Energy sector-related exchange traded funds led the charge on Friday as crude oil prices rallied on a hurricane threat in the Gulf of Mexico that threatened production and a supportive Federal Reserve allayed growth concerns.

Among the best-performing non-leveraged ETFs of Friday, the SPDR S&P Oil & Gas Exploration & Production ETF (NYSEArca: XOP) was up 5.6%, the Invesco Dynamic Energy Exploration & Production Portfolio (NYSEArca: PXE) gained 5.8%, and the Invesco S&P SmallCap Energy ETF (NasdaqGM: PSCE) added 8.1%. The widely observed Energy Select Sector SPDR Fund (NYSEArca: XLE) increased 2.7%.

Meanwhile, the United States Oil Fund (NYSEArca: USO), which tracks West Texas Intermediate crude oil futures, and the United States Brent Oil Fund (NYSEArca: BNO), which tracks Brent crude oil futures, were also up 1.4% and 1.5%, respectively, on Thursday. WTI crude oil futures were up 1.8% to $68.7 per barrel and Brent crude gained 2.0% to $72.5 per barrel.

Crude oil prices strengthened and were on pace for their biggest weekly gain in almost a year, Bloomberg reports.

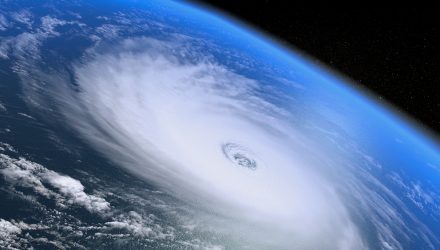

The energy markets gained as oil producers in the Gulf of Mexico began temporarily shutting down operations ahead of the Tropical Storm Ida, which has been upgraded to at least a Category 2 hurricane.

Additionally, Federal Reserve Chair Jerome Powell maintained that the central bank will reduce its monthly bond purchases this year, but it will be patient with its interest rate outlook.

“Clearly, the hurricane is what the market is focusing on now, at least in the short-term. We are going to be losing supply from refiners and some demand,” Andrew Lebow, senior partner at Commodity Research Group, told Bloomberg. “The market had expected what the Federal Reserve was planning and had discounted it.”

Oil prices have experienced a volatile August in response to the rising COVID-19 Delta variant, which has contributed to fears of another economic slowdown.

The Organization of Petroleum Exporting Countries, or OPEC+, is also scheduled to meet next week, along with its allies. Market-watchers anticipate that the group will implement another monthly output increase as it slowly raises supplies that were curbed during the pandemic.