Over the past several years, investors have grown acquainted with some familiar refrains regarding ex-U.S. developed market equities.

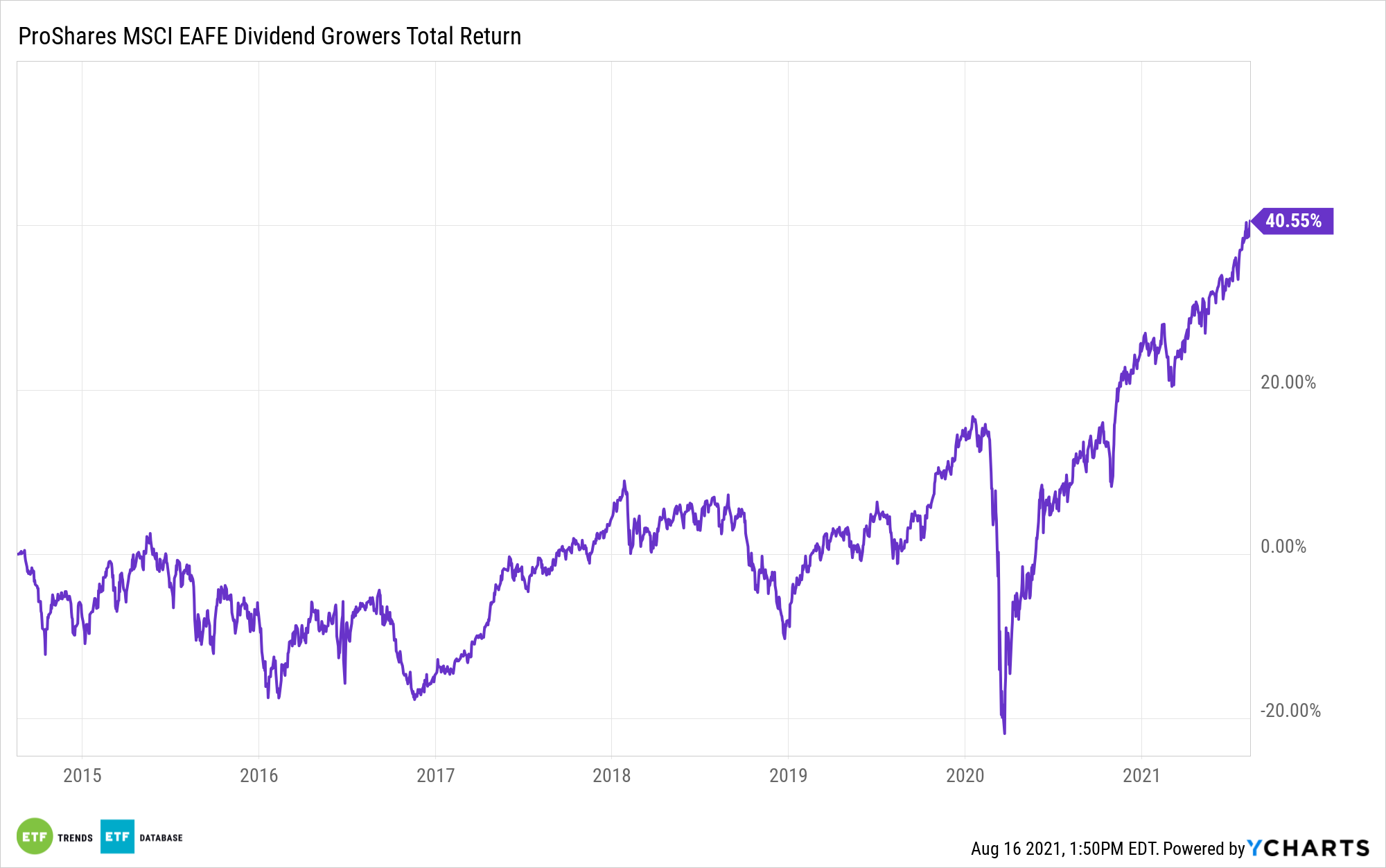

Chief among those are that developed market equities are inexpensive relative to their U.S. counterparts, but they frequently lag domestic benchmarks. That’s certainly been true of the MSCI EAFE Index in recent years, but that benchmark may not be so inexpensive that it’s tough to ignore, spelling opportunity with the ProShares MSCI EAFE Dividend Growers ETF (CBOE: EFAD).

EFAD follows the MSCI EAFE Dividend Masters Index, which focuses on firms “with the longest records of consistent dividend growth in the developed international markets,” according to ProShares.

Owing to the MSCI EAFE Index’s more cyclical leaning than the S&P 500 and the frequent intersection of dividends and value regardless of geography, EFAD could be an avenue for investors looking to be compensated for embracing low valuation equities.

“The valuation case is quite clear: Years and years of underperformance have pushed the MSCI EAFE index down to less than 50% of the price-to-book ratio of the S&P 500, which is an all-time low,” says ProShares Global Investment Strategist Simeon Hyman.

For its part, EFAD isn’t excessively allocated to traditional value sectors. While industrial stocks command almost 20% of the fund’s weight, healthcare and consumer staples, both defensive sectors, combine for about 28%.

While investors have been lured into MSCI EAFE stocks in the past on valuation calls, only to be left disappointed when it comes to performance, this time around could be different. Ex-U.S. international firms have the earnings growth to support potential share price appreciation.

“Valuation, of course, has not been a sufficient condition to drive international equities this century. However, consider this: With just over half of companies reporting, MSCI EAFE earnings are running nearly 32% ahead of estimates—almost double that of the S&P 500. Year-over-year growth (admittedly a pandemic-depressed comparison) is over 180%, which is also roughly double that of the S&P 500,” adds Hyman.

Of course, with a strategy like EFAD, dividends need to be supported too. The ProShares fund has the right geographic mix to ensure sustainable and growing dividends.

For example, Japan is the ETF’s largest country weight at 22.67%. Shareholder yield there is on the rise as more companies deploy cash to buybacks and dividends. Dividends are on the mend in the U.K. following a rough 2020 while Switzerland is already proving to be one of 2021’s top dividend growth markets. Those two countries combine for almost 28% of EFAD’s weight.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.