Midstream energy equities and exchange traded funds such as the Alerian Energy Infrastructure ETF (ENFR) are beloved by investors for above-average dividend yields and a reputation for not being highly correlated to oil and natural gas prices.

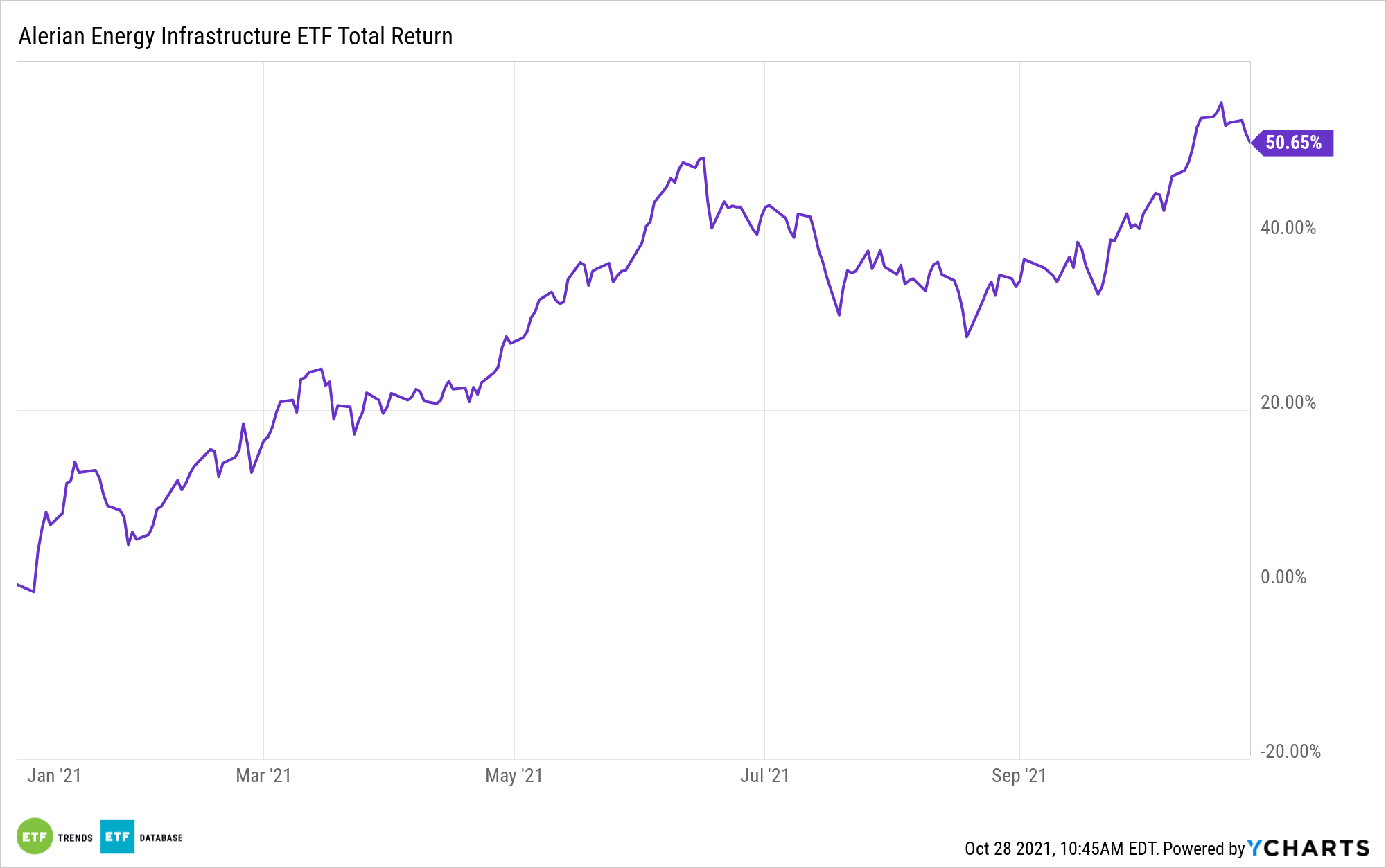

However, ENFR and its components can benefit when demand for energy is soaring, as is the case this year. The ALPS fund is participating, as highlighted by its year-to-date gain of just over 50%. This could be a sign that investors should stay abreast of domestic energy producers’ plans to boost or lower output.

After all, the core competencies of midstream operators are processing, storage, and transportation of energy commodities. One of the big factors at play in the current environment is the fact that exploration and production companies are displaying more capital discipline than they have in recent memory, meaning that they’re not rushing to boost output simply because oil prices are high. That’s meaningful for investors considering ENFR because the midstream is a volume-driven business.

“With this context, moderate growth from producers could result in a goldilocks production scenario for midstream. Modest volume growth would potentially drive incremental cash flows and allow midstream companies to enjoy some operating leverage in systems with excess capacity today, but ideally, the growth is not high enough to drive oil prices down,” says Alerian analyst Stacey Morris.

In theory, more output means more product for ENFR member firms to transport and process, implying that there’s benefit to the midstream in upping production. However, there are also benefits for midstream operators by way of exploration and production remaining judicious and not being hasty simply because crude prices are high.

“While midstream cash flows would be higher with greater growth, the potential negative implications of lower commodity prices and worsened energy sentiment would likely weigh on equities and offset any volume benefit. To the extent producer discipline drives a more stable oil price environment and helps bring generalist interest back to energy broadly as companies reestablish a better track record with investors, that could only be beneficial for midstream,” adds Morris.

Bottom line: While elevated volumes could be positives for midstream operators, including ENFR components, investors need to assess at what cost those volumes are accrued. Markets are already rewarding discipline in the energy sector, including midstream, and that’s to the benefit of investors considering ENFR.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more news, information, and strategy, visit the Energy Infrastructure Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.