Provided by EMQQ.

Emerging Markets Initial Public Offerings (IPOs) in 2021 brought in around $228 billion in total, up 31 percent from the $174 billion raised in 2020, according to Refinitiv. Despite the Covid-19 pandemic, liquidity was injected into the system.

Looking ahead to the new year, both headwinds and tailwinds are visible, which will likely impact IPO activity. A combination of geopolitical tensions, inflation risks, central bank loosening and tightening, and the ongoing COVID-19 pandemic are all in play. Despite all of this, relatively high valuations and market liquidity are keeping the IPO market open in 2022.

Initial public offerings aren’t just startup success stories. Each year they tell us what’s so unique about the tech scene they grew out of: like food delivery unicorn Rappi from Columbia, where this food tech startup is looking to become a super app to take on Mercado Libre, and Chinese social video and photo sharing platform Xiaohongshu, the Gen-Z focused social media company which seamlessly combines existing services, while integrating e-commerce with an Instagram-like social video and photo apps.

One thing we are sure of for 2022, More IPOs outside of the U.S. Three reasons why:

Congress has pushed the SEC to require foreign companies to submit to U.S. auditing standards and governance rules. This advances a movement that should lead to most of the US-listed Chinese companies in our EMQQ Index to be moved to the Hong Kong or Shanghai Exchanges, but the switch should be seamless to investors.

As a result, the next crop of successful Chinese companies is expected to list in Hong Kong or Shanghai. This should be a boon to the U.S. ETF industry since they can easily provide access to these foreign listings for U.S. investors. Also, last year, exchanges from Mumbai to Jakarta revamped their rules in the hopes of attracting more high-profile IPO’s. There are many interesting companies in emerging and frontier markets likely to go for an IPO in 2022.

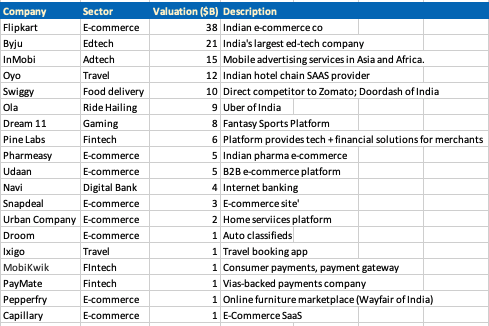

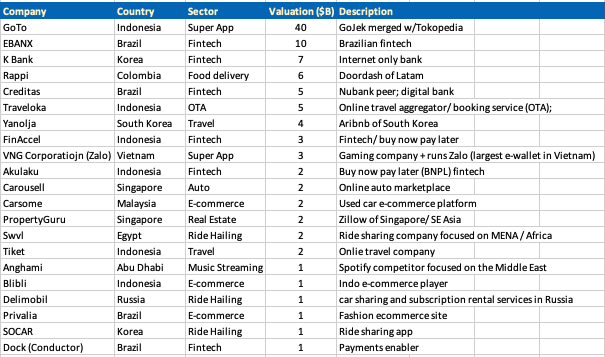

We break down the Internet & Ecommerce Companies in the Emerging and Frontier Market IPO activity we are tracking for 2022.

China

We really like Shein, the Nanjing-based designer killing it with young women globally. They can turn around a new design for clothing in three days and have doubled annual revenue for eight years straight. The pandemic has helped with user adoption for the online health care solutions provider WeDoctor, the Tencent-backed company, which is one of the first and biggest unicorns in digital health care.

India

We really like FlipKart, India’s biggest online store for Mobiles, Fashion (Clothes/Shoes), Electronics, Home Appliances, Books, Home, Furniture, Grocery, Jewelry, Sporting goods. The Indian e-commerce company is mostly owned by Walmart but also backed by Tencent. The pandemic has also boosted Swiggy an Indian online food ordering and delivery platform which is a direct competitor of Zomato the Doordash of India.

Rest Of The EMQQ/FMQQ Index World

We really like the Indonesian company GoTo, the on-demand multi-service platform and digital payment technology group based in Jakarta. As well as Creditas, headquarters in São Paulo in Brazil, a consumer loaning startup that operates a digital platform providing secured loans and relatively low-interest rates.

SUM IT UP

With central bank easing in China expected for 2022, we expect to see ample liquidity for these IPO’s, local consumer demand for new investments, and the economy in these regions to be supportive. The biggest sectors driving IPO volumes were FinTech, Gaming and HealthTech in 2021, we expect those same sectors to continue to be strong in 2022. The main driver in these businesses is the emerging market and frontier market consumer, which is at the heart of the EMQQ and FMQQ story.

Source: EMQQ Index

For more news, information, and strategy, visit the Emerging Markets Channel.

There is no guarantee that the index will achieve its investment objective. Holdings are subject to change. Current and future holdings are subject to risk. Acquisition deals involve risks and uncertainties and may not be completed as discussed.

EMQQ Index

The Emerging Markets Internet and Ecommerce Index™ invests in companies with exposure to the Ecommerce and Internet sectors in emerging markets. EMQQ provides exposure to companies that are positioned to benefit as emerging economies mature, the consumer class expands, and their populations increase their utilization of the Internet and ECommerce. You cannot invest in an Index.

FMQQ Index

The Next Frontier Internet & Ecommerce Index™ invests in companies with exposure to the Ecommerce and Internet sectors in emerging and frontier markets. FMQQ measures and monitors the performance of an investable universe of publicly-traded companies deriving a majority of their assets or revenues from Internet & Ecommerce in Emerging and Frontier Markets (excluding China).