U.S. equities don’t have the dividend game all to themselves. More importantly, they don’t monopolize payout growth.

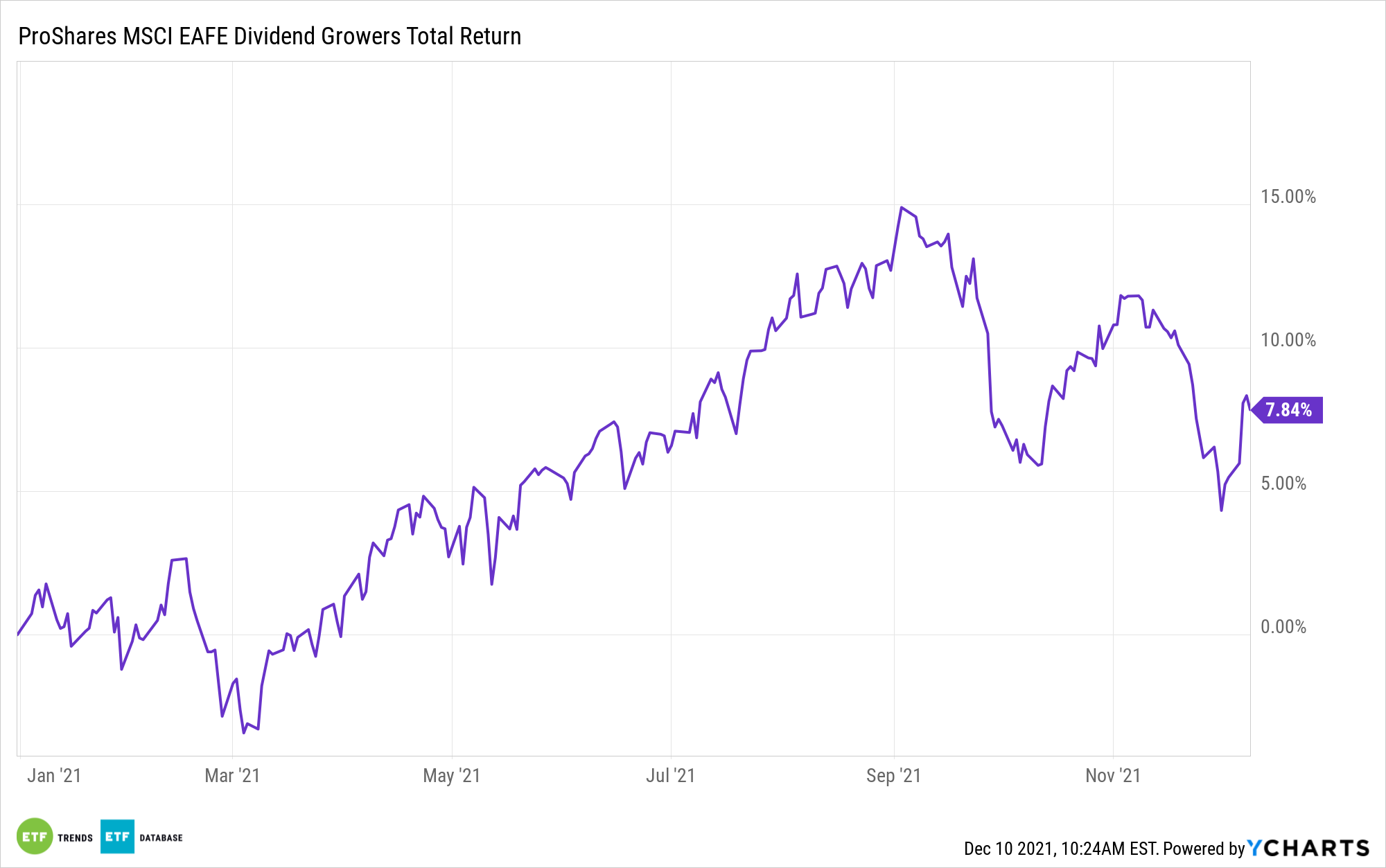

Dividends are growing in an array of ex-U.S. developed markets, potentially signaling to income-hungry investors that exchange traded funds such as the ProShares MSCI EAFE Dividend Growers ETF (CBOE: EFAD) could be worth considering.

EFAD follows the MSCI EAFE Dividend Masters Index, which is a collection of the ex-U.S. developed markets dividend payers with the most illustrious track records of boosting payouts. Proving that’s exclusive territory, EFAD holds just 68 stocks compared to 836 stocks in the MSCI EAFE Index. Overall, EFAD offers a compelling methodology at just the right time.

“Developed markets in Europe and Asia contributed just over 40% of global dividends in 2020, as represented by the MSCI World Index, and represent a large opportunity,” says ProShares Senior Investment Strategist Kierwan Kirwan. “International developed stocks have traditionally yielded more than domestic stocks for years. This dynamic still holds true today, albeit with lower absolute yield level.”

EFAD allocates 30.64% of its weight to Japanese stocks – a favorable trait when considering the following: First, Japan didn’t experience dividend cuts on par with other ex-U.S. markets during the worst days of the coronavirus pandemic. Second, Japan’s dividend yield is low, implying ample room for growth. Third, Japanese companies have the balance sheets to grow dividends over the long term.

Looking at Europe, there were some deep payout cuts there last year, but dividends are on the mend across the Atlantic.

“The silver lining to this dynamic is that international stocks are poised for a strong rebound and are likely to deliver faster levels of dividend growth than domestic payers,” adds Kirwan. “European markets are providing early evidence of this trend and saw first half 2021 payments jump significantly from the prior year.”

European equities account for over half of EFAD’s geographic exposure. Something else to consider: International dividend payers are inexpensive. Yes, ex-U.S. developed markets equities have long been cheap compared to the S&P 500 and have long lagged domestic equities. That under-performance is troubling, but there could be a silver lining.

“The upside to recent underperformance is that international stocks are cheap at a time when domestic stocks are not. Stated simply, the cheaper the starting valuation, the more attractive future returns tend to be,” notes Kirwan.

Based on price-to-earnings, price-to-cash flow, and price-to-book, EFAD’s index trades at deep discounts relative to the S&P 500.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.