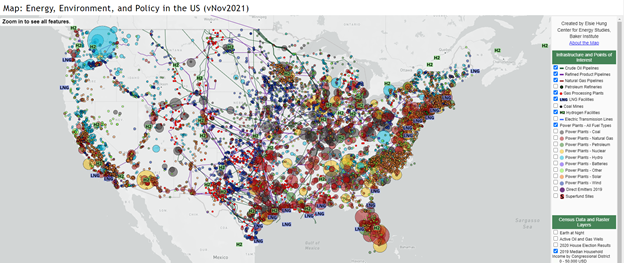

Most people conceptually know and understand the importance of the country’s energy infrastructure for daily living, but a new, interactive map from Rice University’s Baker Institute for Public Policy helps paint a clearer picture of the vast network that provides the U.S. with energy.

Image source: Rice University’s Baker Institute for Public Policy

This open source map was designed to account for energy infrastructure as well as demography to show how the environment, energy, and public policy all intersect and relate. Filters on the map allow users to select what types of infrastructure they want to see, as well as any relevant elections and statistics that might apply at a variety of macro and micro levels. Users of the site can also get information on individual facilities, such as type, operator, any relevant details, operating status, and more with the simple click of a mouse.

The map was designed to show how energy and society interact and relate, according to the creators, Shih Yu (Elsie) Hung, research manager at the Baker Institute Center for Energy Studies; and Kenneth Medlock, the James A. Baker III and Susan G. Baker Fellow in Energy and Resource Economics at the Baker Institute, and the senior director for the Century for Energy Studies, reports TechXplore.

“We hope to stimulate and facilitate pertinent discussions and research with this interactive tool,” wrote Hung and Medlock. “More importantly, it allows the users to effectively navigate key energy and environmental issues with a clear and complete picture of the nation’s infrastructure and demography.”

The map is a great way to visualize how vital energy infrastructure is, as well as the role that midstream plays in energy transport and delivery, and how legislation is impacting and shaping the industry overall.

Investing in Energy Through Midstream Companies

For investors looking for exposure to energy infrastructure and midstream performance, the Alerian Energy Infrastructure ETF (ENFR) is an excellent option.

The fund seeks to track the Alerian Midstream Energy Select Index, an index that includes a mix of North American midstream energy infrastructure companies, including MLPs and corporations that are involved in the storage, pipeline transportation, and processing of energy commodities.

ENFR invests at least 90% of its assets in securities within the index, and cannot invest more than 25% of its assets into the securities of one or more publicly-traded partnerships, including MLPs, per tax code.

Shareholders are not considered to be engaged in the business that MLPs conduct in regards to federal and state tax purposes, and because investments are being put into the fund and not directly into an MLP, income and losses by the fund into MLPs will not pass through to the tax returns of shareholders.

The sector breakdown of ENFR includes a 33.38% allocation to gathering and processing, a 30.69% allocation to pipeline transportation of natural gas, a 26.17% allocation to pipeline transportation of petroleum, 6.44% to liquefaction, and 3.26% to storage, as of December 23.

ENFR carries an expense ratio of 0.35%.

For more news, information, and strategy, visit the Energy Infrastructure Channel.