There’s been ample talk of strength in cyclical stocks, although the group as a whole recently pulled back. One area of the cyclical space that’s holding up quite nicely is real estate/real estate investment trusts (REITs).

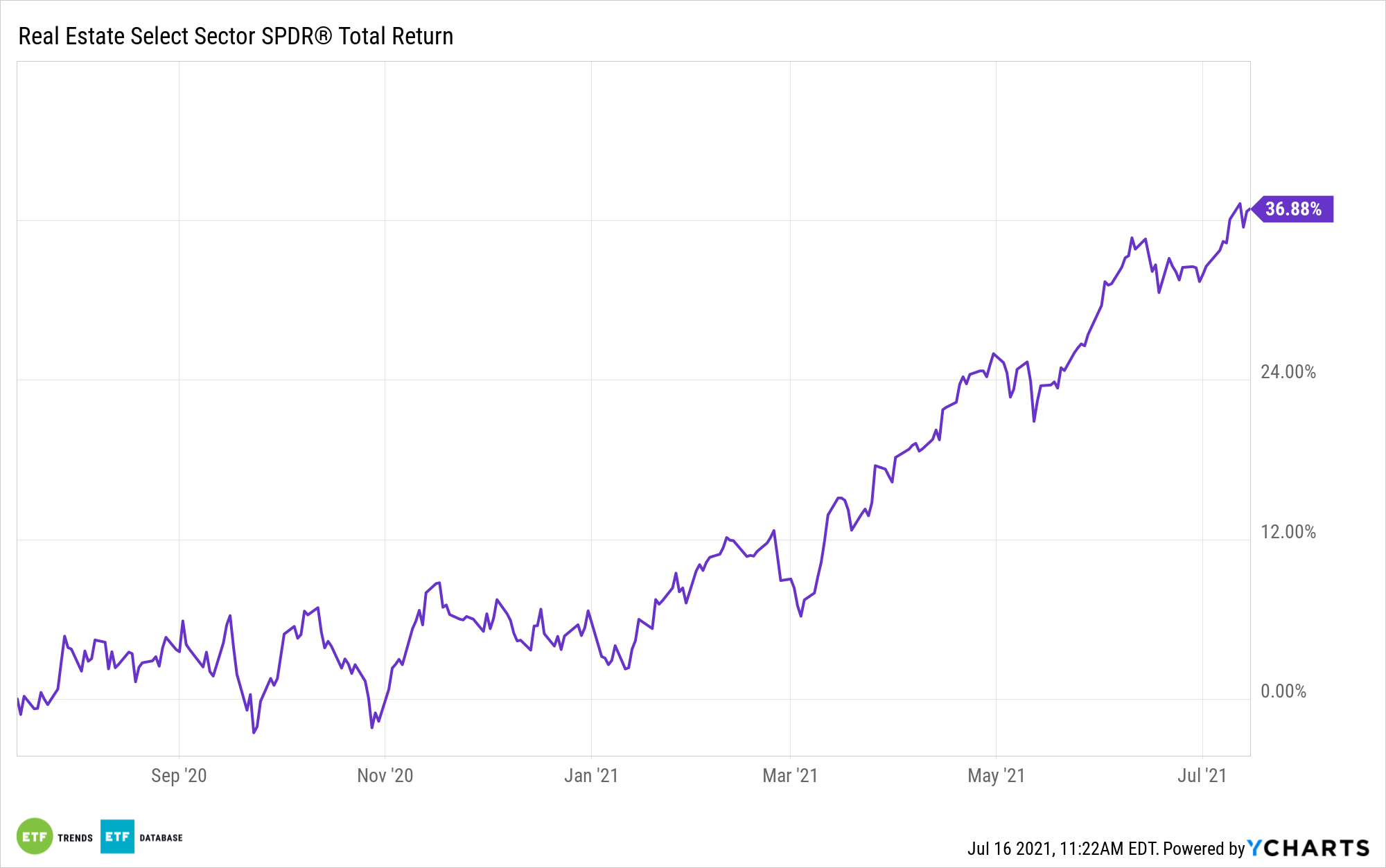

For example, while other cyclical value sectors have dithered in recent weeks, the Real Estate Select Sector SPDR Fund (NYSEArca: XLRE) is higher by 3% over the past month, extending its year-to-date gain to 28.37%. That easily tops the roughly 16% returned by the S&P 500.

XLRE and its friends are experiencing significant tailwinds.

“As the current reopening accelerates, the real estate sector has shown strong price and flow momentum, outperforming the S&P 500 Index by more than 10% over the past six months and gathering $5.1 billion of assets on a trailing three-month basis — the third-largest net inflows among the 11 GICS sectors,” writes Anqi Dong, State Street senior research strategist. “The sector’s earnings sentiment has also improved lately, as 2021 earnings estimates have been raised by 19% since March, compared to 10% for the broad market.”

Ready for Real Estate?

The $3.74 billion XLRE tracks the Real Estate Select Sector Index, which has a 2.38% dividend yield, making the fund a credible destination for income-hungry investors.

For investors considering XLRE as a dividend play, the good news is that funds from operations (FFO), a critical metric for evaluating REIT financial health, is rebounding across various REIT segments.

“Landlords had offered concessions on rents to attract tenants during the economic downturn last year, but these concessions narrowed in Q1, leading to a 2.9% increase in funds from operations (FFO, the common measurement of REITs’ profitability) of residential (REITs) to just 9% below the pre-pandemic level,” adds State Street’s Dong.

Additionally, previously moribund retail REIT FFOs jumped 16% in the first quarter, marking the third straight quarterly increase. Industrial REITs, which are scorching hot due to soaring e-commerce demand, are also sporting impressive FFOs.

Adding to the case for XLRE is that real estate equities still have some catching up to do. The sector is also inexpensive relative to the broader market.

“The real estate sector is still lagging the other cyclical sectors, including Financials, Industrials and Materials, by at least 8% on a trailing 12-month basis, as investors are concerned about the financial health of the sector and the damage to retail and office REITs caused by the pandemic,” notes Dong.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.