The real estate sector and publicly listed real estate investment trusts (REITs) are favored destinations for income investors, but many of those investors focus solely on domestic fare.

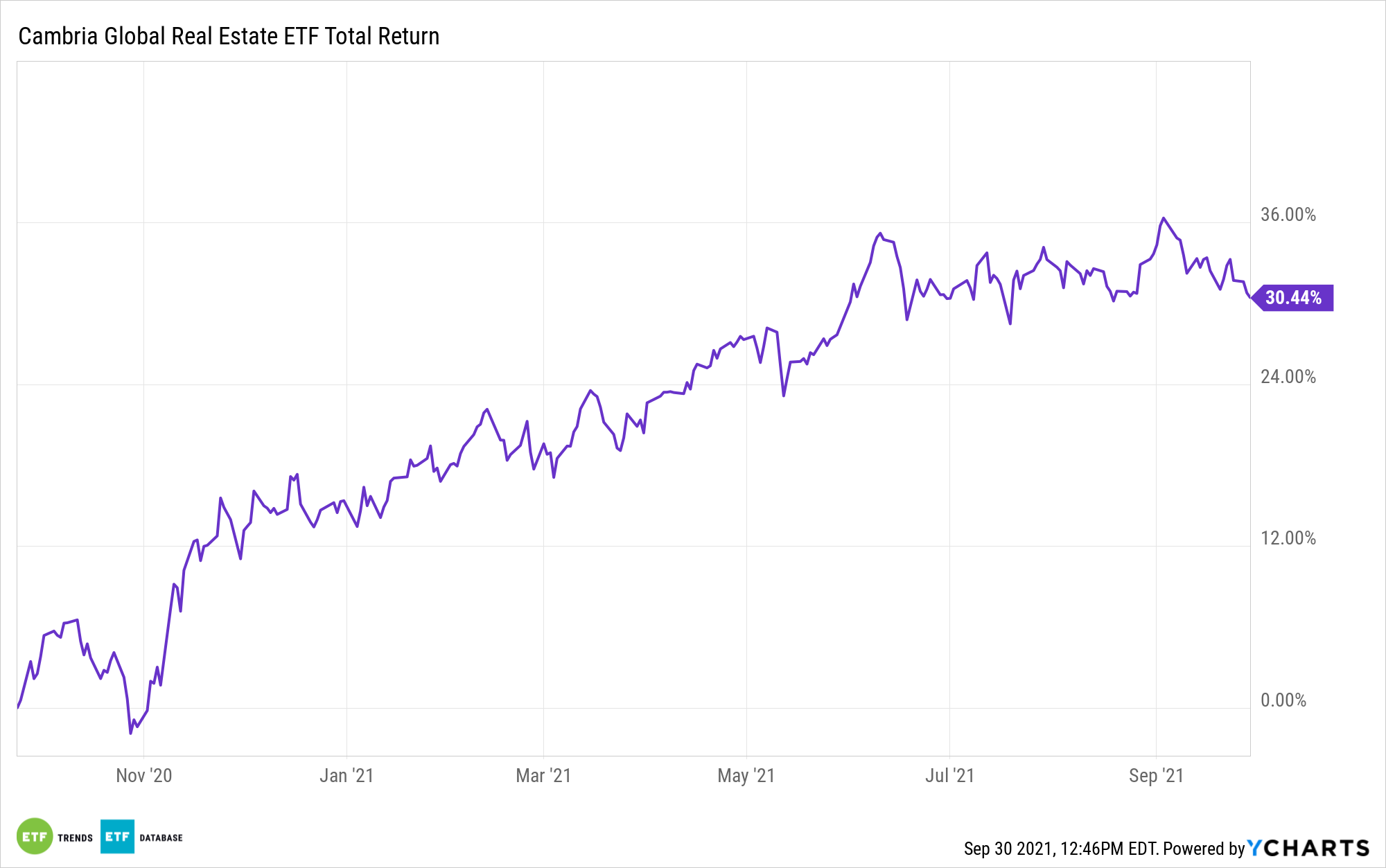

That’s limiting from the perspectives of geographic diversification and income opportunities, but the Cambria Global Real Estate ETF (BLDG) is an example of an exchange traded fund that opens global real estate doors for investors.

BLDG, which recently turned one year old, “seeks income and capital appreciation by investing primarily in the securities of domestic and foreign companies principally engaged in the real estate sector and real-estate related industries that exhibit favorable multi-factor metrics, such as value, quality and momentum, according to a quantitative methodology developed by Cambria Investment Management,” according to the issuer.

With that multi-factor approach, BLDG helps investors eliminate home country bias while putting factors to work in their favor.

“Only considering U.S. exposure when it comes to REITs could be a mistake,” said Cambria CIO Meb Faber in a recent note. “However, considering global exposure is just the first step in creating balanced, optimized REIT portfolio. There are additional, beneficial steps one could theoretically take.”

Some of those benefits include strong long-term potential, and that’s worth considering at a time when bond yields are low. That goes for plenty of ex-U.S. developed market debt, which is notable because many investors consider REIT exposure as a bond replacement strategy.

“If returns for these asset classes over the past twenty years are compared, REITs returned the most, leading the way with a compound annual return of 10.4%,” according to Faber. “There may be benefits of adding REITs to a traditional investment portfolio beyond historical returns.”

The actively managed BLDG holds 77 stocks, none of which exceed weights of 1.87%. Eleven countries are represented in the fund, with the U.S. commanding 61.2% of the fund’s geographic weight. Singapore and Australia, two of the more vibrant developed real estate markets outside the U.S., combine for 21.2%.

While BLDG, which has a 30-day SEC yield of around 3%, is a U.S.-heavy fund, it offers diversification not found in old guard REIT ETFs and can put investors on track to seizing upon some favorable valuations in ex-U.S. markets. Those are important traits when considering, as Faber notes, that many investors in the U.S. are 80% (or more) allocated to domestic equities.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.