By Jonathan Liss

- After a decade of growth stocks leading the market higher, there are signs that value stocks are finally ready to take the baton and overtake growth – or are they?

- Unlike during the last growth-fueled rally, the dot-com bubble of the late 1990s, many of today’s “growth” stocks (AAPL) (MSFT) pay dividends and have rock-solid balance sheets and business models.

Growth stocks have been on a historic tear over the last decade and change – outperforming their value counterparts by a wide margin.

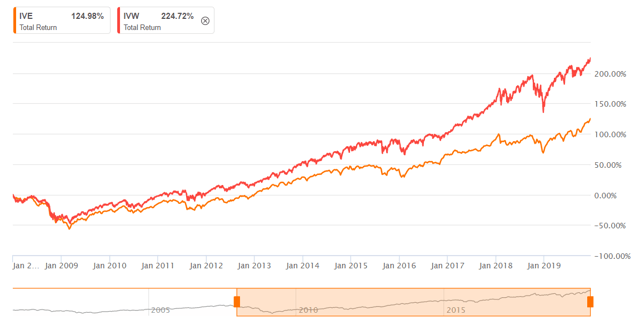

The above chart, courtesy of the momentum tab via Seeking Alpha Premium, shows the total returns the iShares S&P 500 Value ETF (IVE) vs. the iShares S&P 500 Growth ETF (IVW) from the beginning of 2008 through yesterday’s close – and it’s not even close.

From the close on 12/31/2007 through the close on 12/17/2019, IVW, which I’m using as proxy for large U.S. growth is up a whopping 224.72% versus returns of just 124.98% for IVW’s value equivalent, IVE. And this takes into account the fact that IVE has paid a significantly higher dividend yield over this time frame.

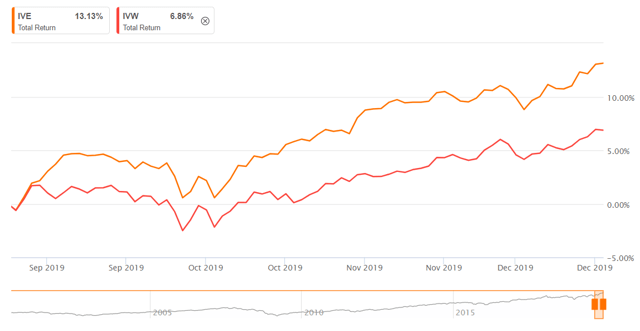

Since September though, there seems to be a marked shift in leadership, with value overtaking growth by a sizable margin – a 13.13% total return for IVE since September 1 vs. just 6.86% for IVW:

While an increasing number of market watchers have been proclaiming the start of a secular shift in market leadership from growth to value, we’ve seen proclamations of this sort fizzle out in recent years.

For example, in February 2017 in a piece titled Charting the Shift in Equity Market Leadership: From Growth to Value, PIMCO asserted the beginnings of a rotation over to value:

PIMCO has believed for some time that we are seeing a rotation from growth to value stocks. Results in 2016 bear this out: Value broadly outperformed growth… and we believe the value cycle is likely still in its early stages.

This clearly did not pan out with growth quickly overtaking value and maintaining its lead for at least another 2 and a half years after this statement was made.