Inflation talk is becoming more persistent by the day. Deutsche Bank strategist Jim Reid said, “Inflation will remain heavily in focus for markets over the week ahead, with recent days having seen investor expectations of future inflation rise to fresh multi-year highs.”

During times of inflation, dividend-focused investments become a critical component of a healthy portfolio. Dividends historically outpace inflation, since companies adjust their payouts to match or exceed inflation rates. Dividend growth funds like the Guinness Atkinson SmartETFs Dividend Builder ETF (DIVS) can help investors generate the income they need to stay ahead of inflation.

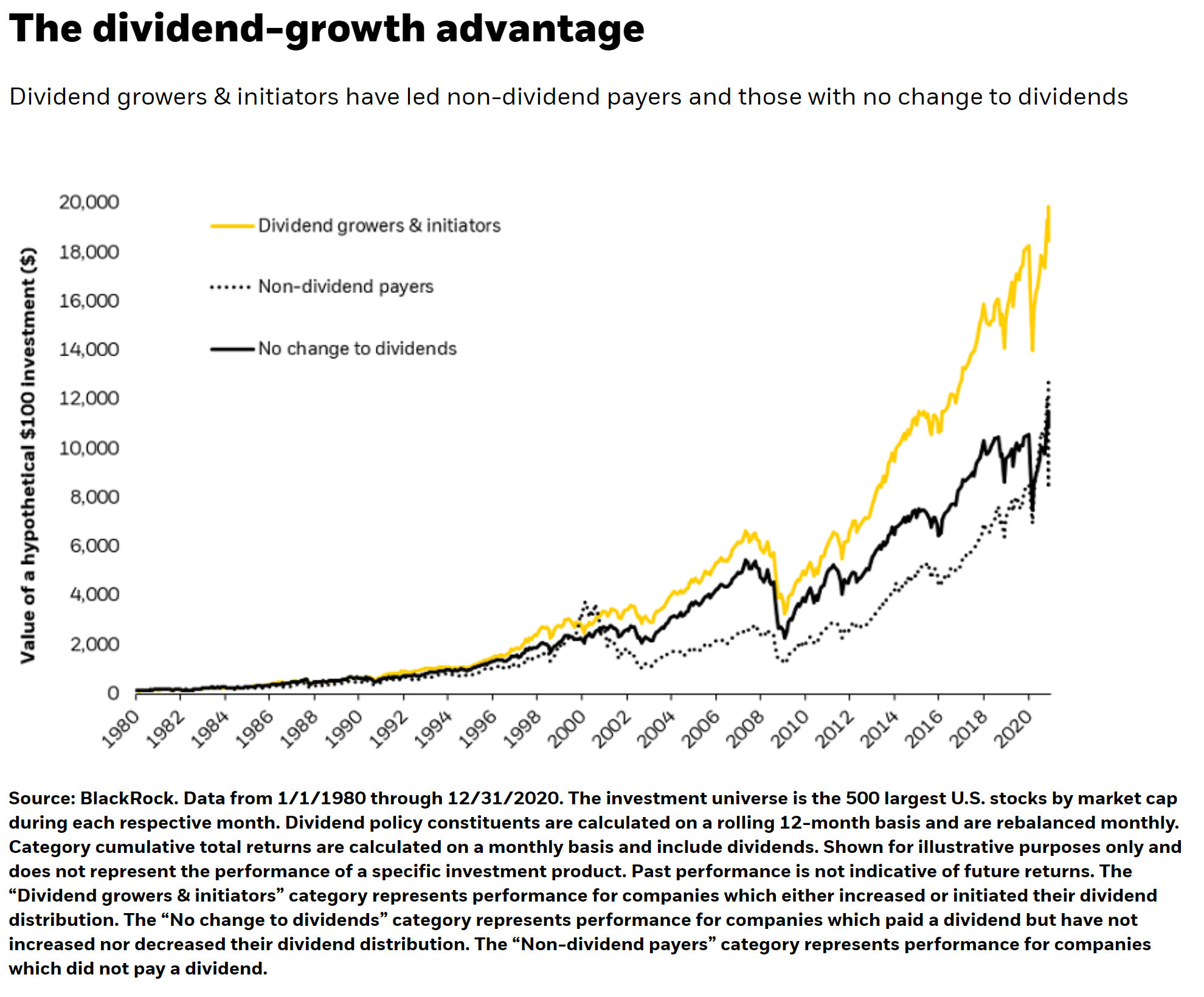

Even in non-inflationary periods, companies that have consistent dividend growth tend to outperform companies that don’t pay out dividends or focus on having consistent high yields.

Inflation Might Be Here to Stay

Despite months of having inflation whispers seemingly everywhere, the market has remained relatively strong, with 84% of companies reporting that they are beating earnings estimates. However, this could be because many investors are seeing inflation as transitory. As more data comes out, the transitory argument is likely to lose steam.

“People have different definitions of transitory. I’m not quite sure how long you would define transitory these days. I mean, I think the real question is, do we see expected cyclical inflation or does it turn into a structural inflation? I don’t think it’s the latter one, personally. But I think with the inflation environment, we will see around us for some time. It’s not going to go away overnight and we’re prepared to deal with that,” said Whirlpool CEO Marc Bitzer in an interview with Yahoo Finance Live.

High energy prices, supply chain shortages, and global economies that are still reeling from the ongoing pandemic could very well all combine to create long-term, persistent inflation. Traditional inflation hedges like gold have been having a rough go of it, and though cryptocurrency is trying to bill itself as the new gold, it remains highly volatile. The last thing you want in an insurance policy is volatility.

Steady dividend growth remains the tried and true way to navigate long-term inflation.

For more news, information, and strategy, visit the Dividend Channel.