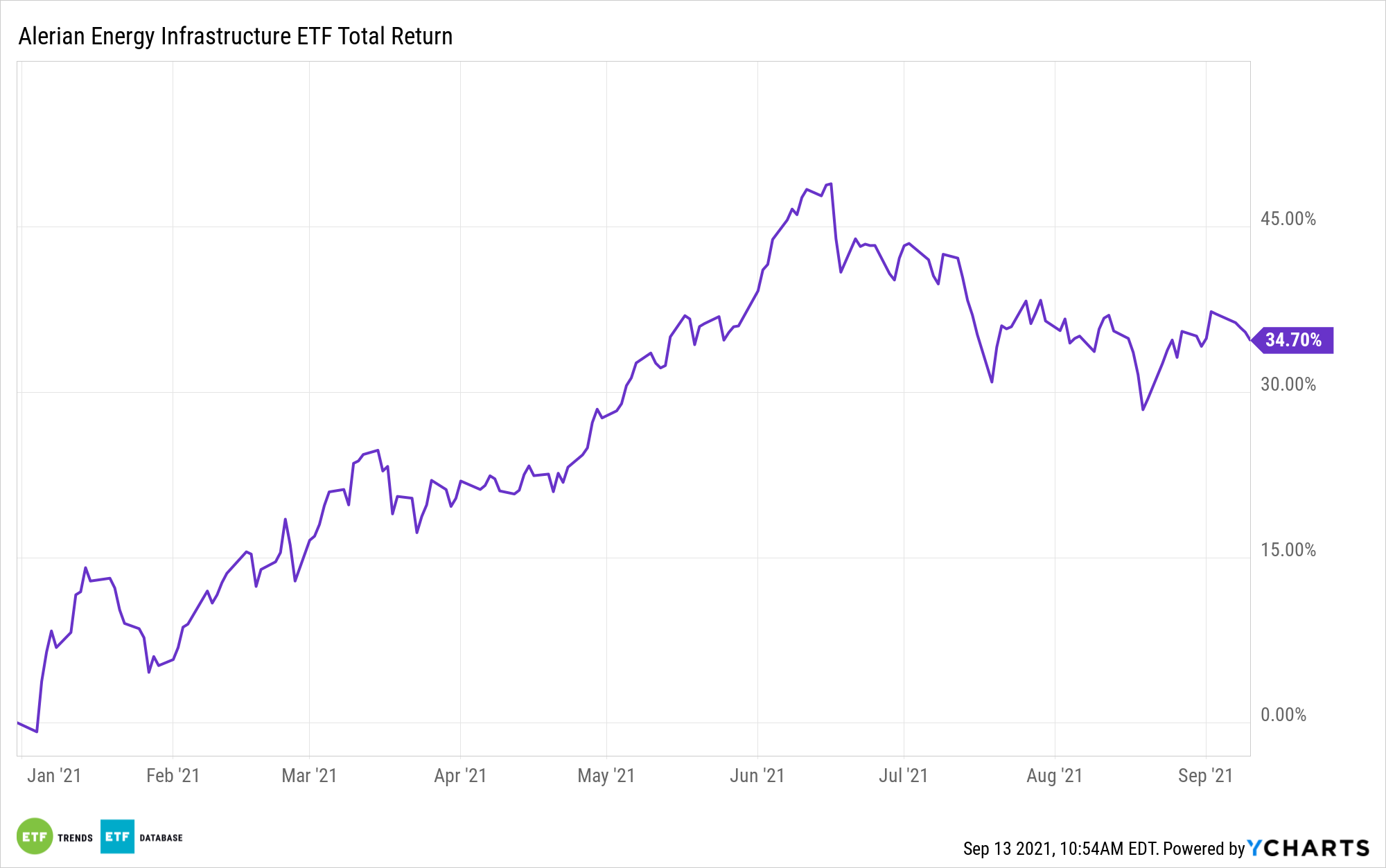

Midstream energy companies, including those represented in exchange traded funds such as the Alerian Energy Infrastructure ETF (ENFR), are equally as vital in the energy equation. After all, ENFR components store and transport the fuels that power everyday commerce and travel in the U.S.

That underscores not only ENFR’s vibrant investment, but also how the midstream affects consumers on a daily basis, whether they know it or not.

“Distribution and marketing is another component of the gasoline price. This line item represents the costs to get gasoline from a refinery to the pump and includes the margin made by the gas station,” says Alerian analyst Stacey Morris. “A gallon of gasoline may travel from a refinery via pipeline to a terminal, where it is then loaded onto a truck and moved to your local gas station. In general, the longer the distance, the higher the fee.”

ENFR Investment Perspective

When it comes to gas prices, summer is usually the period during which those prices rise due to elevated travel demand. Over the near-term, there could be fuel price declines due to reduced travel demand owing to the Delta variant and amid expectations for a mild winter, which could damp demand for heating products.

However, those factors, even if they come to pass, don’t dent the thesis for ENFR and midstream energy companies. ENFR’s dividend yield of 5.74% is clearly tempting. It’s more than quadruple what investors get on the S&P 500 and 10-year Treasuries.

Moreover, midstream energy companies are eschewing profligate spending and firming up their balance sheets. Those moves are constructive for better credit ratings and supporting elevated shareholder rewards, including buybacks and dividends.

Bottom line: Midstream plays a pivotal role for consumers and businesses, and investors can get in on the act.

“Filling your vehicle’s tank with gasoline is just one example of how midstream companies help facilitate aspects of our everyday lives,” adds Alerian’s Morris. “While oil prices tend to have the most impact on what you pay at the pump, there are several other items that factor into gasoline prices. If oil remains relatively stable, gasoline prices should ease into the winter as demand moderates seasonally, winter grade gasoline begins to be sold, and the temporary refining interruptions from Hurricane Ida subside.”

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on energy infrastructure investing, visit our Energy Infrastructure Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.