Global dividend growth is moving at an impressive pace this year, and payouts are inching toward reclaiming pre-pandemic highs.

Factor that into today’s low-yield environment, and it’s a fine time for investors to consider dividend exchange traded funds, including the Schwab US Dividend Equity ETF (NYSEArca: SCHD). Home to $26.7 billion in assets under management, SCHD is one of the largest ETFs in this category. The Schwab taps into some important themes regarding dividend investing.

“Reliable dividends are rooted in solid franchises. Companies that are highly cash-generative and have low reinvestment requirements are likely to send regular checks to shareholders and grow those payments over time,” says Morningstar’s Ben Johnson.

SCHD holds 104 stocks, and plenty fit the bill as solid franchises. BlackRock (NYSE:BLK), PepsiCo (NASDAQ:PEP) and Home Depot (NYSE:HD) are among the ETF’s top 10 holdings.

There are other reasons savvy dividend investors like SCHD. While its distribution yield of 2.87% is more than double the dividend yield on the S&P 500, SCHD isn’t a high-dividend strategy. Rather, it’s a payout growth fund, as highlighted by the Dow Jones U.S. Dividend Index’s — SCHD’s underlying benchmark — requirement that member firms pay dividends for at least 10 straight years. Some fundamental metrics that can increase quality and dividend durability are also added to the mix.

“Stocks that pass SCHD’s initial filter are scored based on a combination of their yield, free cash flow/ total debt, return on equity, and five-year dividend growth. These metrics help set aside stocks whose dividends may be sickly,” adds Johnson.

As Johnson notes, SCHD may occasionally lag the broader market because it’s somewhat light on growth stocks and sectors. While it has 20.9% weight to tech stocks, that’s below the S&P 500’s weight to that sector.

SCHD is also significantly underweight on communication services and consumer discretionary equities. That’s the result of the biggest names in those sectors — Alphabet (NASDAQ:GOOG), Facebook (NASDAQ:FB), and Amazon (NASDAQ:AMZN) — not being dividend payers.

The Schwab ETF allocates almost 22% of its weight to financial services stocks. That weight jibes with dividend growth exposure because the Federal Reserve recently signed off on bank raising payouts. It also gives SCHD a value feel.

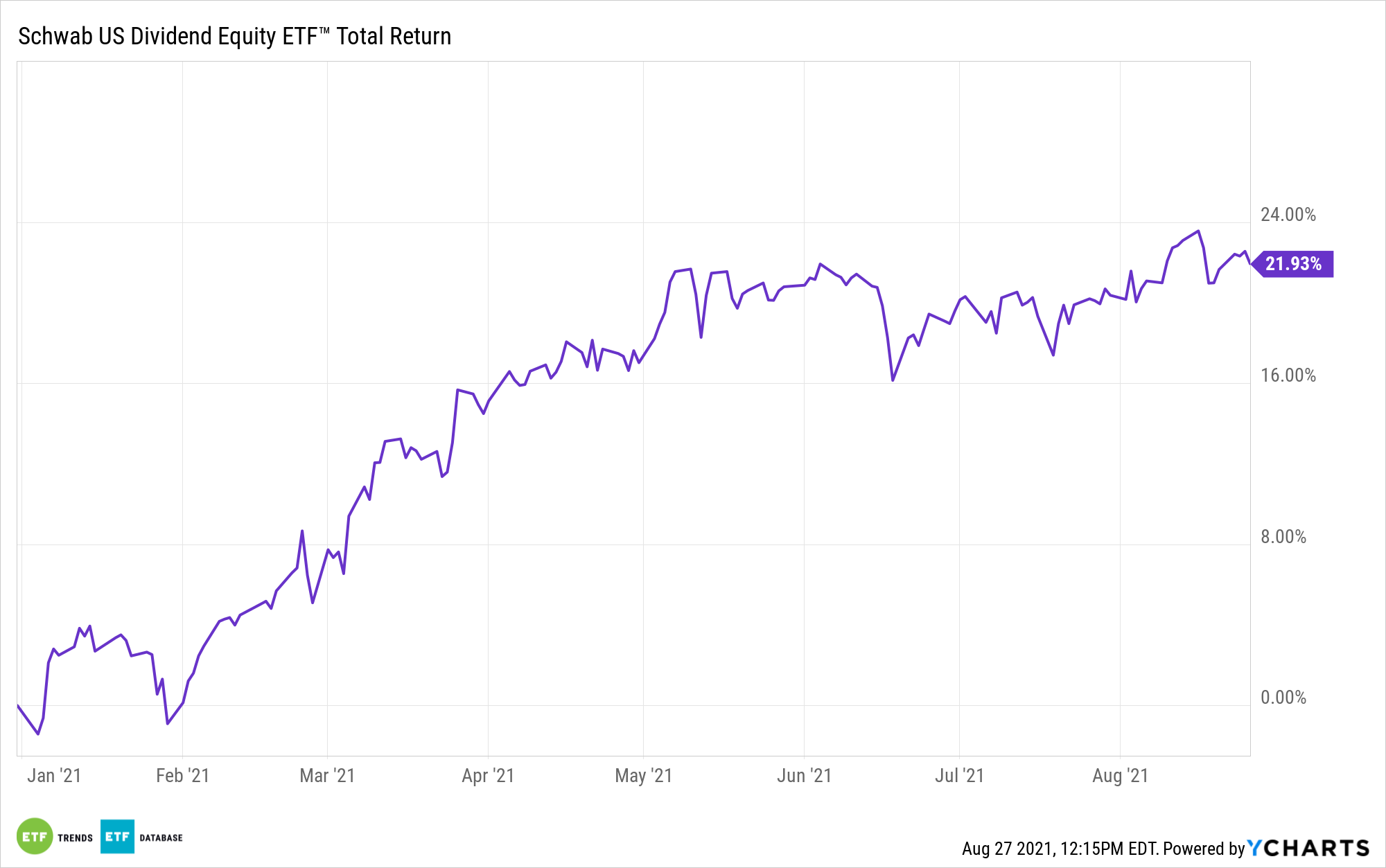

That’s helping SCHD outperform the S&P 500 by 74 basis points year-to-date, and that comes with the benefit of a modest annual fee of 0.06%, or $6 on a $10,000 investment. That makes SCHD one of the least expensive ETFs in the dividend category. Morningstar has a “silver” rating on the fund.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.