With the third quarter in the books, now is the ideal time to analyze S&P 500 dividend growth during the July through September period. Hint: It was remarkable.

Dividend increases in the third quarter totaled $22.2 billion, up 44.1% from $15.4 billion in Q2 2021, according to S&P Dow Jones Indices. On a year-over-year basis, that increase works out to a jaw-dropping 163.5%.

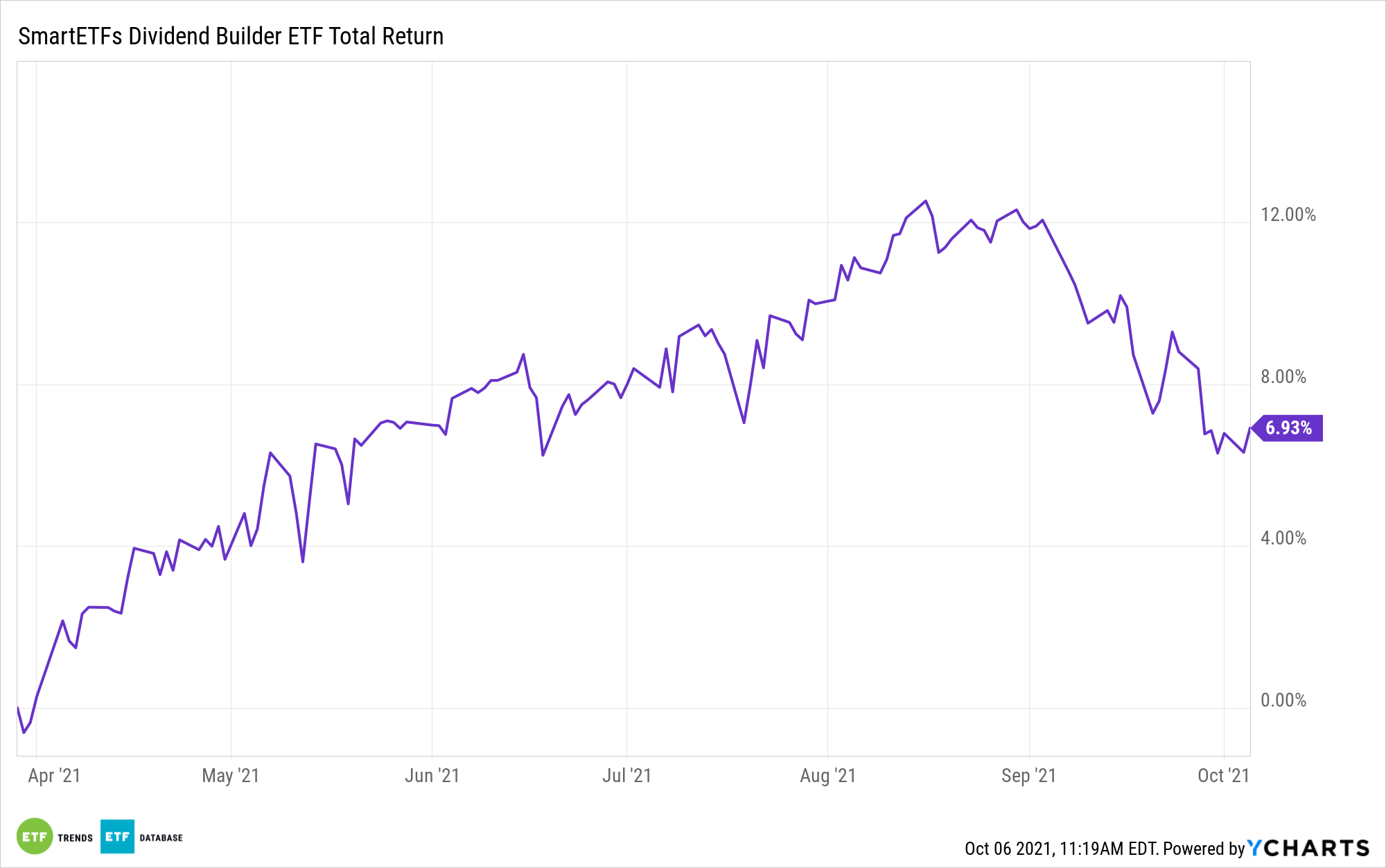

With growth like that, investors may want to evaluate exchange traded funds such as the SmartETFs Dividend Builder ETF (DIVS). Actively managed, DIVS offers equity income seekers a basket of quality companies with strong balance sheets and stout ability to generate cash flow. In other words, DIVS components could have the ability to continue growing payouts without straining balance sheets. Some DIVS holdings likely took part in the third-quarter dividend parade.

“Dividends are back as record earnings, sales, and margins have permitted companies to return to the business of returning shareholder wealth,” said Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. “Larger dividend increases and a lack of cuts produced a record payment to S&P 500 shareholders in Q3 2021. Based on current indicated dividend rates and schedules, Q4 2021 appears set to replace both that quarterly record and set a new annual record for payments in 2021.”

In the July through September period in the U.S., 584 dividend hikes were announced against just 27 cuts. That latter figure is 73.5% lower on a year-over-year basis.

“For the 12-month September 2021 period, the net dividend rate increased $61.4 billion, compared to a net decline of $39.7 billion for 12-month September 2020 period, as increases were $71.8 billion versus $39.5 billion, and decreases were $10.5 billion compared to $79.2 billion for 2020 period,” according to S&P Dow Jones.

DIVS, which eschews weighting stocks by yield, features a concentrated lineup of 35 stocks, but none of its holdings exceed weights of 3.66%.

The sector and industry exposures found in DIVS further highlight the fund’s advantages as a quality holding for equity income investors. Pharmaceuticals stocks account for 12% of the fund’s weight, and healthcare is one of the steadiest sectors in terms of dividend growth. Same goes for consumer staples, which commands almost 20% of the fund’s roster. A 5% weight to financial services stocks could be helpful as more central banks sign off on dividend hikes this year.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.